Since the covid crisis, I had invested more than SGD300-400K into stocks. The amount ploughed into stocks are from my cash in bank as well as profits realised from gold and silver, bitcoin, stocks. In particular Keppel DC REIT returned more than 2 folds and I re-invested into the same stock to make it a “freehold stock” now. But that is only a very small part of my stock holdings, which I intend to progressively make it bigger.

MY PORTFOLIO – MAJORITY IN TECH STOCKS

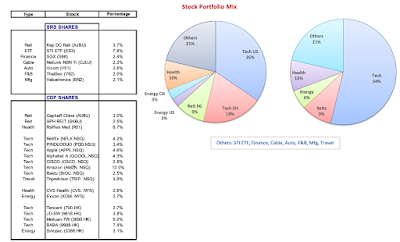

Today, more than 50% of my stock holdings is in Tech stocks that originate from the US (NASDAQ) and China (HKSE). My biggest holding is Amazon, followed by Alibaba (HKSE). I also hold stocks listed in US such as Apple, Alphabet, Netflix, Cisco, and China Baidu, Pinduoduo and stocks listed in HK such as Alibaba, Tencents, JD.com and Meituan DianPing. In fact, there are other stocks which I do not consider as Tech stocks in my portfolio, such as Tripadvisor in US, both Keppel DC Reit and Netlink in SGX are all also closely related to the Digital world of the future.

WHY I MISSED THE BOAT IN TECH STOCKS

Environment in Singapore Financial World

From the start of my investment journey dated a decade back, I have never doubted that the future will be a world of tech and digital. Nonetheless while I was aware of the future potential of tech world, the environment of the financial world or blogosphere in Singapore never really give me a strong enough conviction that I must invest in tech stocks. Everyone here was only talking about Warren Buffett style of investment “Buy and Hold” or “FA of stocks” or “TA of charts”. And most Singaporeans are mainly interested in stocks or topics such as REITs, Keppel, Sembcorp, SIA, SGX, STI ETF etc, even up to today after the covid crisis.

It is natural that you start investing in your field and stocks in your own country

I regretted the missed opportunity! However, I reckon I was not entirely to blame for the short-sightedness. This is because, it is only natural that you begin investing within your own country’s stock exchange. Also, I was working in the Marine and Oil and Gas, hence it is also instinctive that I invested in stocks I know best. When I started investing, I also spent a great deal of time reading and learning about Fundamental Analysis and to a certain extent, Technical analysis as I attended courses and started blogging thereafter.

It is a learning process

Throughout my investment journey, I read many books, articles and videos by “investment great” such as Benjamin Graham, Warren Buffett, Ray Dalio, Peter Lynch, George Soros, Jim Rogers, Nassim Taleb etc. Yet, none stressed the importance of Tech Stocks.

I became a financial blogger in early 2014, and be it in the local blogosphere or local investment websites or local investor authored books, nobody made a great deal about Tech stocks until today. Next, I ventured into ASX, because of Motley Fool Australia recommending stocks in AU. Fortunately, I divested all my AU stocks few years back. Otherwise, not only I will lose greatly in the stock value, but also incur exchange rate losses as AUD has depreciated significantly against SGD over the years.

Finally until recently, I dwelled into the studies of Gold and Silver, before learning more about Cryptocurrency and also invested in it.

Still, there is no major trigger for the investment in Tech Stocks.

WHY NOW, MY SUDDEN INTEREST IN TECH STOCKS

Last year, a business associate became my good friend. He is in the business of IoT and emphasized to me the explosive future of tech and digital business. I was convinced by him. Then my gal is entering into university this year, and while looking through the subjects in different local universities, I finally decided that SMU School of Info Systems is the best for her. Praise God that she was admitted into it.

Even with all these factors, it does not drive me to buy into Tech listed Stocks up to the covid crisis, except that I own Keppel DC REIT and it is doing very well.

However, this Covid pandemic crisis changes everything. It is an eye-opener. My perspective changed completely. This crisis fortifies the resilience of Tech Stocks in a world that is so different now, and in the future.

Warren Buffett is someone who use to loathe Tech Stocks. Today, Buffett’s Berkshire Hathaway (BH) portfolio largest holdings is Apple, valued at USD96.9B of BH’s USD223B total portfolio. This is 43.5%, let alone a further USD1.6B investments in Amazon. WB’s tech stocks’ portfolio is closed to 45%. Refer here for BH portfolio.

ROLF’S FINAL THOUGHTS

Singapore lacking creativity, focus and foresight in Tech

For ten years, nothing serious in this country arouse my interest in Tech Stocks. It also speaks a lot about Singapore as a country lacking foresight into the future. Look at how fast China has grown, when it comes to digital and technology. There are just so many successful and giant tech companies in China. Many smaller tech companies are springing up each day too. My Shanghai friend recently told me about Sky Eye in China where the people in Shanghai are all almost trackable by facial recognition. In Shanghai, almost no taxi can accept cash even several years ago, with all digital payments. I agree it there is no privacy in digital world, but do we have a choice? Do we want to oppose the future, and stay primitive?

How silly I am

It also reminds me of how silly I am NOT to invest in Tech stocks in the very beginning. Afterall, Google, Microsoft and Facebook appears in our everyday life. I also lost count on the number of Apple iPhones I owned. While already subscribed to Netflix since May 2018, yet, I stupidly waited until this month to buy into the stock!

Are there still room to grow?

Yes, the stock prices of Facebook Apple, Amazon, Netflix and Google “Alphabet” (FAANG), Tesla etc are already very high and rise quite a lot! Ask yourself, do you reckon they will stop growing? Do you reckon that if there is a second wave, will it depress the Tech Stocks or will they grow even higher? Even if there is a correction of tech stocks, it present a very good opportunity to buy into it.

I actually believe one day, Amazon will grow so big, that eventually it will build and own complete “Smart Cities” around the world, powered by AI, robots, drones, autonomous vehicles, in a green environment with everything connected to cloud internet. Furthermore, do you reckon that you will stop using Apple Apps or stop using Google twenty to thirty years from now?

How about Alibaba Taobao, Lazada etc, Tencent Wechat, China Google aliked Baidu, E-commerce JD.com, Meituan, Pinduoduo, which all are part of everyday life of Chinese people. Ask yourself if you think that the Tech sector in China is already saturated, or there are still room to grow?

Do remember that China has more than a billion population, and a large part of them are still living in rural and in poverty? China nominal GDP per capita in 2019 is still a mere USD10K.

The Amazon Perspective

Amazon was listed in 1997 with less than USD2 a share. Today the stock is worth USD3,000 a share. Imagine you had invested 1,000 shares back then at USD2 a share, costing you USD2,000. Today after 22 years, your USD2,000 had become USD3 Million dollars.

Better Late than Never – I am still learning….

Regrettably, I admitted that I was so late NOW entering into Tech Stocks. In spite of the lateness, just like my Blog slogan “Better Late Than Never”. I am still a firm believer in the tech stocks changing the world of the future.

That being said, I will also continue to invest in REITs and dividend stocks and have a well mix of other stocks in other industries. I am still holding on to a large part of Cash, Bonds and Precious Metals portfolio which can be converted to cash and take advantage of the low stock price if there is a near-term crisis that drives Tech Stocks price down to attractive level.

In 2017, Warren Buffett’s partner in BH, Charlie Munger said it was a “very good sign” that Buffett jumped into Apple. “It shows either one of two things: Either you’ve gone crazy, or you’re learning,” Munger said. “I prefer the learning explanation.”

Yes, me too… I am still learning every day in my life….

Yeah, think many younger investors have figured out to invest in local reits for income & US tech for capital gains. Maybe 50:50. Those more conservative can have 75% in local blue chip reits.

Agree, that invest in REIT (div) and Tech (capital) is a good way. Sounds very easy, and it is. But younger investors who lack experiences be it in investment or life, usually are more easily to be emotionally affected, and tend to make more poorer decisions at the wrong time at the wrong place, as compared to the older and wiser ones. Being younger also mean your Capital to invest is lesser, which is hard to make real good returns, unless your Dad and Mom help you out.

I have slight opinion differences investing in 75% of local blue chips. This pandemic has truly expose the shortcoming of local blue chips or STI. Many local blue chips not just lack its current shine, but the business fundamentals to adapt to the futuristic world is also not there. If you look at the stock mix of STI it is mostly in Real Estate, 3 banks and Jardine. Refer to my earlier article for more explanation.

https://www.rolfsuey.com/2020/05/why-sti-index-investing-is-not-as.html

I'm referring to "blue chip reits", not blue chips or STI.

E.g. Those Mapletree, Keppel DC, Capitaland, Ascendas, even Frasers for HDB heartland malls.

The strong trends currently are data centres, network infrastructure, logistics, and *some* industrials.

There are also plenty of riskier Reits, with weaker balance sheets or property assets or types of businesses. They may be value plays that can give bigger returns if things turn out well. But it's kinda oxymoronic to invest in Reits for such strategy — you'd want to invest in the underlying companies / tenants for such strategy instead. As usual, risk management with position sizing.

Hi, my bad. Miss out the word "Reit". You are absolutely right. Blue chip Reit seems like SG main triumph card n the dividends is good.

Are you in a financial crisis, looking for money to start your own business or to pay your bills?

GET YOUR BLANK ATM CREDIT CARD AT AFFORDABLE PRICE*

We sell this card to all our customers and interested buyers worldwide,Tho card has a daily withdrawal limit of $5000 and up to $50,000 spending limit in stores and unlimited on POS.

**WHAT WE OFFER**

*1)WESTERN UNION TRANSFERS/MONEY GRAM TRANSFER*

*2)BANKS LOGINS*

*3)BANKS TRANSFERS*

*4)CRYPTO CURRENCY MINNING*.

*5)BUYING OF GIFT CARDS*,

*6)LOADING OF ACCOUNTS*

*7)WALMART TRANSFERS*

*8)BITCOIN INVESTMENTS*

*9)REMOVING OF NAME FROM DEBIT RECORD AND CRIMINAL RECORD*

*10)BANK HACKING**11) BINARY TRADE/ ACCURATE SIGNALS

email Blankatmhacker007@yahoo.com

you can also call or whatsapp us Contact us today for more enlightenment

+1 (854) 203-2224

WE ARE REAL AND LEGIT………..2019 FUNDS/FORGET ABOUT GETTING A LOAN..

IT HAS BEEN TESTED AND TRUSTED

whatsapp only ===>> +1 (854) 203-2224

Cheap as $200

Hey Bro, very solid post. I shall share this post of yours on my twitter account.

Thanks Bro for your support always.

This comment has been removed by the author.

Hi SI, why you delete the post. I see nothing wrong with the original one. Haha. Yeah our friend UN is a crypto guru, and now flowing in his blood is not fluid but "digital" 🙂

Hi hi Rolf, I know u could see it.

Someone told me it might have unintentional impact of glorifying something and maybe cause "sheeps" to be slaughtered

I also on the tech wagon. Let's hope we huat together

Hi FI35,

Tks for dropping by. Saw ur Amazon, Alphabet and Microsoft giving fantastic returns. These are 3 Companies I love most. Read your website https://thefi35.com/2020/05/27/portfolio-update-may-2020-and-how-i-manage-my-1-4-mil-leveraged-portfolio/, which you said as follows. I share the same sentiment:

“I’m not likely to sell anything anymore. I’ll cash in when my kids goes to university and to top-up my CPF retirement sum. Hence, I realise I don’t really care whether it goes up or down. It doesn’t matter as my sell date is like 20 years later. So I don’t feel ecstatic when it goes up or panicked when it goes down.”

Hi, by entering into the tech market now which is near ATH. Don't you think it's a little risky?

So you don't think the second crash will be coming anymore per your post in March 2020?

Hi, I will write another post explaining if it is risky to invest in Tech at ATH prices with reasoning and analysis?

I wasn’t involve in Tech stocks prior to Covid. In March, I was thinking that Covid will be one of the worst crisis and many companies or even countries will collapse thereafter. I still think the same today.

Then I saw the surge of Tech Stocks and their disregard of the crisis. I started to take notice, and with the conviction I already previously have from friends and other news, I am convinced about Tech Stocks’ future.

Therefore, the only difference is the collapse is definitely not Tech Giants but smaller and more old fashioned companies.

After March, I also wrote below articles stating that we should continue to invest and how Large cap US stocks are unstoppable even if there is a second-wave.

If I have excess 100K now, how should I invest over the next one year?

Wall Street Vs Main Street – The Unstoppable US Large Cap Stocks Supported by Fed’s Dovish Promise

I hope you make money from your tech investments. Even if you don't, no need to feel too bad for the reasons below.

If I were to lose money investing in a bubble, I will prefer to invest in a tech bubble. Tremendous social/economic benefits will emerge even when a tech bubble bursts.

The dot-com/telecoms bubble in the late 1990s and early 2000s gave us the internet, fibre-optics, skilled engineers. The over-capacity built up by the tech bubble planted the seeds for later wealth creation/productivity which is being reaped by the U.S today. Another good example a few hundred years ago was the railway bubble which created enormous wealth later for Great Britain and U.S.

Maybe 100 years later, historians will look back and say that crypto-currency bubble laid the foundation for blockchain technology which delivered huge productivity gains in banking, healthcare, legal sector etc

While over-capacity in tech sectors will lead to pain to retrenched engineers, loser investors, some social/economic good will come out of this pain to society at large.

Can we say the same thing about real estate bubbles or over-speculation in innovative financial structured products which tend to benefit mainly the financial innovators at the expense of clients?

Warning: Although I'm fan of tech, I hope you don't get too encouraged into tech investing by my comment. I personally will avoid investing in tech if the bubble is too crazy and price is over-extended. I'm an investor, not a saint. I'm not going to invest in something to benefit others at my own expense.

Hi Hyom,

Thanks for the fantastic insight and wisdom. Everything happens for a reason. It is cause and effect.

No worries for me, as I halted my further foray for now, unless a correction. If you look at my portfolio, my tech is split between US and China tech giants.

If you look at US tech giants, the most overblown is Tesla stock, which I don’t owned. My bet is mainly Amazon, Apple, Google and possible Microsoft later. Netflix is a bit high now too, but there is a 7% correction last week.

In fact, if you look at the Chinese Tech, they are definitely not in the Bubble Zone. Baidu in fact is below its 5 year average. Alibaba and JD only just listed in HK and prices are still very close to IPO prices.

Hi Rolf,

Your post is like a wake-up call.

Will Covid revolutionize tech's role in our daily lives? I think it has already, slowly but surely.

I think some reasons why Singaporean investors don't hype much on tech stocks might be

1) hassle of currency exchange and needing to set up a custodian account to trade them (and more fees involved)

2) uncertainty towards individual tech stocks (as income stocks still rule over stocks with potential capital gain but high beta) – Tesla being one of them

If there should be another crash, likely I will scoop tech ETF.

–

Hyom, *like* your comment!

Hi Rainbow gal, thanks for the comments. I just read newspaper today, that it took years to convince people about the importance of digital in Singapore, but because of Covid now, it took only months to implement now in Singapore.

Yes, you are right about the currency exchange. But actually it is also wise to have some USD instead of SGD. In times of crisis, USD will soar as it is a "safe haven" so as to speak in the society of investment.

Guess both income and capital gains are important. E.g. over a course of 20 yrs, you may have compounded a lot of dividends, which is exceptionally good, but if your stock have minimum capital gain or even decline, then it is not as good.

As I mentioned, if you look at the world's largest capital gain basket of stocks in the last 15 yrs, it is w/o a shadow of doubt – Tech stocks!

Hope (or Hope not) there is another crash.

Do you think if there is another Covid Crash, Tech stocks will crash more than 10%? I mean certain Tech stocks like Amazon, Google, Apple, Alibaba, Tencents etc?

Unless there is a currency crisis in the near term, I doubt the 2nd wave of covid will have much impact to the Tech stocks I mentioned earlier, as Tech stocks are meant to soar even more because of Covid situation.

Like you, I really love that Hyom always write beautifully with so much wisdom!

Hi Rolf and Rainbowcoin,

Thank you for your kind words.

I don’t see any good listing in sgx vs hk stock exchange for quite a while already. I do agree there is a long runway for chinese tech stocks (The likes of pinduoduo, alibaba, tencent), there are dual listing in us market but I prefer hk market due to timezone – easier to monitor. For fixed income play, local reit good ones are overbought and I think it’s lost opportunity cost locked in these vs growth stocks. Maybe when older will look into divesting more into fixed income, but now maybe not.

Hi Sg Lady Road to FI,

Yes. Me too, HK market is better in terms of time zone! Yeah good point about lost opportunity.

Mixture of fixed income and growth is good. Yeah more older people prefer fix income..

Bcos sometimes growth stocks take time!

Natural herbs have cured so many illness that drugs and injection can’t cure. I've seen the great importance of natural herbs and the wonderful work they have done in people's lives. i read people's testimonies online on how they were cured of HERPES, HIV, diabetics etc by Dr Edes herbal medicine, so i decided to contact the doctor because i know nature has the power to heal anything. I was diagnosed with Herpes for the past 3 years but Dr Edes cured me with his herbs and i referred my aunt and her husband to him immediately because they were both suffering from Herpes but to God be the glory, they were cured too .I know is hard to believe but am a living testimony. There is no harm trying herbs, Thanks. Write him on WhatsApp on +2348151937428. @dr_edes_remedies deals with

(1)Alzheimer virus

(2)Cancer

(3)HIV

(4)Herpes

(5)Genital warts

(6)ALS

(7)Virginal infection

(8)HPV

(9)Hepatitis

(10)Asthma

Email him on dredeshome@gmail.com

https://dredesherbalhome.weebly.com

Para evitar todas las infecciones por hongos, le recomendaría que intente ir a este sitio esta página, ya que es aquí donde siempre puedo resolver problemas de este tipo, pruébelo

Hi Rolf,

Good to see you are mostly in Tech. Your port shld be doing well now.

Sorry to comment so late but I guess it is still not too late for discussion.

I also have Cisco, CVS , Alibaba and JD.

My only concern is only on Cisco due to its forecasted flat/negative growth. However, I know Cisco's business is mostly cyclical and it is not their first time. As it appears, the current period is their down cycle. Another worry is it becoming the next IBM tho I feel it is unlikely. What are your thoughts about holding Cisco?

(Since other tech stocks are soaring while Cisco has been range trading)

Thanks!

Hi Frowns88, thanks for dropping by.

It is better late than never.

The portfolio was listed 1.5 months ago. I already sold my CVS, and CISCO is one of my smallest holdings of tech stock, since I added more lots in other tech stocks.

Yes, CISCO is cyclical. And it is one category of stock I buy for unloved now, but potentially jump when economy recovers. Market valuation is pretty low now and eventually due to the increasing use of digital market, network gears will definitely still needed.