Hello readers, I have been pretty quiet in the blogosphere lately. This is partly because of time spent putting up my properties on sale, and at the same time, looking at property to buy. Our property of interest is a landed house. Since my household is big, the natural choice is a house with bigger space.

- Freehold landed (or 999 years old)

- 99 years old Leasehold landed

- Cluster House ak.a. town house or condo with terrace houses.

The above types of landed came into my mind, but after some deliberation, I decided to go for Freehold landed property. This is because I love the fact that I own the land and the property “forever” without deprecation and also with the possibility to unlock the value when I am at an older age. Or I can simply leave it to my kids.

The difference in pricing in terms of Price Per Square Feet (psf) are huge among these types of landed. Clearly, FH is most expensive, followed by 999 then 99 years leasehold.

For leasehold 999 and 99 LH landed, the land belongs to you until expiry. In the case of FH, you own the land forever, unless governmental intervention. This is because ultimately our government still own all land in the country. For Cluster House, it is likened to landed in a condominium and you are NOT able to rebuilt or perform A&A (addition & alterations).

Except for cluster houses, you can basically tear down the house, and rebuilt or do A&A subject to plot ratio, structural integrity, and URA – BCA approval.

PRICE OF Freehold LANDED TODAY?

About 10 years ago, I contemplated buying a landed house and had went for viewings. Back then, you can easily find a FH landed selling for SGD1,000 psf (land) +/- with a 2.5 to 3 storey 2500 to 3000 sqft built up floor area. Today, you can hardly find any in the listings at that kind of price. Perhaps the “super ulu” locations or very run-down conditions, or very odd shapes layout, then the asking price can be SGD1,000 psf (land) or lower.

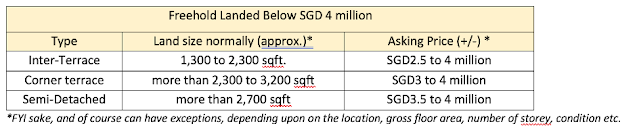

The asking price listed are commonly between SGD1,300 to 1,600 psf, with good locations or well renovated ones as high SGD2,000 psf and above. Below are typical land sizes for 3 different types of FH landed properties within my range of search. Locations such as Changi, Loyang, Tanah Merah, Jurong West, Woodlands, Admiralty, Sembawang, Yio Chu Kang (excludes those near to Lentor MRT), Sengkang, Punggol were all excluded in my consideration.

Below are the pricing estimate. Psf is against land area.

NUMBER OF LANDED PROPERTIES IN SINGAPORE TODAY

There are only 5% of landed house in Singapore today.

In 1990, there were about 46,000 landed properties in Singapore. This is more than the 31,000 Condos and Other Apartments recorded – (data by Singstat). Over the course of the last thirty years, more and more HDBs and Condos and other Apartments were constructed, but definitely not for landed properties. In 2019, there are 69,000 landed properties and 222,000 Condos and Other Apartments and more than 1 million HDB homes.

The below chart tells it all why landed properties is very valuable in a land scarce Singapore.

FINAL THOUGHTS

FH landed properties is really expensive. That said, I am afraid if I miss the boat buying today I will never be able to buy an affordable one in years down the road. Of course, I am those who will work out my sums properly before jumping into a big decision.

10 years ago, I was hoping that price could be SGD 2 million for a decent condition landed property in a rather mid-level convenient location, I cannot find it back then.

10 years later, I was hoping for SGD 3 million with the same condition. Again, it is almost not possible to find.

10 years from now, it is likely that the price tag will be SGD 4 million and above with the same condition. And I reckon that landed property will likely average at SGD2,000 psf (land).

Imagine that a 99 year LH Condo outside CCR already selling for more than SGD2,000 psf. Let alone a land that you owned “forever” at SGD2,000 psf.

For now until the next ½ year or so, I will concentrate on selling my properties while eying for a home sweet freehold landed home.

Do you think landed properties pricing will ever crash in Singapore?

The best time to buy was 10 yrs ago, the next best time to buy is now, I bought mine at chatwell drive for some 4m, i rebuild it.

If u dont buy now, then u will regret again 10 yrs later.

so in this matter, better dont be late, Better late than never is a no no.

Hi, I agree w u. And Serangoon garden is definitely one of my favourite places for my home, if I can afford it!

It is indeed, new MRT lines also coming up not too far. Very good residential area where I go for Long walks. Chomp chomp and many good eateries! The attractions are there

Best wishes!!

✅BINARY SCAM RECOVERY

❌ Binary Option, Forex and their likes are a means of making money but it’s more like gambling. There are no sure means to guarantee that a person could make profit with them and that’s why it can also be reasoned to be scam. Let’s not forget that some individuals even give you 💯 % guarantee of making profits and end up running away with your money. The internet today is full of Binary Option Recovery Scam, you see so much testimonies been shared about how a firm or Company helped them recover what they lost to Binary Options. But believe it, it’s just a way to lure more people and end up scamming them.

❌ You might have also come across some individuals that say they will give you guarantee on successful trades but they only end up as SCAMMERS as well. You here them say stuffs like 200% guaranteed in just 2 weeks and when you go into trade with them, they start telling you to pay profits percentage before you can get your income. These are all liars please avoid them. But if you have been a victim of this guys, then you should contact PYTHONAX now‼️

✳️The big Question is “Can someone Recover their money lost to Binary Option and Scam⁉️

I will say yes, and will tell you how.

The only way to Recovery your money back is by hiring HACKERS to help you break into the Firms Database Security System using the information you provide them with, Extract your file and get back your money. It seems like a really impossible thing to do, I will tell you, it should be impossible, but with the use of specially designed softwares known to HACKERS and Authorities (such as The FBI, CIA e.t.c) it is possible and the only way to recover your money.

✅ PYTHONAX are a group of hackers who use their hacking skill to hunt down SCAMMERS and help individuals recovery their money from Internet SCAMMERS.

We just need the contact details of the SCAMMERS and Paymnet Info and within 4-8 hours your money will be return to you.

✳️ You can contact us via the emails below-:

[email protected]

We also provide Legit Hacking Services such as-:

🔸Phone Hacking/Cloning

🔸Email Hacking & Password Recovery

🔸Social Media Hacking & Passowrd Recovery

🔸Deleted Files Recovery 🔸Mobil Tracking

🔸Virus detection & Elimination.

Email-: [email protected]

Pythonax.

2020 © All Right Reserved.

I think the property price can only keep rising if continued immigration. A lot of it!

Google for 'Singapore TFR'

Yes, I agree, and even so is land that is scarce!

I did the sums when I was in my mid 40s on the pros and cons of concentrating our wealth on a landed versus splitting it over two smaller properties – one for staying and one to generate rental income. Of course, one would not need to do this exercise, if you have sufficient funds to buy a landed home and still have enough money to invest for income.

Needless to say, we settled for two properties. One 4 bedroom condo for staying and one 3 bedroom condo for rental income generation.

Now that we nearing 60, we are happy that we didnt go for the landed property because we cannot imagine maintaining the house, climbing up and down stairs etc.. And to think that it doesnt generate income for us for all this while. To tap its value, one would have to sell the house as did a few of my neighbours who downgraded from their homes to move into our condo.

Staying in a condo also has other benefits such as having the convenience of the facilities at your doorstep. Facilities that we used frequently were the tennis courts, swimming pools, gym and basketball.

Also as we near retirement and in retirement, income (passive) becomes a dominant consideration. In our current situation we do not need to downgrade, as we have passive income from rental, dividend and CPF. Had we bought the landed house, we would be considering seriously selling it off to tap its value for retirement sustenance.

And finally the million dollar question : who would be financially better off ? One who spent $3M on a landed home or one who split the $3M to purchase two condos?

To answer this, I do have a colleague who bought a landed home at about the time we bought our condos. At last check, I think we are better off in terms of total networth and yet have a passive income of close to $200,000 a year.

I know my colleague does not have much passive income because much of his networth is tied up to his landed property.

Read Robert Kiyosaki's book (Rich Dad, Poor Dad) to understand how he classify asset and liabilities.

Agree with your observation and kudos for investing savvily in instruments that generated this. However, I am fairly certain that the rentals from your condo were only minor contributors to the 200000 yearly passive income you get

Am I right? Congratulations and thanks for motivating younger folks here 🙏🏼

i recognise that the choice of the house you live in is an expense (because you could always live in a cheaper place and invest the difference, be it another property or other assets).

However, if you are sure at some point in your life you do want to stop defering that luxury of an expensive home, then the question is if one should do it 10 years ago, right now or 10 years later.

and i guess that comes down to 2 factors: 1. how well your investments are doing vs how fast your eventual “lux home price” is climbing. and 2. how much enjoyment or intangible experiences you might be losing if you by pushing back your purchase 10 years.

For example, if you wanted a garden or condo facilities for your kids to grow up in, or for the grandparents to live in the same house so that the kids will know them better. 10 years later may be too late.

and of course, if you already can afford you lux home option as an expense then no harm jumping in!

i recognise that the choice of the house you live in is an expense (because you could always live in a cheaper place and invest the difference, be it another property or other assets).

However, if you are sure at some point in your life you do want to stop defering that luxury of an expensive home, then the question is if one should do it 10 years ago, right now or 10 years later.

and i guess that comes down to 2 factors: 1. how well your investments are doing vs how fast your eventual “lux home price” is climbing. and 2. how much enjoyment or intangible experiences you might be losing if you by pushing back your purchase 10 years.

For example, if you wanted a garden or condo facilities for your kids to grow up in, or for the grandparents to live in the same house so that the kids will know them better. 10 years later may be too late.

and of course, if you already can afford you lux home option as an expense then no harm jumping in!

i recognise that the choice of the house you live in is an expense (because you could always live in a cheaper place and invest the difference, be it another property or other assets).

However, if you are sure at some point in your life you do want to stop defering that luxury of an expensive home, then the question is if one should do it 10 years ago, right now or 10 years later.

and i guess that comes down to 2 factors: 1. how well your investments are doing vs how fast your eventual “lux home price” is climbing. and 2. how much enjoyment or intangible experiences you might be losing if you by pushing back your purchase 10 years.

For example, if you wanted a garden or condo facilities for your kids to grow up in, or for the grandparents to live in the same house so that the kids will know them better. 10 years later may be too late.

and of course, if you already can afford you lux home option as an expense then no harm jumping in!

Hi, thanks for commenting. Yes, condo and landed have their pros and cons. For me it is becos of bigger family needing space n not solely for monetary reason or investment reason. I m grateful for staying in condo with facilities n my kids enjoyed that.

wow 3 for the price of 1 😱

FH did crashed in the late nineties. My dad's semid valuation dropped from 2mil to 1mil+.

Wow, the two recent times SG prop dropped is probably in 1998 after AFC, but prices rose quickly n higher in 1999. Likewise in 2009 after GFC, but in 2010 n later prices rose again steeply upwards.

I doubt ur dad's semid depreciate in value until today if he bought in late nineties?