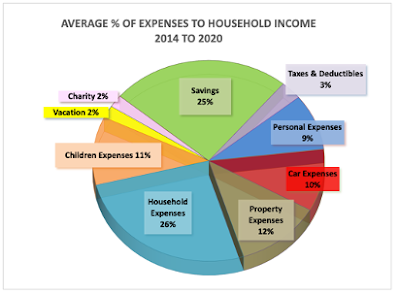

This is first time since I started blogging to publish data related to my household expenses. Below are data reflecting the percentage of My Household Expenses to My Take-Home Household Income. The data is compiled from year 2014 to c2020 (forecast), and below pie chart depicts the average data over the last seven years. 2020 data is accurate up to August and the rest of the quarter is estimated on a relatively conservative basis.

Gross Take-home household income – Me and wife are the two earners in a larger than usual household. The values here shown our Salaries excluding CPF contributions, AND ANY other incomes, such as property rental, professional writing, blogging income etc.

All the rest of the expenses are taken as a percentage of the Gross Take-home household income.

Taxes and Deductibles – This includes personal income taxes, property rental taxes, as well as related rental property expenses (e.g. repairs, furniture, agent commissions, etc). The 3% tax is mainly contributed by my income tax and our rental property tax, as my wife’s income tax is negligible due to a lot of reliefs. The value could have been higher, if not for forty thousands of baby’s birth tax relief received during this period.

Personal Expenses – This include food and entertainment expenses spent personally or with friends, as well as outlay on personal apparels, hobbies, gadgets etc. It also includes personal insurances, medical and dental expenses etc. In general, our personal expenses are considered low, at a combined of 9% (i.e. 3% for Rolf and 6% for wife). This is because we mostly eat home-cooked food, except for weekend spent with family that are included under Household expenses. We rarely spend on ourselves, except for special occasions such as birthdays or anniversary, but both wife and me do catch up with friends regularly for a drink or meal outside. Also, my hobbies are cheap, such as gym, table tennis, swimming, reading, writing etc.

Car Expenses – This expenses are all related to our one car at any one time clocking high double digit percentage expenses. It excludes wife’s, children’s transport expenses etc. My car expenses are rather high during the period of 2014 to 2015, when I owned rather expensive first hand car. From 2016 to 2019, expenditure is for full payments of cars, repair costs and 10 year COE renewal. The full payment in 2019, also mean that 2020 car expenditure is a mere less than 1% and expected to continue stay low in the coming years.

Property Expenses – This includes Cash portion of monthly mortgages paid, but excludes any lumpsum payments of property loan, or regular mortgage payments via CPF. Property tax for “own stay”, fire insurances, condo miscellaneous fees etc are taken into account as well. 12% average for mortgage plus associated expenses are definitely considered low, considering we have more than one property. Note that I am very conservative in my property leverage, and my loan period is kept within a decade.

Household Expenses – Undoubtedly this is the largest expenses each year. It is inevitable due to our large household members under one roof. The largest portion is household food and groceries, our helper’s expenses and extra pocket money to my parent/parents-in-laws. Due to my large relatives and friends base, a significant portion of this expenses also comprises of spending for special occasions such as CNY, wedding, baby showers, birthdays, wakes etc. This year household expenses could have been lesser and not 22%, if not for a sum of 20K accrued for partial renovation of my house, that was put on hold due to Covid. I intend to continue in the coming months or perhaps next year.

Children Expenses – This is another big part of our spending accounting for 11% of our take home income. The baby bonus and CDA top ups do give some reliefs especially on the very high education fees in Kindergarten. I expect this expense to increase as our kids become older due to more expensive enrichment, tuition and sports classes and more pocket money.

Vacation – 2% is very low in my opinion, in comparison to many of my friends who almost travel as a family every year to expensive places such as Japan, Europe etc. The expenses incurred are mostly vacation with my wife in Taiwan, Bali and Malaysia and some of the business trips she tag along with me to the Western Hemisphere.

I am not stingy to spend on family travel, and the lower expenses is due to kids still of young age in the past, the cheaper staycation expenses. My busy work-travel schedules also meant lesser time for vacation. That said, we do have family travel to KL Genting, staycation in Singapore that are equally enjoyable, and in 2019, we went for a big family vacation in Australia and I really spent a fortune of more than 20K. Bearing in mind that when we travel as a family, we normally need to book 2 or 3 rooms or suite and not just a small family of four that definitely has much lower expenses. This year’s vacation expenses will be greatly reduced due to Covid-19, but I have already catered a small sum for year whole family staycation.

Charity – This includes regular and lumpsum disbursement to charitable organisations or to families (not relatives) we know who are poor and in need of support, as well as pocket money for my niece in overseas university. From 2014 to 2016, I did spend on charity but the amount is negligible in percentage and was omitted. From 2017 onwards, we began to spend more for charity, with outlay of 2-4 percentage per annum.

In reality, the amount is definitely higher, as I have considered money that was shove into the pockets of my relatives, as household expenses. We also held several charitable house gatherings of 20 or more in the past, that we provided free food, and this was also included under household expenses.

Savings – Average Savings stand at 25%. I think it is a decently good figure. This year I forecast Savings to be highest at close to 40 per cent of our take-home household income! Without any shadow of doubt, it is due to Covid lockdown. All expenses have dropped in 2020, except for spend on kids, because my youngest started school this year. Property expenses also halved due to “mortgage payment freeze” for six months, this year. Savings could also be higher depending on whether I decide to spend on my house renovation this year.

CONCLUSION

My wife and me worked hard to have a comfortable household income for our family. According to 2019 Singstat data (here), our gross household income for the past seven years are consistently in the top ten percentile and in the landed property range.

Nonetheless, I was, and will never be complacent. I always remind my wife and myself that no jobs and salary are guaranteed, no matter how diligent we are. Just look at the Covid situation. Even the “iron gold rice bowl” of the Pilots are in doubt nowadays.

As a result, I rarely overspent or even spent for myself, except for spending on my wife, family and kids, and for people who are generally good hearted, and/or in need. These are huge portions of our expenses, and including property expenses, account for half of our household income.

Apparently I consider spending on kids as investments, as they will bear fruit in the future. Not just money, we also commit a lot of time with our children.

My savings will often turn into investments, and ultimately with the money saved or earned, I intend to buy a freehold landed-house for my big household and finish paying within the next ten to fifteen years.

In terms of charity, I will definitely love to do more, but our huge household and kids’ expenses can be a drag at times. On average, our Charity expenses is comparable to Vacation. This give an equal emphasis on Charity and helping others to just pampering ourselves.

Personal finance is so fascinating simply because it is personal. Everyone has different circumstances to handle! As always, thanks for sharing. I can imagine your household situation to be very "interesting" so many people living together! Some snippets on that in future, if you don't mind.

Lastly, congrats on the comfortable household income situation AND knowing how to make good use of that!

Kevin

Hi Kev,

Well said. Personal finance is “personal”. Everyone has different way of “losing” and earning money. Eg. some spend on cars, some on vacations, some on food, some on expensive cameras, some on golf, some on kids’ education, some even in mistresses… oops!!! Mine is mainly family.

When we meet one day, I will show u personally the snippets of my household, since it’s “personal”.. haha.

Looking forward! Agree, there is a reason why both of us choose to remain semi-anonymous 😉

Is it worthwhile to buy a freeland house given the likely need for a bank loan in the later part of life?

A two cents worth of views.

WTK

Hi WTK,

Appreciate your views, sincerely.

I agree with you that landed prop are exorbitantly priced in SG, esp FH. I hate to spent that kind of money on a house so ex!

However because of my larger household, most are sleeping on the floor now, and even a 4 bedroom flat is not quite enough. I will definitely love to buy a landed overseas for less than 500k, yet bigger, compared to SG. But there is a foregone conclusion unless we migrate. “also worth my thoughts”!

Anyway, my thoughts on property mortgage and interest payments are in my earlier article!

https://www.rolfsuey.com/2020/05/rolfs-analysis-to-help-you-decide-to_29.html?m=1

I am lucky to have a nett +ve value of >7 digit for my pte apt now, and also collecting another prop’s rental. So either I will buy the landed with two properties rental supporting? not quite feasible now due to the high stamp duties, and I will need to sell off a big portion of my stock portfolio…

Guess it’s more feasible for me to sell one prop and put a comfortable downpayment for the landed. Then I will incur lesser interest payment, and yet supported by another prop rental income. Together with stock dividend, and of course our salaries, guess the mortgage burden will be very minimum.

Or I can actually sell off my investment portfolio n one prop to pay down huge portion of my landed mortgage. But that is something not worth doing bcos the prop interest is so low now.

My target to clear my landed loan within 10yrs from now, and hopefully my investment portfolio will do well by then for me to cash out to be loan free.

Anyway, I have very little financial goal in life, as I am too lazy to further climb in the corporate world due to the politics. Also I don’t really look forward to FIRE, bcos I love to keep on working actually..strange!!! But maybe in a diff environment.

Hence, I set the landed prop target to drive n keep myself going, otherwise, I worried that I will just fired my “boss” n just do nothing… if one day I really feel so dry out.

Also, as a gift for my kids in future.