PORTFOLIO

In the past few months, I continued to increase the percentage of my shares in my overall portfolio. In April, I wrote in my blog post Rolf’s Updates – My Priorities in Life – Health, Finance, Family, Friends & Hobbies – 2020 1Q , that excluding properties and CPF and jewelleries; I had 51% Cash, 28% metals, 15% shares, 5% bonds, 1% crypto. Currently, my portfolio as follows.

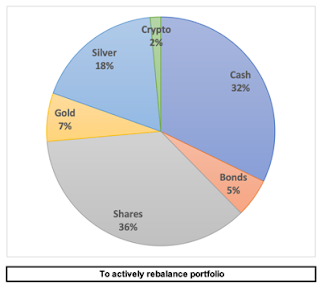

Basically 3 categories:

· Cash + Bond – 37%

· Shares – 36%

· Gold, Silver and Crypto – 27%

Strategy

The strategy of these 3 categories is to have flexibility to withstand all periods of the market situation. For e.g. if there is stock market crash, I assume the precious metals pricing will rise. I can then profit from the sale precious metals and use the proceeds to buy the cheaper stocks. If the stock market peak, precious metals will be unloved and I will sell my shares to accumulate more of it. I also have sufficient cash to keep on accumulating cheaper shares or other assets if relevant. Also, I am a believer of cryptocurrency but I keep the percentage low to minimize risk. If prices of crypto crash, I will accumulate more of it too.

Cash

I keep a huge percentage of cash and easily liquid-able bonds. It sounds really silly as cash gives very low or no returns. But frankly, it is not the case for me, as I derive say two or more percentage of return. My OCBC365 savings account provides more than 2% return of interest with my salary, bills, spending tagging to it. My bonds are all more than 2.5% return on average.

But the bigger factor of my larger cash holdings is due my individual household situation. I have a huge household of 4 studying children with huge expenses. Aside from my own family, every month we also support my parents-in-law, my domestic helper, 4 adopted World Vision children and pastoral families in poorer countries.

My relative base is huge, and there are lots of commitments in weddings and events which requires “red packet”. My aunties, uncles and cousins are generally less financially sound too, and each time when there are gatherings, I will slot money into their pockets. Now, with my wife resigned, the burden each month for me is even bigger.

Lastly, my accumulated cash can also be use to pay down my lumpsum of my mortgage every two years when I re-financed my loan.

SHARES

During the next one year or so, I will continue to accumulate shares regularly. If there is another crash, I am also well-positioned utilize the sale proceeds of my precious metals and cash to take advantage of the cheaper shares.

Long Term

My strategy for shares is to hold for long term for now. In my earlier years of investments and even recently, I always took profit too early even when the company fundamental is still sound. I had learnt my lesson and will not do that anymore.

Invest in US and HK stocks

In the past, I am only fixated to Singapore stocks. This pandemic opened my eyes that I need to buy growth stocks in USA and HK. I also explained in my earlier article : Why STI Index investing is not as lucrative, and long term future is not bright?

Categories of Stocks

Growth Stocks – I am bullish on Tech and Data stocks and China. I firmly believed they are the future. Despite their high prices now, I think they have more room for further growth. Will continue to add.

Unloved Stocks – I bought Tripadvisor for this reason and will continue to find and put other stocks in this category.

Dividends Stocks – Will continue to accumulate SG REITs or dividend stocks into my basket.

Energy Stocks – I think that they are cheap now, and will continue to add, when relevant.

Brother Rolf, do you mind to share your Bond portfolios. Thanks.

Bro, thanks for dropping by. Mine is SSBNov15 & Jul18 with 2.75 & 2.65 % for 10 years. And also FCL3.65.

My advice is do not buy SSB now as yield is too low. Actually if you do not need the money and do not mind value go under par, you can go for corporate bonds such as FCL3.65, CapitaMall3.08, AstreaIV4.35 n V3.85, DBS etc…

https://www.sgx.com/fixed-income/retail-fixed-income-securities

Thanks Bro for the great info. Appreciate it.

Hi Rofl,

If you are open to share – for your metals, are they physical or paper holdings?

Thanks!

BmD

Hi Buildingmydream, tks for dropping by. I use to have 50% paper (GLD ETF) n 50% physical gold (bought from UOB). Now UOB also has paper Gold savings account I think, but you need to be there physically to open the account. Since the crisis, I sold off GLD to buy more stocks. Physical is more troublesome to sell.

For Silver it is the same, I have UOB silver accounts and bought Physical silver from Silver Bullion. The charges for storage charges in the vault is expensive and UOB also deduct your Silver oz as charges each year. My silver holding is high but not lucrative. I sort of regretted buying too much more Silver than gold. I think for a start, you should go for gold, which I think it is a good hedge already. But if you think Silver is really cheap now and may explode, then go ahead also.

I bought physical back then, because I love having all experiences of paper and physical. Also, I like to see and touch both gold and silver back then.

But frankly, I think if it is just for investments and not items collector, paper is more liquidable!

But if possible, you can have 50% paper 50% physical, as being Asians, you feel good to have something physical in your possession and there can be times when physical pricing can diverge from paper. https://www.rolfsuey.com/2020/05/understand-divergence-of-physical.html

Please also refer below and I did mention more about gold and silver and how to invest your 100K.

https://www.rolfsuey.com/2020/05/if-i-have-excess-100k-now-how-should-i.html

Also a commenter mentioned GLDM paper gold is cheaper!

Thanks Rofl!

I have always been in a dilemma between physical and paper metals since physical would be reflecting a real hedge against fiat currencies and paper would become useless in that kind of situation if we revert to the days of barter trade.

Also, the recent divergence that you pointed out raises concern on paper although it is definitely more liquid.

Appreciate your suggestions, I will certainly look into them!

Hi BmD,

I use to believe there is slight possibility that we may one day go into useless currencies and go into barter trade. But nowadays I think the possibility is really very very slim, because of government intervention, ease of digital currency printing, and advent of technology to eliminate the needs of barter trade..

In times of greater crisis, when real demand and shortage of metals due to fear are taking place, ok.. physical will deviate from paper. But the Physical are also subject to bullions or banks earning more commissions during buy and sell…

Overall, I think 50 – 50 should be ok, if you really believe in metals as a hedge! Bcos you can sell paper metals easily to convert into cash if needed, the physical is as backup!

Thanks for dropping by. Please do your own research too! 🙂

Seems like you have gained faith in the alternatives minimising the needs of barter trade days..

Hopefully, this similar phase will pass for me too..

Cheers!

**Sotong me. Realised comment below was in the wrong section. Repost here..

This comment has been removed by the author.

Natural herbs have cured so many illness that drugs and injection can’t cure. I've seen the great importance of natural herbs and the wonderful work they have done in people's lives. i read people's testimonies online on how they were cured of HERPES, HIV, diabetics etc by Dr Edes herbal medicine, so i decided to contact the doctor because i know nature has the power to heal anything. I was diagnosed with Herpes for the past 3 years but Dr Edes cured me with his herbs and i referred my aunt and her husband to him immediately because they were both suffering from Herpes but to God be the glory, they were cured too .I know is hard to believe but am a living testimony. There is no harm trying herbs, Thanks. Write him on WhatsApp on +2348151937428. @dr_edes_remedies deals with

(1)Alzheimer virus

(2)Cancer

(3)HIV

(4)Herpes

(5)Genital warts

(6)ALS

(7)Virginal infection

(8)HPV

(9)Hepatitis

(10)Asthma

Email him on [email protected]

https://dredesherbalhome.weebly.com