The ever positive and optimistic Warren Buffett investment guru sounds cautious during Berkshire Hathaway (BH) Annual shareholder meeting recently.

NOBODY KNOWS WHAT THE MARKET IS GOING TO DO TOMORROW.

QUOTED WB

“I don’t know, and perhaps with a bias, I don’t believe anybody knows what the market is going to do tomorrow, next week, next month, next year. I know America is going to move forward over time, but I don’t know for sure, and we learned this on September 10th, 2001, and we learned it a few months ago in terms of the virus. Anything can happen in terms of markets, and you can bet on America, but you got to have to be careful about how you bet, simply because markets can do anything.”

UNQUOTE

Comments Rolf:

I agree entirely that nobody knows what the market is going to do tomorrow or next year or the year after next. If you are having the mindset that wow… stock market is cheap and I am going to throw everything in, think again! Or if you think stock market is expensive now because it has risen 20% since late March low and you miss the boat, and are waiting for stock to retest March low, before you throw every cash you have in, also please think again. If you are trading, and in the last few months whether long or short and you managed to win $ and think highly about yourself, that you are going to win loads and loads of $ during this downturn, think again too! Your pride can just be your biggest misery, because nobody knows what the market is going to do going forward.

WB RECOUNTING GREAT DEPRESSION

It is almost first time I recall (correct me if I am wrong) that WB talks a great length about Great Depression during his annual meeting. An event that he himself having almost 80 years of investing experience did not experience the greatest collapse of the stock market in the last centure. Perhaps that is why he rarely talks about the Great Depression because WB loves to relate his experiences when he is giving a speech or answering during interviews. But this time, he sounds different and cautious!

To recap,

WB highlighted on September 3rd, 1929, the Dow average closed at 381.17, and people were very happy and buying stocks on margin that worked wonderfully. His dad, who was 26 years of age back then, was an employee in the bank who sold stocks to people.

Few months later 13 Nov 1929, Dow drop 48% to 198.69. His dad was too ashamed to face those people he sold stocks to, and stay at home and 9 months later WB was born.

The last trading day before WB was born on 30 Aug 1930, Dow was up 20% to 240.42 from 1929 low.

QUOTE WB:

People did not think in the fall of 1930, they did not think they were in a great depression, they thought it was a recession very much like had occurred at least a dozen times, although not always when stock markets were important, but we’d have many recessions in the United States over that time, and this did not look like it was something dramatically out of the ordinary. For a while, actually for about 10 days after my birth, that’d be …and the stock market actually managed to go up all of 1-2% there in those 10 days, but that’s the last day. UNQUOTE.

Almost 2 years later 7 Aug 1932, Dow was at low point of 41.22.

QUOTE WB:

if somebody had given me $1,000 on the day I was born, and I’d bought stocks with it, and bought the Dow Average, my $1,000 would have become $170 in less than two years, and that is something that none of us here have ever experienced that we may have had it with one stock occasionally, but in terms of having a broad range of America mark down 83% in two years, and mark down 89% of the peak, that was in September 3rd, 1929, was extraordinary.

UNQUOTE

1 Apr 1951 Dow 240.85, after more than 20 years, a buyer on WB’s day of birth finally gets even (though dividends had been received).

Comments Rolf:

Rolf: If you buy a stock in 1930 believing the crash in late 1929 is the worst and has bottom, it will take you 20 years in 1951 for your stock to recover to breakeven price. Likewise if you are buying a stock in late March 2020 and think that in the next 2-3, or even 3-5 years the recession will be over and you will earn a lot of money, think again. There can be a chance that you may end up in the mindset or situation with those who invested in 1930 and have to wait for over 20 years to breakeven your stock price.

I never say for sure it will happen, but what I am saying is there is a chance it can happened because nobody knows. Of course, I also think there is an equal chance the market will recover and hit high again.

Therefore when it comes to investment, when it is uncertain, you have to weigh RISK and REWARD carefully and cannot just bet for sure that market will improve within next few years. And if you do not throw all your eggs into the market and only thinking about recovery, then you are betting and not investing. Better to be safe than sorry! It is better to win less money with backup for worst of the worst, than having to wait for 20 years like what happened during 1930-1950s.

CONCLUSION

If you think that you know what is going to happen in the market next month, or next year, or next few years, YOU DON’T!

If you think that you are very smart because you utilize significantly large percentage of net cash buying into the market at its lows in March, YOU ARE NOT!

If you think that you are smarter than the rest because currently you are making money now in the market, YOU ARE NOT!

You are just fooled by randomness, and using betting mentality rather than weighing risk and rewards.

Always be humble and have the prepare for the worst mindset, while staying cautiously optimistic about the future.

Always seek the truth and be realistic and use data, risk and reward metrics to justify your actions.

Last but not least, do not overspend time looking at the market or news, as life encompass more things other than your desire to make money from the market.

Aside from work (if you still have it now),

Spend time enjoying with your family.

Spend time calling your good friends.

Spend time doing some exercise.

Spend time in your hobbies.

Spend time helping others if you are called to.

And of course spend time to relax enjoying nature….

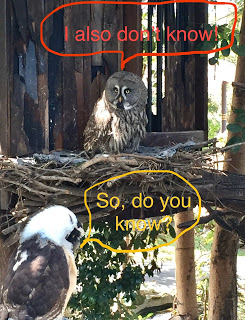

A picture taken when I was in Hanoi end last year.

Hi Rolf

Nice picture by Hanoi! I went to Danang and Hoi An too last year which was great.

Anyway, back to the market. It's hard to ask equity investor to think about the risk more than the rewards. You can compartmentalised some of it but not most of it since otherwise that very same person would either have to be a bond investor or Warren Buffet, or a blended of the two 🙂

Hi B,

Tks. I was suppose to have my holiday in Danang last year, but things crop up and I postpone ticket till Apr this year with hotel also booked, but guess u know the rest.

Agree that human nature tends to think about rewards more than risks. Likewise myself think the same. I just want to use this article to say the other side of the coin for people to realise there are 2 sides.

Not discouraging investing now, nor encouraging. 🙂 I am still investing now…. at least in Apr, I took some positions.

If DOW down by more than 5% tonight, tmr one or more markets in Asia and Australia will be down. 🙂

Yes very much. Asia and AU, especially SG tends to trend quite similar to US / Dow.

Guess we should see more rally in the market as economy re-opens. At the same time, more earnings are reporting this month. Hence, really no point to bet which way.

What you think?

With reinvested dividends the Dow took 6 years to regain its all time high of 1929, i.e. by end 1935. But I doubt a normal human will have the stomach to not only hold, but to also reinvest all his dividends back into a market that is dropping -50%, -70%, -80%, month after month, year after year.

The big difference between today and GD is that during GD the govt withdrew liquidity from the economy, and they did it early on during the early 1930s, thus making things worse. The economists at the Fed at the time thought that loose monetary policy was to blame for the excesses of a wild 1920s boom & so leading to a bubble in stocks. They were right in their analysis but gave the wrong medicine for the wrong sickness. It was like closing the barn after the horses had ran off.

The protectionist anti-trade policies adopted by most countries at that time also made the GD worse … and contributed to many countries' warlike & belligerent policies. This time round, we have to see the US-China situation.

Becoz of the trillions of liquidity today, I don't think it'll be like GD. The trade war & the anti-fragilisation of supply chains however, will be a wild card for both China & Singapore.

I think markets will be in a large sideways churn for the foreseeable future, going between -10% to -40% of the all time highs. At least till there's a vaccine or if the virus dies out e.g. through herd immunity, such that there won't be the sword of Damocles of repeated lockdowns after economies reopen for business.

It is a medical problem, not a structural problem. Hence there's a high probability of end date being earlier than expected. But there'll be winners & losers among individual stocks and companies in terms of how much the new realities impact them & whether they can take advantage e.g. ultra cheap financing, changed consumer behaviour, WFH movement, greater virtualisation & onlining of commerce, work & entertainment.

Covid & its repercussions SHOULDN'T be the reason why anybody should or shouldn't invest, or how much to invest. This question should be answered by other more fundamental principles.

Hi, thanks for taking the time come back and the great insight and comments.

I am definitely a positive and optimistic guy, not naysayers. So below reply is not to say there will be a GD, but another side of the coin perspective. I myself pick up stocks last month and in Mar! 🙂

It’s not just having stomach to reinvest div 6 yrs, but perhaps u may already lost your jobs, or huge paycut, or lost ur house in 1930-1935. With many other problems in GD, not just single sided investment perspective.

Not really fair to compare Covid with GD, or GFC. This crisis has nothing to make reference to, unlike the past crisis which is generally related to financial. Hence, I agree with WB that really nobody knows!

Like I explain to B, I do not think we in GD mode now. Nor, I wanted a GD, nor I speculate it will happen. I am just providing the other side of the coin! Definitely not to say we should not invest, but to what extent, what mindset, n have u consider the worst situation? Perhaps we or our wife will have lower income, perhaps a big illness/accidents hitting during recession. Ok, Singaporean mindset… no worry lar…Govt will provide! No worry lar, it will not be me mindset.. is this type of mindsets truly what we want to have and what we want our children to have?

Unless there is a big 2nd wave and world economy including China is shutting again for as long as 6m to a year. Then we can see a clearer picture. Will that happen? Do we dare to say it will DEFINITELY NOT happen? So there is a possibility. Then why are we only thinking about the optimistic view that we will be winners in stocks?

If world shut down for another 6m-12m due to Covid, then can we confidently say the medical problem is a medical problem ONLY?, and it will not lead to structural problems. I think the medical problem may also be one way of revealing the weak structural problem the world is building upon since 1970 when USD de-pegged from gold.

Actually I was just explaining to another blogger about the withdrawal of liquidity and tax increase during GD. That is not the fundamental reason of making economy worse as many have thought and just read from Wikipedia / or other general source. And it is not about the loose monetary policy back then, or wrong medicine which many is misleaded or mis-guided. I will explain in my next post, what causes the GD.

Trillions of liquidity is only good temporary! In the long-term there will be structural problems, inflation, hyperinflation, severe deflation! Refer to my earlier post.

https://www.rolfsuey.com/2020/04/why-deflation-qe-helicopter-money-then.html

Very Nice lorry transport near me

Hello everyone, Are you into trading or just wish to give it a try, please becareful on the platform you choose to invest on and the manager you choose to manage your account because that’s where failure starts from be wise. After reading so much comment i had to give trading tips a try, I have to come to the conclusion that binary options pays massively but the masses has refused to show us the right way to earn That’s why I have to give trading tips the accolades because they have been so helpful to traders . For a free masterclass strategy kindly contact ([email protected]) for a free masterclass strategy. He'll give you a free tutors on how you can earn and recover your losses in trading for free..

Natural herbs have cured so many illness that drugs and injection can’t cure. I've seen the great importance of natural herbs and the wonderful work they have done in people's lives. i read people's testimonies online on how they were cured of HERPES, HIV, diabetics etc by Dr Edes herbal medicine, so i decided to contact the doctor because i know nature has the power to heal anything. I was diagnosed with Herpes for the past 3 years but Dr Edes cured me with his herbs and i referred my aunt and her husband to him immediately because they were both suffering from Herpes but to God be the glory, they were cured too .I know is hard to believe but am a living testimony. There is no harm trying herbs, Thanks. Write him on WhatsApp on +2348151937428. @dr_edes_remedies deals with

(1)Alzheimer virus

(2)Cancer

(3)HIV

(4)Herpes

(5)Genital warts

(6)ALS

(7)Virginal infection

(8)HPV

(9)Hepatitis

(10)Asthma

Email him on [email protected]

https://dredesherbalhome.weebly.com