This post is one of the series of posts I written earlier relating to my

view on the global economy. In Part 1 & Part 2, I discussed about

the artificial harvest of the past and shared my views. Part 3 describes how the

entire world has been leveraging up in recent times. This article is an

extension of Part 3 which we turn our attention back home to see if Singapore

is over-leveraged?

view on the global economy. In Part 1 & Part 2, I discussed about

the artificial harvest of the past and shared my views. Part 3 describes how the

entire world has been leveraging up in recent times. This article is an

extension of Part 3 which we turn our attention back home to see if Singapore

is over-leveraged?

Debt profile of Singapore

Public (aka Government)

Debt

Debt

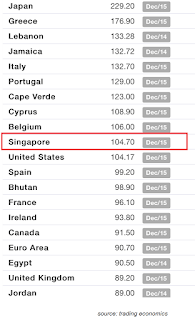

Singapore has all-time high debt to GDP of ~105% recorded as of end

2015. We ranked top ten in world’s most indebted nation relative to GDP. U.S. sits

just below Singapore in the indebtedness ranking.

2015. We ranked top ten in world’s most indebted nation relative to GDP. U.S. sits

just below Singapore in the indebtedness ranking.

Surprised?

Over the last twenty years or so, our public debt to GDP ratio has increased close to 40% from a record low public debt-GDP ratio in 1994 at 66.9%

to the current level of more than a century percentage.

to the current level of more than a century percentage.

Total debt

If we include debt associated with non-financial corporate sector and

household, our Total Debt to GDP is a staggering 382% in 2014 and we are within

the top 3 most indebted nation in the world. Japan tops the list with a 400%

ratio.

household, our Total Debt to GDP is a staggering 382% in 2014 and we are within

the top 3 most indebted nation in the world. Japan tops the list with a 400%

ratio.

According to a report from McKinsey in Feb 2015, Singapore

had the fastest debt growth since 2008 only after Ireland. In particular, Singapore’s

corporate’s debt rapid growth had been nerve-racking and our household debt

incurred primarily via housing loans is one of the highest in the world.

had the fastest debt growth since 2008 only after Ireland. In particular, Singapore’s

corporate’s debt rapid growth had been nerve-racking and our household debt

incurred primarily via housing loans is one of the highest in the world.

That said, it pays not just scratching the surface, and instead, let’s

delve deeper.

delve deeper.

Why high corporate

debt?

debt?

“For some nations,

an unusually high debt‑to‑GDP ratio does not signal imminent

danger. These are places

that serve as business and financial hubs. The high level of financial ‑sector and corporate debt

that results may or may not involve heightened risks. Singapore and Ireland, for

example, have tax regimes and other regulations that make them attractive for locating operations

of global corporations. The debt incurred by these entities is used to fund activities in

other nations, so its relationship to the host country’s GDP is not indicative of risk.

an unusually high debt‑to‑GDP ratio does not signal imminent

danger. These are places

that serve as business and financial hubs. The high level of financial ‑sector and corporate debt

that results may or may not involve heightened risks. Singapore and Ireland, for

example, have tax regimes and other regulations that make them attractive for locating operations

of global corporations. The debt incurred by these entities is used to fund activities in

other nations, so its relationship to the host country’s GDP is not indicative of risk.

As a major

business hub, Singapore has the highest ratio of non‑financial corporate debt in the world,

at 201 percent of GDP in 2014, almost twice the level of 2007. However nearly two‑thirds of companies

with more than $1 billion in revenue in Singapore are foreign subsidiaries. Many

of them raise debt in Singapore to fund business operations across the region, and this

debt is supported by earnings in other countries. Singapore has very high financial‑sector debt as well

(246 percent of GDP), reflecting the presence of many foreign banks and other

financial institutions that have set up regional headquarters there.”

business hub, Singapore has the highest ratio of non‑financial corporate debt in the world,

at 201 percent of GDP in 2014, almost twice the level of 2007. However nearly two‑thirds of companies

with more than $1 billion in revenue in Singapore are foreign subsidiaries. Many

of them raise debt in Singapore to fund business operations across the region, and this

debt is supported by earnings in other countries. Singapore has very high financial‑sector debt as well

(246 percent of GDP), reflecting the presence of many foreign banks and other

financial institutions that have set up regional headquarters there.”

– Mckinsey Global

Institute Feb 2015 Report “Debt and Not Much Deleveraging.”

Institute Feb 2015 Report “Debt and Not Much Deleveraging.”

Why high government

debt?

debt?

SGS, T-Bills, SGSS,

SSB & CPF

SSB & CPF

Singapore government’s debts are in the form of security bonds. In

general, they are:

general, they are:

1) Singapore

Government Securities (SGS) and T-bills to develop the domestic debt and active

secondary markets. It also encourages issuers and investors, both domestic and

international, to participate in the Singapore bond market.

Government Securities (SGS) and T-bills to develop the domestic debt and active

secondary markets. It also encourages issuers and investors, both domestic and

international, to participate in the Singapore bond market.

2) Special Singapore

Government Securities (SSGS) that are non-tradable bonds issued specifically to

meet the investment needs of the Central Provident Fund (CPF) Board. Central Provident Fund (CPF) monies are not

managed as a separate entity by the GIC but pooled and invested with the rest

of the Government’s funds.

Government Securities (SSGS) that are non-tradable bonds issued specifically to

meet the investment needs of the Central Provident Fund (CPF) Board. Central Provident Fund (CPF) monies are not

managed as a separate entity by the GIC but pooled and invested with the rest

of the Government’s funds.

3)

Singapore Savings Bonds (SSB) started on Oct 2015 that are non-marketable

SGS issued to individuals to provide them with a long-term savings instrument.

Singapore Savings Bonds (SSB) started on Oct 2015 that are non-marketable

SGS issued to individuals to provide them with a long-term savings instrument.

Above table shown

is as of March 2013 and excludes SSB.

is as of March 2013 and excludes SSB.

No external debt

According to Singapore Ministry Of Finance, borrowings are

not for spending as Singapore operates a balanced budget policy and often

enjoys budget surpluses. Therefore the lion share of debts are in fact Central

Provident Fund Board (CPF) which is the main holder of these debts. This means government

borrowed the most from the people’s CPF, and has no external debts owing to other countries or private entities.

not for spending as Singapore operates a balanced budget policy and often

enjoys budget surpluses. Therefore the lion share of debts are in fact Central

Provident Fund Board (CPF) which is the main holder of these debts. This means government

borrowed the most from the people’s CPF, and has no external debts owing to other countries or private entities.

Investment returns

more than sufficient to cover debt

more than sufficient to cover debt

Singapore Government cannot spend the monies raised from SGS and SSGS.

All borrowing proceeds are therefore invested. The investment returns are more

than sufficient to cover the debt serving costs. As of 2013, this can be seen from the

investment returns that are made available for spending on the

Government Budget – or Net Investment Returns Contribution (NIRC). Under the

NIRC framework, up to 50% of the long-term

expected returns earned

on the net

assets (i.e. assets

net of liabilities) are

available for spending.

The NIRC of

about S$7 billion each

year means that even

after deducting all

the Government’s liabilities

(including CPF monies), the remaining

net assets produce significant returns.

All borrowing proceeds are therefore invested. The investment returns are more

than sufficient to cover the debt serving costs. As of 2013, this can be seen from the

investment returns that are made available for spending on the

Government Budget – or Net Investment Returns Contribution (NIRC). Under the

NIRC framework, up to 50% of the long-term

expected returns earned

on the net

assets (i.e. assets

net of liabilities) are

available for spending.

The NIRC of

about S$7 billion each

year means that even

after deducting all

the Government’s liabilities

(including CPF monies), the remaining

net assets produce significant returns.

Surplus returns belong to Past Reserves and cannot be spent by the

Government.

Government.

Strong balance sheet

The Singapore Government also has a strong balance sheet, with assets well

in excess of its liabilities. According to the 2013 MOF report, our S$396b

public debt also does not take into account the Government’s asset position, which exceeds its liabilities, and

its ability to service debts through returns on its assets. Government’s assets

are mainly managed by GIC. The Government also places deposits with the MAS; in

turn, MAS as a statutory board holds its own assets on its balance sheet. In

addition, the Government is the sole equity shareholder of Temasek Holdings

(Temasek). Temasek owns the assets on its balance sheet.

in excess of its liabilities. According to the 2013 MOF report, our S$396b

public debt also does not take into account the Government’s asset position, which exceeds its liabilities, and

its ability to service debts through returns on its assets. Government’s assets

are mainly managed by GIC. The Government also places deposits with the MAS; in

turn, MAS as a statutory board holds its own assets on its balance sheet. In

addition, the Government is the sole equity shareholder of Temasek Holdings

(Temasek). Temasek owns the assets on its balance sheet.

Credit Ratings

Since 2003, Singapore has consistently achieved the top credit ratings

of triple-A with a stable outlook from the three main credit-rating

agencies.

of triple-A with a stable outlook from the three main credit-rating

agencies.

Why high housing

debt?

debt?

High ownership of

housing

housing

Singapore has 90% home ownership which is the highest in the world with

Germany at the other extreme with 53% home ownership. This high ownership is

largely due to our government policy that majority of the Singaporeans are

staying in HDB. As of 2013, 80% of our population is living in HDB with 95% of

them owning their HDB flat. Since HDB’s inception on 1 Feb 1960, it had built

1,077,103 flats up to end 2014.

Germany at the other extreme with 53% home ownership. This high ownership is

largely due to our government policy that majority of the Singaporeans are

staying in HDB. As of 2013, 80% of our population is living in HDB with 95% of

them owning their HDB flat. Since HDB’s inception on 1 Feb 1960, it had built

1,077,103 flats up to end 2014.

Government’s

CPF-HDB policies

CPF-HDB policies

As mentioned earlier majority of Singapore’s public debt is held by CPF

of the people. A large part of the CPF is also used to invest in HDB in

Singapore. So our government borrowed money from us (CPF), to build home for

us. They also invest for us to pay interest to our CPF. We then borrowed money

from the government to buy these HDB built. In order to repay the long term

debts of HDB, the people will then have to work their lifetime to repay the

debt and interest.

of the people. A large part of the CPF is also used to invest in HDB in

Singapore. So our government borrowed money from us (CPF), to build home for

us. They also invest for us to pay interest to our CPF. We then borrowed money

from the government to buy these HDB built. In order to repay the long term

debts of HDB, the people will then have to work their lifetime to repay the

debt and interest.

Therefore if the government invests more and more on public housing, our

government debt will increase. As the people borrowed more and more from the

government to buy housing, household debt will also increase.

government debt will increase. As the people borrowed more and more from the

government to buy housing, household debt will also increase.

But essentially, there is no external debt involved.

Further

justification that Singapore is not over-leveraged

justification that Singapore is not over-leveraged

An

article from Strait Times (refer here) in Nov 2014, further

justified why Singapore is not heading for a debt disaster despite our high

debt-to-GDP ratio.

article from Strait Times (refer here) in Nov 2014, further

justified why Singapore is not heading for a debt disaster despite our high

debt-to-GDP ratio.

Extracted essence from the article:

Ability to service debt

Singaporean

households have shown an excellent ability to service their debts, mainly

thanks to the robust job market and their ownership of liquid assets. Singapore’s

household have strong ability to liquidate our assets to pay in a timely

manner. Huge household liquid assets are held in the form of cash and bank

deposits. At the end of March 2014, it had in aggregate $329.4 billion in cash

and bank deposits, which exceeded the total liabilities of $282 billion.

households have shown an excellent ability to service their debts, mainly

thanks to the robust job market and their ownership of liquid assets. Singapore’s

household have strong ability to liquidate our assets to pay in a timely

manner. Huge household liquid assets are held in the form of cash and bank

deposits. At the end of March 2014, it had in aggregate $329.4 billion in cash

and bank deposits, which exceeded the total liabilities of $282 billion.

Strong

household balance sheet

household balance sheet

Assets of

Singaporean households were worth over six times their liabilities in each of

the past five years. In short, for every dollar that the household sector has

in debt, it has over $6 in assets for repayment.

Singaporean households were worth over six times their liabilities in each of

the past five years. In short, for every dollar that the household sector has

in debt, it has over $6 in assets for repayment.

Strict lending conditions

US

sub-prime crisis took place due to over lenient lending conditions. On the

contrary to US, Singapore has strict lending conditions with home loan capped

at 80% of property price. The 8 rounds of property cooling measures after the

GFC with the increased Sellers Stamp Duty (SSD), lengthened holding period and

introduction of Total Debt Servicing Ratio (TDSR) had proven this.

sub-prime crisis took place due to over lenient lending conditions. On the

contrary to US, Singapore has strict lending conditions with home loan capped

at 80% of property price. The 8 rounds of property cooling measures after the

GFC with the increased Sellers Stamp Duty (SSD), lengthened holding period and

introduction of Total Debt Servicing Ratio (TDSR) had proven this.

Furthermore,

in practice, mortgage loans have been lower than the bank mortgage limits. The

Monetary Authority of Singapore (MAS) estimated that the average loan-to-home

value was 47.5 per cent as of the 1Q2014.

in practice, mortgage loans have been lower than the bank mortgage limits. The

Monetary Authority of Singapore (MAS) estimated that the average loan-to-home

value was 47.5 per cent as of the 1Q2014.

Reasonably low loans

As of

2014, personal loans were at 26 per cent of total liabilities, and credit card

loans at 3 per cent, throughout the last five years. There is no sign of a

significant change in consumer spending or borrowing habits.

2014, personal loans were at 26 per cent of total liabilities, and credit card

loans at 3 per cent, throughout the last five years. There is no sign of a

significant change in consumer spending or borrowing habits.

The size

of bad loans for the banking sector in Singapore averaged only 1 per cent of

their lending portfolio as at the end of last year. Bankruptcy cases, while on

the rise from 1,748 in 2012 to 1,992 last year, represented only 0.14 per cent

of total credit-card users over the same period, an insignificant number at the

macro level.

of bad loans for the banking sector in Singapore averaged only 1 per cent of

their lending portfolio as at the end of last year. Bankruptcy cases, while on

the rise from 1,748 in 2012 to 1,992 last year, represented only 0.14 per cent

of total credit-card users over the same period, an insignificant number at the

macro level.

Low unemployment

In

addition, the unemployment rate is very low at about 2 per cent, and job market

prospects still look healthy, barring unforeseeable economic calamities.

addition, the unemployment rate is very low at about 2 per cent, and job market

prospects still look healthy, barring unforeseeable economic calamities.

Flexibility of foreign workforce

One

special characteristic of the labour market in Singapore is the high proportion

of foreign workers: about 35 per cent of the workforce. Should unemployment

rise, the Government can activate pro-Singaporean worker schemes to promote

employment among the resident population. This makes it unlikely that a

prolonged high level of unemployment will threaten Singaporeans’ financial

stability.

special characteristic of the labour market in Singapore is the high proportion

of foreign workers: about 35 per cent of the workforce. Should unemployment

rise, the Government can activate pro-Singaporean worker schemes to promote

employment among the resident population. This makes it unlikely that a

prolonged high level of unemployment will threaten Singaporeans’ financial

stability.

The unexpected bear striking

If all

earlier said is true, then our high debt levels should then be no cause of

alarm. Nonetheless,

it pays to be prudent and there can be inconceivable scenarios which will push many Singaporeans to the corner. Below are some scenarios.

earlier said is true, then our high debt levels should then be no cause of

alarm. Nonetheless,

it pays to be prudent and there can be inconceivable scenarios which will push many Singaporeans to the corner. Below are some scenarios.

Property

price shock

price shock

Our household

debt is backed strongly by household asset. However household asset value is

vulnerable to property price shocks. If the economy is not doing well, unemployment

rate will rise and income will fall. This will affects the ability to service

the mortgage debt. Auctions of “debt default” properties will soon become

widespread and put spiral down pressures on the property price. If outlook

continues to deteriorate, there will then be many desperate sellers. Then it

will not just be the price of property that matters, but the inability to find

buyers in a certain period of time.

debt is backed strongly by household asset. However household asset value is

vulnerable to property price shocks. If the economy is not doing well, unemployment

rate will rise and income will fall. This will affects the ability to service

the mortgage debt. Auctions of “debt default” properties will soon become

widespread and put spiral down pressures on the property price. If outlook

continues to deteriorate, there will then be many desperate sellers. Then it

will not just be the price of property that matters, but the inability to find

buyers in a certain period of time.

Interest

rates in Singapore have a high correlation with US interest rates. The

Singapore dollar is pegged to a basket of currencies, with one of the

currencies being the US dollar. If for whatever reasons, Fed implements a rate

hike, households and corporations with large share of the loans on variable

rates will be drastically affected.

rates in Singapore have a high correlation with US interest rates. The

Singapore dollar is pegged to a basket of currencies, with one of the

currencies being the US dollar. If for whatever reasons, Fed implements a rate

hike, households and corporations with large share of the loans on variable

rates will be drastically affected.

Imagine a

scenario which you use to have a good job with good income, servicing your

mortgage with 1-2% floating interest rate for the last 7-8 years. You are very

comfortable. Now you lose your job, and floating mortgage rate spike to 2-3,

then 3-4%, then 5-6%. Your cash is depleting faster than you expected without

income and yet have to service the hefty loan. Fearing that interest rate rise

further, you wanted a fixed interest rate financing. Unfortunately, you are

unable to re-finance because you have no job and no income. Even if you still

have income, the value of your house may have depreciated against your loan

value. This makes re-financing impossible unless you fork out additional cash

to top up the difference in the loan and the property valuation.

scenario which you use to have a good job with good income, servicing your

mortgage with 1-2% floating interest rate for the last 7-8 years. You are very

comfortable. Now you lose your job, and floating mortgage rate spike to 2-3,

then 3-4%, then 5-6%. Your cash is depleting faster than you expected without

income and yet have to service the hefty loan. Fearing that interest rate rise

further, you wanted a fixed interest rate financing. Unfortunately, you are

unable to re-finance because you have no job and no income. Even if you still

have income, the value of your house may have depreciated against your loan

value. This makes re-financing impossible unless you fork out additional cash

to top up the difference in the loan and the property valuation.

If you

are staying in a HDB, perhaps government is still kind enough for you to

default many payments of installments. If you are staying private property with

relatively high bank loan that you no longer can service, soon the bank will

take possession of your house.

are staying in a HDB, perhaps government is still kind enough for you to

default many payments of installments. If you are staying private property with

relatively high bank loan that you no longer can service, soon the bank will

take possession of your house.

Asset

rich but not cash rich

rich but not cash rich

Most

Singaporeans are asset rich but not necessarily cash rich. Furthermore, assets

and liabilities are not necessarily evenly divided among households. There

can be a possibility that the minority of the wealthy are contributing to the

healthy figures shown.

Singaporeans are asset rich but not necessarily cash rich. Furthermore, assets

and liabilities are not necessarily evenly divided among households. There

can be a possibility that the minority of the wealthy are contributing to the

healthy figures shown.

Vicious

cycle

cycle

In an

unfavorable economic situation, there is high chance of corporate default in

debts. This will lead to more non-performing loans recorded in Banks. We already

had seen how DBS had been over-optimistic or not as transparent to say the

least in their handling of Swiber’s debts.

unfavorable economic situation, there is high chance of corporate default in

debts. This will lead to more non-performing loans recorded in Banks. We already

had seen how DBS had been over-optimistic or not as transparent to say the

least in their handling of Swiber’s debts.

If corporations

and banks are not doing well, jobs will be lost. Unemployment heightens, income

of individual will fall. And if debt burden is rising faster than income, servicing

of mortgage or personal loans will become increasingly difficult. Cash of

individual household will deplete faster than expected. This will lead to

Government intervention and likely drawing from our past reserves to salvage

the situation. Not a situation we want to see.

and banks are not doing well, jobs will be lost. Unemployment heightens, income

of individual will fall. And if debt burden is rising faster than income, servicing

of mortgage or personal loans will become increasingly difficult. Cash of

individual household will deplete faster than expected. This will lead to

Government intervention and likely drawing from our past reserves to salvage

the situation. Not a situation we want to see.

War

If war do

takes place which is not totally unlikely and like one of the readers pointed

out during the Iraq war, even when it was nowhere geographically near to

Singapore, prices for daily necessity back then inflated rapidly due to the panic. Undersized panic, but not to be underestimated! Earnings fall, cost of living rise – double whammy!

takes place which is not totally unlikely and like one of the readers pointed

out during the Iraq war, even when it was nowhere geographically near to

Singapore, prices for daily necessity back then inflated rapidly due to the panic. Undersized panic, but not to be underestimated! Earnings fall, cost of living rise – double whammy!

Rolf’s final thoughts

Without

any external debt and with strong reserves coupled with a stable political

system, we are in a strong position to weather any downturn ahead (if any). While being paranoid, I am confident that Singapore is still able to do well or at least sustain economically for decades to come unless

we see a big screw up in our leadership.

any external debt and with strong reserves coupled with a stable political

system, we are in a strong position to weather any downturn ahead (if any). While being paranoid, I am confident that Singapore is still able to do well or at least sustain economically for decades to come unless

we see a big screw up in our leadership.

That said,

the short term possible knee-jerk events may mean sufferings for many Singaporeans.

the short term possible knee-jerk events may mean sufferings for many Singaporeans.

As Warren

Buffett once said “Only when the tide goes out do you discover who’s been

swimming naked.”

Buffett once said “Only when the tide goes out do you discover who’s been

swimming naked.”

For our survival sustainability, a lot have to depend on the next generation in the 90s/ millennials. I am no big fan of them, but let’s even hope there can be an awakening to change their mindset.

The thing that inflicts more concerns for the country I love TODAY is not just economically ….

In the past ……

As a boy in the 80s and 90s, I was always told by all my teachers that Singapore was well recognised by the world as the “Garden City” clean and green! Rarely heard that from kids nowadays.

The two Lions that I am proud of, so prominent for all Singaporeans in the 80s / 90s!

Today ……

We are more proud of these man-made structures today. The kids are talking about it.

The landmark of Singapore to all tourists in the world is almost always – Marina Bay Sands!

Oooops …. didn’t we realise that the CORE of MBS is a casino or at the very least owned by an owner whose wealth were acquired via gambling business.

Think again…. Singapore’s landmark today…. A casino!

ok what? You really think so?

not all metrics measure equally.

not all metrics measure fairly.

"Singapore has all-time high debt to GDP of ~105% recorded as of end 2015. We ranked top ten in world's most indebted nation relative to GDP. U.S. sits just below Singapore in the indebtedness ranking. "

good highlight

"The debt incurred by these entities is used to fund activities in other nations, so its relationship to the host country’s GDP is not indicative of risk."

Hi SMK,

Yes, mostly to develop domestic debt and borrowed from CPF for housing and foreign investments.

Perhaps the right metric is to be able to collect local industries leverage data eg. SME, GLCs. and look at the ratio to tell.

Hi Cory,

I do not have that data, perhaps u have something to share?

Read an article today:

Mas : corporate debt mkt grew at compound annual rate of 14% from 2010-14.

Total outstanding debt $308b at end of 14.

Sgd corporate bond ave 20-25b pa over last few yrs. As of 1H16, sgd bond outstanding at 140b. this incl. HDB bonds.

Default of corporate bonds: Pacific Andes Jan16, Trikomsel Nov15 & Swiber Aug16.

Don't think I will delve into details as I already mentioned Sg have no external debt and most debts are issued to CPF, so I reckon SG is not highly leverage as it seems.

Hi Rolf, agreed to your comment SG is not highly leverage. Which is why when sometimes i come across analyst report that use general debt to rate country risk i shake my head.

Time has really changed. From the Singapore Lion to Esplanade aka Durian to Marina Bay Sands. Anyone still remember the Singapore Flyer? What's next?

Hi Sweet retirement,

U mean the flyer failure?

We do have a nice views of Sg during F1. It's stunning views which is something we should be proud of.

Just that I am uncomfortable with a casino being our landmark today. Maybe I think too much.

i suddenly remembered this old skool coin donation box (a girl with bear/dog?) for the Spastic Children's Association of Singapore ..

are these still around?!

Hi FC,

Nice to see u back. Hope u r still "threading water" well in the oil and gas.

I cannot recall about the donation box… any significance?

hi Rolf,

good to be back. stil threading precariously. situation has gotten only slightly better, only so very very slightly.

there are rumors of projects coming up, so hopeful that turns out well.

i am actively seeking other opportunities at the same time and trying to improve myself.

no la, i saw the retro courtesy lion (singa?).. then just recalled that retro donation box too. no significance at all. haha

Hi FC,

Wish you all the best in your search.

I am a believer that if we do good, the good will befall on us!

I am sure you are a good person who do good things in life.

Even retrenchments or losses in stocks may not be a bad things sometimes or they can be indication for us that we need a change and the change may be for the better!

🙂

Testimony of Restoration with the help of Martinez Lexie(Lexieloancompany@yahoo.com OR +18168926958)..

I have been in financial mess for the past months, I'm a single mum with kids to look after. My name is Renee Joan Rothell, and am from Ridley Park, Pennsylvania. A couple of weeks ago My friend visited me and along our discussion she told me about Mr Martinez Lexie of ( Lexieloancompany@yahoo.com ); that he can help me out of my financial situation, I never believed cause I have spend so much money on different loan lenders who did nothing other than running away with my money. She advised, I gave it a try because she and some of her colleagues were rescued too by this Godsent lender with loans to revive their dying businesses and paying off bills. so I mailed him and explain all about my financial situation and therefore took me through the loan process which was very brief and easy.. After that my loan application worth 78,000.00 USD was granted, all i did was to follow the processing and be cooperative and today I am a proud business owner sharing the testimony of God-sent Lender. You can as well reach him through the Company website: http://lexieloans.bravesites.com OR text: +18168926958

Thanks for the informative post. My friends moved to Singapore a few years ago and they say they are very happy there. The economy in Singapore is very stable while the unemployment rate is low. Thus, everyone who wants to work has a chance to get a job. There are very good career opportunities from people from all over the world! It’s great when your job and the country you live in make you feel confident in your tomorrow. For example, I haven’t heard that many people in Singapore to use quick and easy loan services online to make ends meet.

CONTACT PROSPER LOAN AND BE FOREVER PROSPEROUS :- prosperloanplc@gmail.com or call +1(205) 224-8709 .

Greetings to everyone, Life they say is full of deceit. No torture and pain can be compare to what i Theresa L. Bernard experience in the hands of scammers, I trusted the words of those fake loan lenders without verifying, I lost more than $12,500 in the quest of obtaining a loan i sold my car defaulted in my bills but i keep on falling victim my life has been piece of trash full of mess. My kids dropped out of school, My bank denied me credit because my credit score was down already. Until last week a very close friend told me that she got a loan from PROSPER LOAN PLC that i should also give it a try. Not having an option I contacted them with a heart full of sorrow and skepticism i shyly follow their procedures comply to their policy, I was waiting for the bad news like every other loan company i contacted gave me then i receive a credit alert that my bank account has been credited with $250,000 which i initially applied for instantly tears of joy roll out of my eyes because I never believe it will come through. Whenever you are in need of any kind of loan don't be a prey and contact the one true loan company via their information. Email: prosperloanplc@gmail.com or Call +1(205) 224-8709. And receive your financial breakthrough.

helpful

In my view one of the best maid agencies in Singapore with over 30 years of experience in Filipino Maids, Indonesian Maids, Myanmese Maids, and transfer maid singapore. Also if you are from other countries and you want to hire maids from your country then you can also contact that with them.