This post continues from the previous post – Part

1 & Part

2. In my earlier posts, I wrote about the artificial harvest of the past because

of the loose monetary policies. In other words, increased borrowings. In this article, let us take a look at the global financial system of today, where the advanced economies of

the world are leveraging up at a rapid rate.

1 & Part

2. In my earlier posts, I wrote about the artificial harvest of the past because

of the loose monetary policies. In other words, increased borrowings. In this article, let us take a look at the global financial system of today, where the advanced economies of

the world are leveraging up at a rapid rate.

Monetary system of the past

Since 1971 when the world went off gold standard, it has never been the

same.

same.

Imagine you held currencies worth US$35 since 1970. Fast forward more

than 40 years today, while the paper US$35 currencies are still the same dollar

notes, the purchasing power of the currencies have fallen dramatically. In retrospect, if you bought 1 ounce of gold

in 1970 which cost US$35, the dollar value of that ounce of gold is worth

US$1,350 at present time. This is a whopping increase of >38 times.

than 40 years today, while the paper US$35 currencies are still the same dollar

notes, the purchasing power of the currencies have fallen dramatically. In retrospect, if you bought 1 ounce of gold

in 1970 which cost US$35, the dollar value of that ounce of gold is worth

US$1,350 at present time. This is a whopping increase of >38 times.

Why?

The answer: inflation due to the rapid increase in currencies worldwide

– in particular US dollars which is the reserve currency of the world at

present time. Therefore, “savers” have been losers since, due to inflation

eroding the purchasing power of the currency we hold. The currencies we hold

are no longer backed by the finite gold or silver. Central bankers in US can

now print infinite amount of currencies to flood the global economy when they

run into deficit.

– in particular US dollars which is the reserve currency of the world at

present time. Therefore, “savers” have been losers since, due to inflation

eroding the purchasing power of the currency we hold. The currencies we hold

are no longer backed by the finite gold or silver. Central bankers in US can

now print infinite amount of currencies to flood the global economy when they

run into deficit.

To understand more about the history of world monetary policy, read my

earlier article:

earlier article:

Gold

and Silver – A peek into history to understand its impact on the world monetary

system (Part 2)

and Silver – A peek into history to understand its impact on the world monetary

system (Part 2)

Monetary policy – United States

Ask yourself this question. What will you do when your debt gets too

huge? Do you cut spending or borrow more?

huge? Do you cut spending or borrow more?

To me, it is no brainer that we will cut spending, right!

Nah…this is not what is happening in most developed economies today. We

increased borrowings instead. It is insane right!

increased borrowings instead. It is insane right!

During Global Financial Crisis (GFC), the sub-prime mortgage debt in US ballooned

and collapsed. When a debt gets too huge, according to Ray Dalio’s economic

principles, there are four ways of deleveraging.

and collapsed. When a debt gets too huge, according to Ray Dalio’s economic

principles, there are four ways of deleveraging.

1) Restructure debt 2) Austerity 3) Redistribution of wealth via tax 4)

Debt monetization or print money! Read :

Debt monetization or print money! Read :

Quantitative Easing

The first three methods of deleveraging will be extremely painful.

Hence, the American Federal Reserve chose the last option which is to increase

currency supply via Quantitative Easing (QE). QE is a monetary policy to stimulate the economy when standard

monetary policy has become ineffective because of short-term interest

rates reach or approach zero. In simple terms, it is no difference

from printing money out of thin air to cover borrowings.

Hence, the American Federal Reserve chose the last option which is to increase

currency supply via Quantitative Easing (QE). QE is a monetary policy to stimulate the economy when standard

monetary policy has become ineffective because of short-term interest

rates reach or approach zero. In simple terms, it is no difference

from printing money out of thin air to cover borrowings.

During the GFC, QEs were used to acquire assets of longer maturity as well as the distressed mortgage

backed securities from US government sponsored Fannie Mae and Freddie

Mac, thereby lowering longer-term interest rates. Thanks to

QE1 implemented in Nov 2008, just one year after the worst crisis since

Depression, business remarkably went back to usual. Subsequently, QE2 took place in Nov 2010, followed by QE3 in Sep

2012.

backed securities from US government sponsored Fannie Mae and Freddie

Mac, thereby lowering longer-term interest rates. Thanks to

QE1 implemented in Nov 2008, just one year after the worst crisis since

Depression, business remarkably went back to usual. Subsequently, QE2 took place in Nov 2010, followed by QE3 in Sep

2012.

The source of the problem

Turning back the clock, it all started with the Dot.com bubble burst in year 2001. It

got worst with the 9/11 attack and wars in Iraq and Afghanistan. To salvage the

situation, Fed Alan Greenspan (in office 1987-2006) loosened monetary policies

which later led to the real estate sub-prime crisis. This resulted in the

GFC, which Greenspan’s successor Ben Bernanke (in office 2006-2014)

not just “received the rotten baton” but deepened the world’s potential

financial problems with his series of excessive QEs.

got worst with the 9/11 attack and wars in Iraq and Afghanistan. To salvage the

situation, Fed Alan Greenspan (in office 1987-2006) loosened monetary policies

which later led to the real estate sub-prime crisis. This resulted in the

GFC, which Greenspan’s successor Ben Bernanke (in office 2006-2014)

not just “received the rotten baton” but deepened the world’s potential

financial problems with his series of excessive QEs.

Janet Yellen, the current Fed chairwoman was left behind an enormous public

debt problem in US today (~19 trillions) that I reckon there is no way she can

turn back, but to continue the artificial support of the world’s economy. It is

possible that any major tightening of money supply will possibly lead to

collapse of the entire market. When debt becomes so huge, even a less than

substantial increase in borrowing rate can bring about significant interest

repayments.

debt problem in US today (~19 trillions) that I reckon there is no way she can

turn back, but to continue the artificial support of the world’s economy. It is

possible that any major tightening of money supply will possibly lead to

collapse of the entire market. When debt becomes so huge, even a less than

substantial increase in borrowing rate can bring about significant interest

repayments.

Greenspan’s

warning

warning

Alan Greenspan, at 90 years of age probably realized his mistakes of the

past. Today it seems like he is trying all means to atone his sins. Greenspan

became very active speaking about the dangers of the fiat monetary

policies eventually leading to inflation. Recently he also discussed the

biggest worries in US now is the low productivity growth that will eventually

lead to economic stagnation particularly in most developed OECD

countries.

past. Today it seems like he is trying all means to atone his sins. Greenspan

became very active speaking about the dangers of the fiat monetary

policies eventually leading to inflation. Recently he also discussed the

biggest worries in US now is the low productivity growth that will eventually

lead to economic stagnation particularly in most developed OECD

countries.

“Distorting a currency to achieve stabilization is a loser’s

game” – Greenspan

game” – Greenspan

Monetary policy – Japan

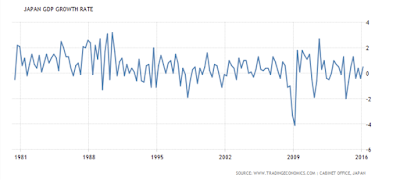

Japan had enjoyed the post war growth, boom and eventually collapsed in

the early 1990s. Since then, the country’s economy had been facing

deflationary woes. GDP growth rate in Japan average 0.48% from 1980 to 2016.

See below.

the early 1990s. Since then, the country’s economy had been facing

deflationary woes. GDP growth rate in Japan average 0.48% from 1980 to 2016.

See below.

To counter the chronic deflation, policymakers in Japan tried to revive

the economy via a series of aggressive monetary and fiscal stimuli. Interest

rate remains less than 1% since 1994 and has been close to zero since 1999.

Today, rate is even in the negative territory. Despite Japanese government’s

numerous interventions to “print and spend”, it has limited effect in

revitalizing the once second largest economy, resulted in what it was commonly

known as “lost 2 decades” in Japan.

the economy via a series of aggressive monetary and fiscal stimuli. Interest

rate remains less than 1% since 1994 and has been close to zero since 1999.

Today, rate is even in the negative territory. Despite Japanese government’s

numerous interventions to “print and spend”, it has limited effect in

revitalizing the once second largest economy, resulted in what it was commonly

known as “lost 2 decades” in Japan.

But, why?

Perhaps the monetary and fiscal policies fail to address the core

problems facing the Japanese economy! Japan has the world’s oldest population, very

low fertility rate and little immigration. After the crisis in the 90s,

willingness in spending is low, and companies are invested overseas rather than

domestically. Prime Minister Abe’s plan of weakening the Yen did bring about an

increase in corporate profits. However domestic spending and wage growth is

still low. The monetary and fiscal “shock-therapy” has little

effect in growing the economy. Instead Japan becomes the largest debtor nation

in the world with a public debt to GDP ratio of 246%.

problems facing the Japanese economy! Japan has the world’s oldest population, very

low fertility rate and little immigration. After the crisis in the 90s,

willingness in spending is low, and companies are invested overseas rather than

domestically. Prime Minister Abe’s plan of weakening the Yen did bring about an

increase in corporate profits. However domestic spending and wage growth is

still low. The monetary and fiscal “shock-therapy” has little

effect in growing the economy. Instead Japan becomes the largest debtor nation

in the world with a public debt to GDP ratio of 246%.

Just recently, PM Abe had announce another round, >28 trillions yen

($265b) of stimulus. However its effectiveness remains to be seen. Many suspect

if this strategy is to fail, Japan may need more dramatic strategy ahead, such

as “helicopter money”!

($265b) of stimulus. However its effectiveness remains to be seen. Many suspect

if this strategy is to fail, Japan may need more dramatic strategy ahead, such

as “helicopter money”!

Monetary policy – Europe

By and large, Europe has different actors over different countries but

story remains very much similar to Japan and USA – “Print the way out of

misery!” The latest data in June shows that Inflation is still at zero percent

despite all the stimuli European Union (EU) is banking on. Unemployment rate is

10%.

story remains very much similar to Japan and USA – “Print the way out of

misery!” The latest data in June shows that Inflation is still at zero percent

despite all the stimuli European Union (EU) is banking on. Unemployment rate is

10%.

Brexit

The recent Brexit does not bode well for the EU. About half of UK

imports come from EU. In particular France and Germany are UK largest trading

partners after the U.S. Brexit also further dampened the solidarity in EU.

Already cohesiveness is low because the

core economies do not like the idea that they need to support the countries that

cannot pay their bills, which includes Greece, Portugal, Spain, Ireland and

Cyprus who defaulted resulted in the Euro Debt crisis after the GFC.

imports come from EU. In particular France and Germany are UK largest trading

partners after the U.S. Brexit also further dampened the solidarity in EU.

Already cohesiveness is low because the

core economies do not like the idea that they need to support the countries that

cannot pay their bills, which includes Greece, Portugal, Spain, Ireland and

Cyprus who defaulted resulted in the Euro Debt crisis after the GFC.

Read: Brexit

– Rolf’s View

– Rolf’s View

Euro Debt Crisis after GFC

Many believed that the Eurozone crisis is a result of globalization of

finance and the ease of credit from 2002-2008, which led to the international

trade imbalance and real estate bubbles.

finance and the ease of credit from 2002-2008, which led to the international

trade imbalance and real estate bubbles.

Below is the public debt profile in 2012. And yes, Greece

defaulted thereafter.

defaulted thereafter.

One solution to tackle the crisis is Eurobonds jointly issued by 19 Eurozone

countries in Nov 2011. In effect, this is the borrowing of more future money to

cover the current debt. There are mixed reactions. Inevitably,

debt-ridden countries are in favour of this solution while those who need to

provide support to the free rider object to it. The then Italian Minister of economy Giulio Tremonti calling it the “master solution” to

the eurozone debt crisis. Austria, Bulgaria, Finland and the Netherlands

objected over eurobond issuance. Bulgarian finance minister Simeon Djankov criticised eurobonds in Austria’s Der Standard:

countries in Nov 2011. In effect, this is the borrowing of more future money to

cover the current debt. There are mixed reactions. Inevitably,

debt-ridden countries are in favour of this solution while those who need to

provide support to the free rider object to it. The then Italian Minister of economy Giulio Tremonti calling it the “master solution” to

the eurozone debt crisis. Austria, Bulgaria, Finland and the Netherlands

objected over eurobond issuance. Bulgarian finance minister Simeon Djankov criticised eurobonds in Austria’s Der Standard:

“Cheap credit got us into the current eurozone crisis,

it’s naive to think it is going to get us out of it.”

it’s naive to think it is going to get us out of it.”

Since then, ECB had been employing expansionary monetary policy lowering

interest rate to bail out defunct countries. Greece,

Spain, Portugal are undergoing austerity measures already.

interest rate to bail out defunct countries. Greece,

Spain, Portugal are undergoing austerity measures already.

Italy – The biggest concern

The biggest current concern of the bloc today is banking crisis in

Italy. Since 2010, it is reported that the amount of gross NPL in Italy’s banks

had risen 85% to Eur 360 billions and account for 18% of Italy’s total bank

loans.

Italy. Since 2010, it is reported that the amount of gross NPL in Italy’s banks

had risen 85% to Eur 360 billions and account for 18% of Italy’s total bank

loans.

Unlike Greece whose GDP is only 1.3% of

total EU-28 countries in 2014, Italy is one of the fifth

largest economy in EU. In 2015, Italy had a GDP of ~1.63 trillions accounting

for approximately ~11.2% of EU’s total economy. If we excludes UK’s GDP of

~2.58 trillions after Brexit, Italy’s share of the bloc’s GDP will be 13.5%.

This is a significant figure compares to Greece.

total EU-28 countries in 2014, Italy is one of the fifth

largest economy in EU. In 2015, Italy had a GDP of ~1.63 trillions accounting

for approximately ~11.2% of EU’s total economy. If we excludes UK’s GDP of

~2.58 trillions after Brexit, Italy’s share of the bloc’s GDP will be 13.5%.

This is a significant figure compares to Greece.

GDP of EU countries 2014

More stimulus

ECB President Mario Draghi had reiterated recently on his willingness to

act (or print) to bolster inflation. During a meeting on July 21 this

year, ECB announced that its monthly asset purchases of Eur80 billion would run

until end-Mar 2017 or beyond, until “a sustained adjustment in the path of

inflation consistent with its inflation aim of 2% is achieved. Interest rates

will be unchanged for refinancing operations (0%), marginal lending facility

(0.25%) and deposit facility (-0.4%).

act (or print) to bolster inflation. During a meeting on July 21 this

year, ECB announced that its monthly asset purchases of Eur80 billion would run

until end-Mar 2017 or beyond, until “a sustained adjustment in the path of

inflation consistent with its inflation aim of 2% is achieved. Interest rates

will be unchanged for refinancing operations (0%), marginal lending facility

(0.25%) and deposit facility (-0.4%).

Monetary policy – China

China had been the main engine to revive the global economy after the

treacherous GFC. Many people have no clues that China is also “printing

money”! Let me explains.

treacherous GFC. Many people have no clues that China is also “printing

money”! Let me explains.

China export-led economy in the last decade had provided them with loads

of US dollars inflow. The massive US dollars China owned will then be used to

fund their foreign investments. However majority of the dollars is used to

purchase US Treasuries, earning a meager interest rather than leave it within

China earning no interest at all.

of US dollars inflow. The massive US dollars China owned will then be used to

fund their foreign investments. However majority of the dollars is used to

purchase US Treasuries, earning a meager interest rather than leave it within

China earning no interest at all.

With loads of US dollars on hand, China essentially is required to use

the Dollars they received to purchase Chinese Yuan in the forex open market.

However this will cause the Yuan to appreciate by a great deal relative to the

Dollar, which will reduce China’s competitiveness in her exports. Instead, the

People Bank of China (PBOC) has been artificially keeping the Yuan exchange

rate low by pegging to the US dollar. In simple terms, it means that for every

US$ China has, PBOC will print a fix amount of Yuan say 6.5 times in

circulation. In fact, last August the PBOC devalued Yuan by close to 2% which

rattled the stock markets globally.

the Dollars they received to purchase Chinese Yuan in the forex open market.

However this will cause the Yuan to appreciate by a great deal relative to the

Dollar, which will reduce China’s competitiveness in her exports. Instead, the

People Bank of China (PBOC) has been artificially keeping the Yuan exchange

rate low by pegging to the US dollar. In simple terms, it means that for every

US$ China has, PBOC will print a fix amount of Yuan say 6.5 times in

circulation. In fact, last August the PBOC devalued Yuan by close to 2% which

rattled the stock markets globally.

While China’s national debt is ~44% of GDP today, her total debt (including

household and corporate debt) to GDP ratio is in the range of 240-270%. To

many, the total debt figure is still manageable compared to U.S’s figure of

over 300 percent. That said, it is not the absolute debt levels that is

worrying but the rapid rate of increase that is causing alarm. A decade ago, China’s total debt to GDP ratio

is only approximately 150%.

household and corporate debt) to GDP ratio is in the range of 240-270%. To

many, the total debt figure is still manageable compared to U.S’s figure of

over 300 percent. That said, it is not the absolute debt levels that is

worrying but the rapid rate of increase that is causing alarm. A decade ago, China’s total debt to GDP ratio

is only approximately 150%.

Rest of world

It is not just US, Japan, Europe, and China that are leveraging up. The

rest of the world is following suit, resorting to printing more currencies to

inflate the global fiat currency reserves.

rest of the world is following suit, resorting to printing more currencies to

inflate the global fiat currency reserves.

Australia central bank just announced to cut rates to fresh record low

to counter low inflation and subdued employment figures. Reserve Bank of

Australia lowered rate by 25 basis points to 1.5%. Reasons of the rate

slashed is mainly due to slowing growth of China as well as the end of

mining boom seen few years ago.

to counter low inflation and subdued employment figures. Reserve Bank of

Australia lowered rate by 25 basis points to 1.5%. Reasons of the rate

slashed is mainly due to slowing growth of China as well as the end of

mining boom seen few years ago.

South Korea has unveiled an 11 trillion won (S$13.3b) budget spending to

support labour market.

support labour market.

Canada projected C$120b of cumulative budget deficits over six years and

biggest increase of spendings since 2009.

biggest increase of spendings since 2009.

Following its Brexit, Economists are pretty sure that UK policymakers

are likely to resort to all sorts of stimulus measures to prevent a painful

contraction.

are likely to resort to all sorts of stimulus measures to prevent a painful

contraction.

To be continued …

as of now, it seems while EU and BOJ haven't abandoned their monetary stimuli, the Fed will continue to hold off any rate hike.

BOJ's recent action has caused a noticeable reaction on long dated treasuries.

When debt becomes so huge, even a less than substantial increase in borrowing rate can bring about significant interest repayments.

productivity growth can no longer lead to jobs and higher income due to technology.

it may become more relevant again with higher acceleration of consumption demand.

consumption demand by itself will not help much, only acceleration of its growth will.

productivity growth is an old metric. and i suspect increasingly irrelevant.

Recently he also discussed the biggest worries in US now is the low productivity growth that will eventually lead to economic stagnation particularly in most developed OECD countries.

i believe this stimulus disappointment was the best move by BOJ at this current juncture due to previous stimulus moves resulting in higher yen.

http://shiohmekiah.blogspot.com/2016/08/boj-buying-up-japanese-etfs-and.html

the problem with Japan is a mentality problem that won't go away easily.

but demographics are changing and the younger guard are bringing back some energy and new ideas and new changes.

it will take time though.

Just recently, PM Abe had announce another round, >28 trillions yen ($265b) of stimulus. However its effectiveness remains to be seen. Many suspect if this strategy is to fail, Japan may need more dramatic strategy ahead, such as "helicopter money"!

it will require coordinated central banks together with coordinated fiscal policies.

Janet Yellen, the current Fed chairwoman was left behind an enormous public debt problem in US today (~19 trillions) that I reckon there is no way she can turn back, but to continue the artificial support of the world’s economy. It is possible that any major tightening of money supply will possibly lead to collapse of the entire market.

for the personal, just simply reduce your debts.

but the interesting immediate consequences of a gradual rate hike is the effect of this on currencies and trade balances.

surprisingly, I think the cheap devaluation of GBP and EUR (without spending upfront money, they may pay for it with legislation and restructuring of economic policies later on) has given them some help. we may see this positive aid in figures later this year granted confidence hasn't totally abandoned EU with the recent bank stocks collapses and being kicked out of STOXX and the recent terror attacks and the recent migration of more elites from Europe to US and other countries.

the problem with europe is long term and cannot be solved easily.

They will still do better as a trading bloc but it is not so simple; binding one size fits all legislation, binding currencies out of sync with the economies, tyranny of the majority votes in EU, conflicting interests.

they can do better with a looser structure but the EUR is important for them.

The recent Brexit does not bode well for the EU. About half of UK imports come from EU. In particular France and Germany are UK largest trading partners after the U.S. Brexit also further dampened the solidarity in EU. Already cohesiveness is low because the core economies do not like the idea that they need to support the countries that cannot pay their bills, which includes Greece, Portugal, Spain, Ireland and Cyprus who defaulted resulted in the Euro Debt crisis after the GFC.

China has devalued this year too.

but comparatively, they are quite nice already. they didn't devalued too much.

even given their long transition pains from export to self sustainable economy.

they are already being nice to global community so far.

Hi SMK,

As usual thanks for the long comment.

Any rate hike less than 100 basis points is to create confidence in the market perception, not necessary means fundamentals improved, just like end last year 25 basis points hike.

About productivity growth, u r referring more to developed ctries I supposed. Emerging economies productivity growth is still important n relevant. We have to see the stages where the ctries economies are.

About Japan, the older generation is really the hinder. Most are much richer and holding higher positions in most big organizations in Japan, having the say.

The young can differentiate right and wrong, but they cannot oppose the "big picture long term" wrong enforced by the old, who tends to act base on benefits of staunch past out-dated cultures and short term benefits for their generation.

I reckon in my generation, I will not see this once Asia rising sun, shinning bright again.

The world is chaotic now. We should already be contended if there is no war upcoming let alone a coordinated central banks worldwide. Remember : US, EU, Japan Central bankers cannot represent the world. Unless China, Russia or Middle East for that matter, can sit in the same table smilingly discussing how to save the world. Possible?

About Europe, I agree with you that problem is long term. Being relatively familiar with European cultures myself, one huge problem in itself is to force them to gel given their diverse cultures and high egoistic character about their own country's culture and benefit. The Northern Europeans should be able to do better by themselves without the bloc.

About China, they are one country that is being most misunderstood by the world, thanks to the proliferation of manipulated global media from the west.

IMO, in the long run after the next global crisis (if any), China will learn from their lesson, recovers and become stronger. Having work with the Chinese for so many years, they are one of the best learners!

this has turned out to be quite a decent series on your observations.

Thank you. 🙂

Play box HD app is not just a movies application, but it's also an excellent service for the people who love to enjoy their time with the films.

Yes, now you don't have to worry about watching movies on your iOS or Android

PlayBox for PC

Economy questions are not the one I'm good at but I still know something about that. I know that our economies suffer from the unemployment and poverty rates. In a time when we have the lowest salaries, the government tries to get benefit from that. When people lack money for a simple monthly living, they refer to the banks and take out loans to support the family. IN turn, banks provide the highest commissions rates on payouts and they make people get into the debt pit they will never get out from. I would recommend referring to the online Installment Credits service, the payday lender who provide small commision and doesn't pay attention to your credit history.

Thank you for posting such a great article! I found your website perfect for my needs

visit our website

Wonderful!! this is really one of the most beneficial blogs I’ve ever browsed on this subject. I am very glad to read such a great blog and thank you for sharing this good info with us. Alfalah VISA Platinum Credit Card | Alfalah Titanium MasterCard