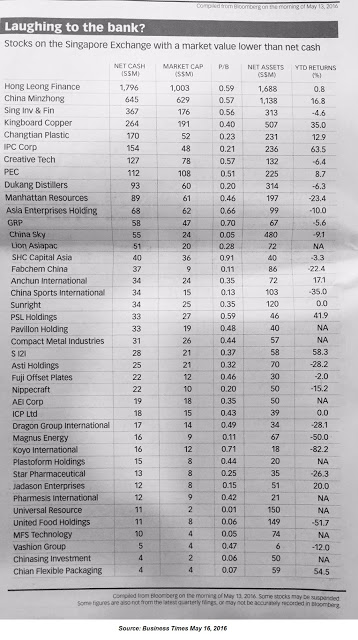

I read an article on Business Times today about Bloomberg tabulated

SGX Shares with Net Cash higher than their Market Capitalisation?

SGX Shares with Net Cash higher than their Market Capitalisation?

In layman term, “Net Cash” means how much a company have in the bank after accounted for

borrowed money.

borrowed money.

This type of investing is also called Net-Net investing made famous by

Benjamin Graham. According to investopedia, Net-net is a value investing technique in

which a company is valued solely on its net current assets. The net-net investing method focuses on

current assets, taking cash and cash equivalents at full value, reducing

accounts receivable for doubtful accounts, and reducing inventories to liquidation values. Total liabilities are

then deducted from the adjusted current assets to get the company’s net-net

value.

Benjamin Graham. According to investopedia, Net-net is a value investing technique in

which a company is valued solely on its net current assets. The net-net investing method focuses on

current assets, taking cash and cash equivalents at full value, reducing

accounts receivable for doubtful accounts, and reducing inventories to liquidation values. Total liabilities are

then deducted from the adjusted current assets to get the company’s net-net

value.

You may start to wonder: Wow….. such a value deal that Net Cash is higher than market value, which means even if the whole business were to collapse, the Cash the company has in the bank is still higher than stock price. It is like dirt cheap stocks or what Warren Buffett called it “Cigar Butt” stocks.

How can this be possible?

Therefore It pays to dig deeper into the business of the company rather than just looking at the numbers on the surface.

For instance, Hong Leong and Sing Inv being financial institutions may require to keep more cash because of the cash to loan ratio. Also if there are bad debts which means these companies need to write off their debts, they will need to keep significant amount of cash for investors’ confidence.

China Minzhong low stock pricing relative to her cash may be because of her Chinese origins which investors are sceptical.

Kingboard copper has accusation from minor shareholders on her IPT mandate in which she was accused of selling copper foil at a discount to her parent company.

Creative Technology is not coming up with new innovative product that interest investors, which can explains why the share is so cheap. Also in her latest quarterly result, cash is derived mainly from lawsuit win rather than actually revenue.

See any comments or posting from CNAV camp. 🙂

Hehe…. 🙂

Being part of the CNAV camp, I think the article in Business Times is not very right to include financial firms.

As for the post, may I explain that Net Cash may not constitute as Net Net?

Cash minus Borrowing = Net Cash.

Current Asset minus Total liabilities = Net Net.

Hopefully I am right as I yet to read the article.

Hi guys,

According to investopedia, net cash is total cash minus total liabilities. This means that net cash is even more strict than net net. Not sure if the straits times report is using that though. It could be what T.U.B mentioned.

Hi TUB,

Thanks for dropping by the first time.

Net net "header" is by me. Sgx only mentioned Net cash. I apologized. They only mentioned Net cash financial firms.

I know about CNAV but even your definition of net net is arguably not accurate also.

In investopedia explanation of net net, you even need to subtract doubtful accounts and reduce inventories.

Current asset can includes Account receivables so if we just use cash and equiv / liquid short term investment investment excl. AR and inventories it is more conservative than Net Net.

Sometimes if u r not Benjamin Graham or WB where you can access to the top, it's not easy for retailers or even auditors to identify doubtful accounts or any fraudulent inflated figures.

So no matter what, retailer always have more disadvantage with if our stats or CNAV is very presumingly accurate on paper!

End of the day, the net net is just a terminology, we should identify our own method of judgement.

Hi LP,

BT definition not explicit, only states money in bank after account of borrowed money.

But u are right, Net cash is more stringent and it also does not take into account AR etc

Hi Rolf,

First time commenting. But not the first time reading.

Anyway, I agree my CNAV is not the most accurate calculation. But to me, its the simplest to understand.

Nevertheless, the main thing is without knowing how Business Time calculate Net Cash, we can never know how accurate the list of stocks are.

just my thoughts.

Hope this helps to explain.

Did a check on few companies they profiled, perhaps "Net Cash" here refers to cash and equiv or short term liquid investment (excl other current assets) subtract borrowed money (current and non current)!

PEC seem like the only I have looked at the past with a real business. Have not keep myself updated though.

Creative have a real business going after Samsung and Apple. But going to invest due on that

hi mike

i have PEC and HL finance too.

dividend is good so far:)

i believe once market doing better, they will shine:)

Typo. Not going to

Hi SI,

Creative does not seem Creative anymore after their sound blasters boom!

haha…

wow, a lot of coys that i've heard first time.

vested in PEC, but as with its peers, beaten down due to the current climate. and not much catalyst too.

the rest, errr…..

Hi FC,

Always good to know companies we do not know. happy hunting'

Hi Rolf

Net net or net cash, as far as how good that is, i guess it proves that it still pays to understand the underlying business well.

Net net or net cash is only good upon liquidation situation where you think you can get better money off their balance sheet than what you pay for, but it can also trapped our money there for a long period of time.

Nod Nod Nod!

My take is that it is about diversification. Net Net has higher returns at portfolio level but larger losses in those stocks that turned bad. To me, the overall returns is worthwhile to take those occasional pains.

Also, there is time stop for Net Net which most people miss out. Holding period is 2 years or +50% gain, whichever earlier.

Net Cash = Cash – Total Liabilities

Net Net or NCAV = 2/3 of Net Current Assets (Current Assets – Total Liabilities)

NNWC = Cash + short term investments + 75% receivables + 50% inventories – Total Liabilities

CNAV = Properties + Cash + 50% of other assets (excluding goodwill, deposits, prepayments) – Total Liabilities

Hi Alvin,

Thanks for the explanation. Yes I agree on the part of diversification. Eventually diversified or not is always a subject matter relating to individual preference.

By the way, good to know there is a holding period of 2 yrs!

To me, diversification means more for overall portfolio diversification, meaning, some stocks, some bonds, some cash, some metals, some property (if can afford) etc… Then within stocks up to u to further diversify?

For net net or any graham based strategy must diversify. It is not due to preference. Graham said 30. But studies show 15 is sufficient to reduce unsystematic risk by 90%

For net net or any graham based strategy must diversify. It is not due to preference. Graham said 30. But studies show 15 is sufficient to reduce unsystematic risk by 90%

yes always good to diversify, but sidetrack abit, there are many successful businessman who put all the eggs in one basket which is their business and they prosper.

George soros when he broke the Bank of England in late 90s in one interview says that he is so sure that he is damn right in a once in a lifetime chance that he bet it all against the pound. Indeed he was right!

Agree that Graham is legendary, but not everyone is Graham and there are more to it in his mind we does not know than just the normal us reading his book and follow his investment style and claim success.

BG is WB mentor but even WB is developing his own style after learning from BG.

Hence true successful investing in my opinion is the ability the find your own personality and fuses with the investment you learnt / failed / experience to eventually evolve a style that is truly yours!

Media only show the success stories of ppl who made big bets and win, seldom those who lost.

Less stocks need more work because cannot afford to be wrong. More stocks actually requires less work and roughly correct is good enough.

I would say the decision to diversify or not is from a risk management standpoint and not a matter of preference.

I am not saying graham or buffett is better. It depends on what kind of stocks you buy to determine u shd diversify or not.

That why we seldom read news or cyber articles on large losses until some go bankrupt then got some news. I probe around those seniors around me, quite a number of them lost their CPF saving in CPFIS during AFC that is before Govt limit CPFIS to 35%