George

Soros piled up gold

Soros piled up gold

Gold has

been one of the best investment assets since the start of the year increasing

by more than 20%.

been one of the best investment assets since the start of the year increasing

by more than 20%.

Recently,

Billionaire investor George Soros cuts US stocks by 37% and buying gold. Soros

bought 1.05 million shares in SPDR Gold Trust, which tracks the price of

bullion and took a stake in Barrick Gold Corp, which is the world’s biggest

producer of gold, amounted to $264 million.

Billionaire investor George Soros cuts US stocks by 37% and buying gold. Soros

bought 1.05 million shares in SPDR Gold Trust, which tracks the price of

bullion and took a stake in Barrick Gold Corp, which is the world’s biggest

producer of gold, amounted to $264 million.

Why? What

exactly is gold and silver? How are the economic conditions going to affect the

prices of gold and silver?

exactly is gold and silver? How are the economic conditions going to affect the

prices of gold and silver?

Ultimately,

you want to know if you should own some of the precious metals and if you are going

to make money when you buy gold / silver for investment reason?

you want to know if you should own some of the precious metals and if you are going

to make money when you buy gold / silver for investment reason?

I shall leave

you with diverging views from two experts below.

you with diverging views from two experts below.

Warren

Buffett criticism on gold

Buffett criticism on gold

Quote 1: “Today the world’s gold stock is about

170,000 metric tons (year 2012). If all of this gold were melded together,

its…value would be about $9.6 trillion. Call this cube pile A. Let’s create a

pile B costing an equal amount. For that, we could buy all U.S. cropland…plus

16 ExxonMobils…After these purchases, we would have about $1 trillion left

over…”

170,000 metric tons (year 2012). If all of this gold were melded together,

its…value would be about $9.6 trillion. Call this cube pile A. Let’s create a

pile B costing an equal amount. For that, we could buy all U.S. cropland…plus

16 ExxonMobils…After these purchases, we would have about $1 trillion left

over…”

“A century from now the 400 million acres of

farmland will have produced staggering amounts of corn, wheat, cotton, and

other crops…ExxonMobil (s) will probably have delivered trillions of dollar

in dividends to its owners and will also hold assets worth many more

trillions…The 170,000 tons of gold will be unchanged in size and still

incapable of producing anything. You can fondle the cube, but it will not

respond.”

farmland will have produced staggering amounts of corn, wheat, cotton, and

other crops…ExxonMobil (s) will probably have delivered trillions of dollar

in dividends to its owners and will also hold assets worth many more

trillions…The 170,000 tons of gold will be unchanged in size and still

incapable of producing anything. You can fondle the cube, but it will not

respond.”

Quote 2: “This type of investment requires an

expanding pool of buyers, who, in turn, are enticed because they believe the buying

pool will expand still further. Owners are not inspired by what the asset

itself can produce — it will remain lifeless forever — but rather by the

belief that others will desire it more avidly in the future.”

expanding pool of buyers, who, in turn, are enticed because they believe the buying

pool will expand still further. Owners are not inspired by what the asset

itself can produce — it will remain lifeless forever — but rather by the

belief that others will desire it more avidly in the future.”

— Warren

Buffett

Buffett

Ray

Dalio saying Warren Buffett is making a huge mistake by not owning gold

Dalio saying Warren Buffett is making a huge mistake by not owning gold

Another

legendary investor Ray Dalio (one of my favorites) said this about gold,

counterintuitive to Warren Buffett’s theory. Dalio advocates investors to have

5% to 10% of their assets in gold. Maybe 5% in gold stocks and 5% in bullion

and then rebalance every year. Refer to his interview here.

legendary investor Ray Dalio (one of my favorites) said this about gold,

counterintuitive to Warren Buffett’s theory. Dalio advocates investors to have

5% to 10% of their assets in gold. Maybe 5% in gold stocks and 5% in bullion

and then rebalance every year. Refer to his interview here.

‘If you don’t own gold, you know neither

history nor economics’

history nor economics’

“I would say that we are in an environment

where it is very important to have a well-diversified portfolio, and that’ll

include assets gold. In other words,

what could I tell investors, try to achieve balance in various ways. That’s a whole subject about how to do it.

where it is very important to have a well-diversified portfolio, and that’ll

include assets gold. In other words,

what could I tell investors, try to achieve balance in various ways. That’s a whole subject about how to do it.

And also I think that gold at 5 percent of your

portfolio, 5 percent or 10 percent of your portfolio, under the circumstances,

would be also a prudent thing to do.

Prudence is the important thing to do.

The reason I’m also referring to that is we have a situation where a debt is money. In other words, we have

a fiat monetary system, too. And so we are having problems as these

central banks operate. And so think of it as another form of cash and when

cash now has zero or 0 percent interest rates or less, think of it as one of

those possibilities in terms of how do you create diversification

portfolio, 5 percent or 10 percent of your portfolio, under the circumstances,

would be also a prudent thing to do.

Prudence is the important thing to do.

The reason I’m also referring to that is we have a situation where a debt is money. In other words, we have

a fiat monetary system, too. And so we are having problems as these

central banks operate. And so think of it as another form of cash and when

cash now has zero or 0 percent interest rates or less, think of it as one of

those possibilities in terms of how do you create diversification

— Ray

Dalio

Dalio

Who is

correct?

correct?

Anyway, this

article will be the first of Gold and Silver series articles.

article will be the first of Gold and Silver series articles.

In this

first article, it will basically be an introduction about things you need to

know when investing in physical gold and opening a UOB silver account.

first article, it will basically be an introduction about things you need to

know when investing in physical gold and opening a UOB silver account.

In the next

article (in progress now), I will delve into the history of precious metals and

its impact to the global monetary system.

article (in progress now), I will delve into the history of precious metals and

its impact to the global monetary system.

My

own experiences at UOB bank buying physical gold and opening UOB silver account

own experiences at UOB bank buying physical gold and opening UOB silver account

By the way,

I went to UOB Main Branch at Raffles Place. I assume it is the easiest.

Otherwise just call up UOB bank hotline to ask how to buy physical gold and

open silver account. Pretty much “idiot proof”.

I went to UOB Main Branch at Raffles Place. I assume it is the easiest.

Otherwise just call up UOB bank hotline to ask how to buy physical gold and

open silver account. Pretty much “idiot proof”.

For now, I

will like to bring you “additional uncommonly known info” you may need to know

when you buy physical gold with UOB bank in Singapore and when you opened a UOB

Silver account.

will like to bring you “additional uncommonly known info” you may need to know

when you buy physical gold with UOB bank in Singapore and when you opened a UOB

Silver account.

Unit for gold

First, get

the buy and sell UNIT of gold correct. Gold price is calculated in troy ounce and not in ounce.

the buy and sell UNIT of gold correct. Gold price is calculated in troy ounce and not in ounce.

1 troy

ounce = 31.103 g

ounce = 31.103 g

1 ounce =

28.349 g

28.349 g

So troy

ounce is about 10% heavier.

ounce is about 10% heavier.

UOB gold and silver prices

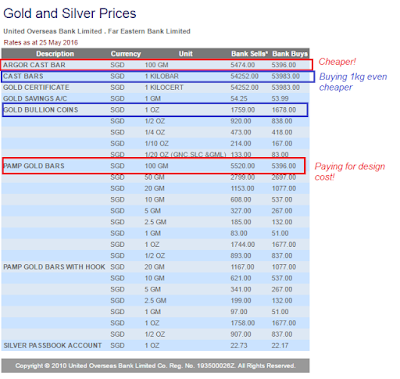

Visit UOB

website here, and then click tab -> Rates and Fees ->

check our indicative gold and silver prices! Below is a table showing

indicative pricing. You see the prices of different types of gold.

website here, and then click tab -> Rates and Fees ->

check our indicative gold and silver prices! Below is a table showing

indicative pricing. You see the prices of different types of gold.

Loss Spreads

Always note

the buy and sell prices for the loss spread. The smaller the loss spread during

buy and sell, the better it is.

the buy and sell prices for the loss spread. The smaller the loss spread during

buy and sell, the better it is.

Given on

the same time you buy and sell, the spread you LOSE for 1 KG will be as follows

using the above indicative pricing:

the same time you buy and sell, the spread you LOSE for 1 KG will be as follows

using the above indicative pricing:

1 KG Cast

Bar : 54,252 – 53,983

Bar : 54,252 – 53,983

= Loss S$269.00

100 GM Argor

Cast Bar : 5,474 – 5,396 = S$78.00. To get 1 KG, you multiply by 10 and that

will be = Loss S$780.00

Cast Bar : 5,474 – 5,396 = S$78.00. To get 1 KG, you multiply by 10 and that

will be = Loss S$780.00

100 GM PAMP

Gold Bar : 5,520 – 5,396 = S$124.00. To get 1 KG, you multiply by 10 and that

will be = Loss S$1,240.00

Gold Bar : 5,520 – 5,396 = S$124.00. To get 1 KG, you multiply by 10 and that

will be = Loss S$1,240.00

1 OZ Gold

Bullion Coin : 1,759 – 1,678 = S$81.00. To get 1 KG, you multiply by 32.1507

from troy ounce, and that will be

Bullion Coin : 1,759 – 1,678 = S$81.00. To get 1 KG, you multiply by 32.1507

from troy ounce, and that will be

= Loss S$2,604.00

During my

purchase of physical gold, I was advised by the UOB staff that for investment

purposes, 1 KG of Cast Bars is the

cheapest to trade with UOB as you can also see above. In other words, the loss

on spreads is much lower if you happen to buy and sell on the same time!

However it costs ~>50KSGD per Kg with little divisibility. Imagine you

misplace your 1 KG of gold….woooohoooo heartache!

purchase of physical gold, I was advised by the UOB staff that for investment

purposes, 1 KG of Cast Bars is the

cheapest to trade with UOB as you can also see above. In other words, the loss

on spreads is much lower if you happen to buy and sell on the same time!

However it costs ~>50KSGD per Kg with little divisibility. Imagine you

misplace your 1 KG of gold….woooohoooo heartache!

Therefore,

if you are afraid to misplace it or wanted more divisibility with a reasonable

investment amount of >5KSGD and a reasonable loss spread, then 100 GM Argor

cast bar is a good choice!

if you are afraid to misplace it or wanted more divisibility with a reasonable

investment amount of >5KSGD and a reasonable loss spread, then 100 GM Argor

cast bar is a good choice!

Further

smaller divisibility, then you can buy Bullion coins at 1 OZ each but loss spread

is higher.

smaller divisibility, then you can buy Bullion coins at 1 OZ each but loss spread

is higher.

However the

advantage is that it comes with many different designs suitable for gifts.

Likewise, PAMP Gold Bars comes with different designs.

advantage is that it comes with many different designs suitable for gifts.

Likewise, PAMP Gold Bars comes with different designs.

Do not open the seal

Below is a

typical 100 GM Argor Cast Bar I own. Another thing to note is “DO NOT OPEN THE

SEAL!” Once seal is opened, UOB will not buy back the gold at all. There is

also a unique code for each gold bar.

typical 100 GM Argor Cast Bar I own. Another thing to note is “DO NOT OPEN THE

SEAL!” Once seal is opened, UOB will not buy back the gold at all. There is

also a unique code for each gold bar.

Invoice costs money

The invoice itself does not cost additional money. What I am saying is if we lost the invoice per 100gm of gold we bought, UOB will charge S$100 deduct from the buy back price.

This means that if we bought 200gm of gold from UOB, lost the invoice and if we are selling it back to UOB later, they will deduct S$200 from our sell price.

Open UOB Silver account

Again, it

is more or less idiot proof when you are at the Main UOB Branch. Just tell them

that you need to open a Silver account and the staff will guide you through.

is more or less idiot proof when you are at the Main UOB Branch. Just tell them

that you need to open a Silver account and the staff will guide you through.

One thing

to note is the charges of gold or silver account per annum! It is slightly more difficult to comprehend. Imagine

that you are owning 200g of Gold and 500 oz of Silver in UOB account, then the

charges per annum will be ~S$76 and S$55 respectively.

to note is the charges of gold or silver account per annum! It is slightly more difficult to comprehend. Imagine

that you are owning 200g of Gold and 500 oz of Silver in UOB account, then the

charges per annum will be ~S$76 and S$55 respectively.

Also note

that there is a minimum amount or deposits to set up the accounts but it is

refundable in cash once you close the account. The deposits cannot be used for

trading, and to ensure the account is active, the minimum deposit amount must

be there.

that there is a minimum amount or deposits to set up the accounts but it is

refundable in cash once you close the account. The deposits cannot be used for

trading, and to ensure the account is active, the minimum deposit amount must

be there.

Other

ways: Gold ETF (SGX) and Silver

ways: Gold ETF (SGX) and Silver

Two other

ways to own the precious metals in a more direct manner is to buy Gold ETF on

SGX and Ishares Silver Trust on NYSE i.e. GLD US$ (O87: SGX) and ISH Silver

(SLV.P : NYS)! Both is traded in US$!

ways to own the precious metals in a more direct manner is to buy Gold ETF on

SGX and Ishares Silver Trust on NYSE i.e. GLD US$ (O87: SGX) and ISH Silver

(SLV.P : NYS)! Both is traded in US$!

Alternatively

in Singapore, you can also buy and store physical gold or open account with

BullionStar. Refer webpage here.

in Singapore, you can also buy and store physical gold or open account with

BullionStar. Refer webpage here.

There are other precious metals ETF or related stocks that you can buy too. I will not elaborate it here though.

Other

bloggers spoke about it

bloggers spoke about it

Big Fat

Purse

Purse

ASSI

My 15HWW

Simply

Jesme

Jesme

Foolish

Chamelon

Chamelon

Rolf’s

thoughts

thoughts

Disclaimer: I own physical gold, UOB silver

account and Gold trust.

account and Gold trust.

In the

Singapore finance blogosphere, there are so many analysis on stocks, but not

many on gold and silver. Even if there is, there is little explanation on the

fundamentals of the precious metals and the role it plays in the history of

mankind.

Singapore finance blogosphere, there are so many analysis on stocks, but not

many on gold and silver. Even if there is, there is little explanation on the

fundamentals of the precious metals and the role it plays in the history of

mankind.

Instead,

there are more articles related to instructions how and where we can buy

precious metals in Singapore OR using gold as an hedge against inflation or as

insurance OR basically showing the charts of pricings/returns over the year!

there are more articles related to instructions how and where we can buy

precious metals in Singapore OR using gold as an hedge against inflation or as

insurance OR basically showing the charts of pricings/returns over the year!

Understand

the history of gold will give you a better perception of the future impact it

is likely to have in the world monetary system.

the history of gold will give you a better perception of the future impact it

is likely to have in the world monetary system.

Stay tuned

for Part 2.

for Part 2.

UOB silver acc got third party risk, something like this, i hearsay before. Can please explain what is that? I m newbie. Thanks

These are paper silver and not backed by actual physical silver in the vault.

It is the same as Gold ETF, even if they were backed by physical gold, it is not sufficient quantity. So in some ways, it's more like futures contract of gold and silver pricing similar to commodities pricing,

Hi rolf

Can I know what is the difference between buying from uob and bullion dealers in singapore ? How do we know whether the current pricing is overpriced? Thanks

Gold or silver, paper or silver? may I ask?

I assume u only care abt $ n cents! Just look at the spread between Uob and Bullion.

I normally love to share, but errrr to Anoymous readers, I tend to share lesser during Q&A.

Because I believe being honest and smartlytransparent is one important factor to be successful or even rich and sustainable for a long time!

Hope u understand. U can always drop me an email. Have a nice Sunday!

Be that as it may, don't lose track of the main issue at hand as putting resources into gold has it's disadvantages quite recently like some other speculation would. IRA Gold Advisor

I recently found many useful information in your website especially this blog page. Among the lots of comments on your articles. Thanks for sharing. Gold Buyers Guide

Thanks for a very interesting blog. What else may I get that kind of info written in such a perfect approach? I’ve a undertaking that I am simply now operating on, and I have been at the look out for such info. Cheap Jewelry for Sale

Thanks for a very interesting blog. What else may I get that kind of info written in such a perfect approach? I’ve a undertaking that I am simply now operating on, and I have been at the look out for such info. Cheap Jewelry Stores

Your blog provided us with valuable information to work with. Each & every tips of your post are awesome. Thanks a lot for sharing. Keep blogging.. Buy Bullion and Coins Online

Thanks for another wonderful post. Where else could anybody get that type of info in such an ideal way of writing? Buy Gold Bullion Bars Online

You completed several good points there. Used to do a search for the issue and found nearly all people will go in addition to together with your blog. Read Full Article

in China, they do not respect intellectual property at all. too many software and movie pirates out there` internet

???, ??? ???? ????? ??? ???? ? ??????? ?? ????? ???? ????? ????? ????? ????? ?????? ??????. Learn More Here

Along with having one of the best on screen fights of the year with Johnson,Vin Diesel gives a fantastic,real return-to-form performance as Dominic. look at these guys

wireless routers are very necessary nowadays because we do not want so many wires running around the home* look at this now

I was reading some of your content on this website and I conceive this internet site is really informative ! Keep on putting up. purple gemstone rings

Good artcile, but it would be better if in future you can share more about this subject. Keep posting. garnet engagement ring

Pretty good post. I just stumbled upon your blog and wanted to say that I have really enjoyed reading your blog posts. Any way I'll be subscribing to your feed and I hope you post again soon. Big thanks for the useful info. unique garnet rings