Should we quickly pay down our house mortgage with all our excess monies less expenses, or keep should we use our extra income to invest?

Before we start, let us do a simple mortgage analysis.

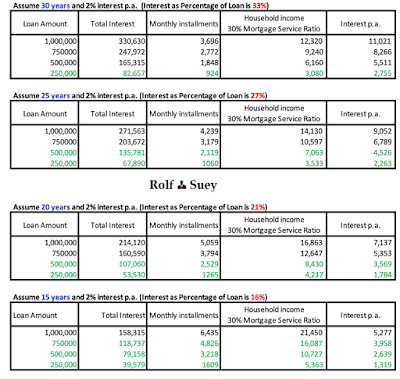

Assuming 2% interest p.a. on average, below is a table depicting different loan amounts with varying loan periods of 30, 25, 20, 15 years to show what is the total interest payable and the monthly instalments.

ROLF’S MORTGAGE PAYMENT CRITERIA

Mortgage Service Ratio

In the above table, you can see the Mortgage Service Ratio (MSR) which is defined as the ratio of monthly instalment to household income, kept at 30%.

Currently, the Singapore government set the Total Debt Service Ratio (TDSR) limit at 60% which means all your debt obligations (student loans, credit card debts, car loans, personal loans, and so on), cannot exceed 60% of your income. This applies to property loans granted by all financial institutions (not just banks).

However, I feel that hitting the 60% TDSR limit can be too risky especially in times of crisis where income sustainability is at stake. I recommend to keep MSR comfortably at 30%, so that you still have 70% of the savings to pay off car loan (if any), and potentially savings also for investments.

My very own MSR is even more conservative at 15% average for the past many years. This is due to my high expenses in a big household and also my preference to have more liquidity to invest, to potentially set-up business when opportunities arise, to use as emergency etc.

Absolute interest payable

Another criterion is to consider absolute value of total interest payable. It is wise to keep it within SGD 150K, otherwise you will be paying just too much interest over the period of your tenure. I think SGD 200K is the maximum you should go for even with a higher property loan.

Unless, it is very clear that you are going to sell your property for a significant profit within a certain period of time. But nobody knows! I have known many friends and relatives who took on big property loan with more than 20 years loan. Often times when I quipped if they are then paying too much interest, most will say “its ok” because I am going to sell it for a good profit after 5 years. Then you will realise that most of them only have one property or they have not been able to sell after 5 years.

In fact, I met with most who lost a lot of money after some unforeseen circumstances take place. E.g. divorce, retrenchment or big pay cut making their re-financing more difficult, such that they have to endure a higher interest rate on the 3rd year interest rate onwards.

Per annum interest payable

It is important to pay more than 50% of your monthly payment on principle and not more than 50% on interest. Hence, I am suggesting to have interest below SGD 10K per annum on average. The reasoning is because at SGD 10K yearly interest, is equal to SGD 900 per month of interest, and assuming monthly instalment is SGD 2,000 plus, then at the very least you are still paying more than 50% of the principal.

Recommended mortgage

Using these criteria and referring to the above table, the highlighted green figures are the recommended mortgage variables.

Of course, if you have higher household income, or excess savings or bonuses in those years, then upon refinancing your loan (every two years), you can either shortened the loan period, or you can pay down a fix lumpsum to reduce the loan amount significantly. Both ways, can help you to reduce the overall interest payments, as long as you are comfortable.

BALANCE BETWEEN PAYING MORTGAGE AND INVESTMENTS

Fulfilling the above criteria, then I suggest that you should definitely invest with the rest of your savings.

However, before you invest, you need to learn more about investments. This is of utmost importance. It will take time and patience. Above all, you may have to pay school fees and remember DO NOT BE TOO PROUD if you find quick success during the start of your investment journey. Most of the time, you are just fool by randomness during the beginning. It is not because you are skilful. It is likely market is just too bullish or you are pure lucky, or you probably have not experience or anticipate any crisis yet in your life! That said, once you have your experiences of hardwork, “pain-learn-improve”, you should be able to beat the market over time.

If you do not have humility, time or patience to learn investments or to learn how to manage a portfolio, I suggest you should not invest by just hearsay and pick stocks sentimentally. It is much better to just pick a low risk fund or a bond and to put in money monthly and not to be bother about the market movements. Alternatively, your CPF may give you better compounded returns.

I know friends in their late 50s who are not overly engross in learning investment as they focus on their career to increase their income and sitting at management position. They then invested in funds with their insurance agents for more than 20-30 years and today, and the return on those funds today is able to help them with retirement and to fund all his children for universities.

WHY IS IT BETTER NOT TO PAY ALL OF YOUR MORTGAGE AT ONCE?

Low interest rate in Singapore

As you probably know, interest rate of housing loan in Singapore has been very low below 2% for the last ten years. In comparison to the rest of the world, home loan here is one of the lowest. In USA, fixed interest rate for 30 year-old loan can be as high as more than 3.5%. China and the rest of the South East Asia have more than 4-5% mortgage rate on average in the last ten years.

Taking advantage of economic health’s direct proportional relationship to interest rate

In fact, if you try to refinance every two years in the last 10 years like I did, all my rates are below 2%, and in fact even below 1% at one time.

Also, if interest rate rise in times of good economy with job security and your investments is doing well, you can cash out investments or use your increased bonuses to pay down mortgage lumpsum or shortened the loan period during refinancing.

If economy is not good, generally interest rate will be low, then you can use your excess monies (because you did not pay down your mortgage aggressively), to buy stocks during times when stock prices are depressed.

However, take note that interest rate may not be always be directly proportional to economic health.

HDB Loan and Singapore government is “sympathetic”

If you are taking HDB loan, although rates are generally higher say c. 2.5%, but our government is more forgiving and will not chase you out of the house even if you default. When I was young, I had seen my neighbor default for many months rental, instead of HDB chasing them out of the house, they will send social worker to their house to talk to them and help them to find jobs.

Singapore is also generally quite sympathetic in times of crisis when you lose your job and unable to pay your mortgage. This covid pandemic is the best example when government dictate banks to allow for deferment of mortgage payments.

Emergency savings

If you use all your excess monies to pay down mortgage, then you will not have emergency savings during times of crisis. Equally bad is when you use all your excess savings to buy stocks instead of mortgage. Then in times of crisis when market is depressed, your stocks portfolio will drop significantly. And let’s say you need emergency money and need to cash out your stocks, you will make huge losses.

Hence it is better to keep emergency savings in cash or in bonds which is considered very safe which can be easily liquidated and yet with percentage returns.

Otherwise you can have gold and silver to hedge against times of crisis, like what I do. So that if stock market crash, and gold price rise, you can then sell your gold at high price and use the profits to either buy stock cheaply or to help you for emergency needs during economic crisis like now.

OTHER FACTORS

Of course, there are other factors to consider in relation to your own income and expenses to decide how much you should pay down your mortgage and how much you should invest.

It differs from household to household. Some household have family to take care of, some don’t. Some has more security in their jobs. Some are willing to work until they are old, therefore they can have lower monthly instalments for mortgage repayments, and have more money for investment portfolio.

CONCLUSION

If you are in Singapore owning a Singapore property, my advice is don’t cripple your cash reserves on the quest to be mortgage-free. It is not that smart in a low interest rate environment.

However, if you really seriously have zero interest in investment knowledge, and you are very risk adverse, then you can quickly pay down your mortgage, but remember to have at least one year of emergency savings on expenses. I am more “kiasu” and advise to have 1.5 years of liquidable emergency savings.

Finally, it is not wise to pour all your money and savings in stocks alone. It is better to have an investment portfolio comprising of stocks, bonds, precious metals, cash etc. This can help you to hedge against economic crisis when stock market crash. And if it just happen that you need emergency cash because you are being retrenched or there is a double whammy economic and personal health crisis, then, at least the downside or the black swan event is avoided.

Is the table missing?

Apologies and thanks for informing. Table updated.

Quite a comprehensive article. I will share it with our company financial planners.

Dear Kyith, thanks for dropping by and the compliment. It's been ahwile and you are definitely one who will be always around. Still see that you continue to churn out great articles over the years consistently.

Stay safe and healthy.

Hello everyone, Are you into trading or just wish to give it a try, please becareful on the platform you choose to invest on and the manager you choose to manage your account because that’s where failure starts from be wise. After reading so much comment i had to give trading tips a try, I have to come to the conclusion that binary options pays massively but the masses has refused to show us the right way to earn That’s why I have to give trading tips the accolades because they have been so helpful to traders . For a free masterclass strategy kindly contact (paytondyian699@gmail.com) for a free masterclass strategy. He'll give you a free tutors on how you can earn and recover your losses in trading for free..

Natural herbs have cured so many illness that drugs and injection can’t cure. I've seen the great importance of natural herbs and the wonderful work they have done in people's lives. i read people's testimonies online on how they were cured of HERPES, HIV, diabetics etc by Dr Edes herbal medicine, so i decided to contact the doctor because i know nature has the power to heal anything. I was diagnosed with Herpes for the past 3 years but Dr Edes cured me with his herbs and i referred my aunt and her husband to him immediately because they were both suffering from Herpes but to God be the glory, they were cured too .I know is hard to believe but am a living testimony. There is no harm trying herbs, Thanks. Write him on WhatsApp on +2348151937428. @dr_edes_remedies deals with

(1)Alzheimer virus

(2)Cancer

(3)HIV

(4)Herpes

(5)Genital warts

(6)ALS

(7)Virginal infection

(8)HPV

(9)Hepatitis

(10)Asthma

Email him on dredeshome@gmail.com

https://dredesherbalhome.weebly.com