So what is new?

- Return to profitability in 3Q 2020 vs 2Q S$697m net loss.

- Still, 3Q20 profits is significantly lower than 3Q19. Note: 3Q19 attributable profit is S$159m

- Still loss making for 9M20. Mainly due to impairments of S$919m in O&M.

- Group’s revenue 9M20 was S$4,818m compared to 9M19’s S$5,382m

- Net gearing 0.96x qoq improvement from 1.00x.

2030 Vision:

- Last quarter, divest S$140 million in assets from landbank and non-core assets.

- Secured an offshore renewables contract worth about S$600 million.

- Focus on Energy & Environment, Urban Development, Connectivity and Asset Management.

Energy & Environment

Keppel O&M

- Revenue S$1.1b for 9M 2020 vs S$1.4b for 9M 2019

- S$900m new contracts YTD, of which 72% from Offshore wind and LNG projects.

- This includes 3Q20, S$600 million contract from EPC of a vessel in renewable energy sector.

- Continues to face headwinds amidst depressed oil prices.

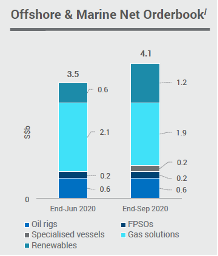

- As at end-September 2020, Keppel O&M’s net orderbook stood at S$4.1 billion, up from S$3.5 billion as at end-June 2020.

Rolf’s Thoughts: O&M business is not as bad as it looks since KOM still continues to win project. But the success really stems in the capability to make the renewable projects profitable, as these are pretty new to Keppel. 4B backlog is quite decent figures, but backlog is useless if it is loss-making projects!

Renewable energy sector continues to thrive in the midst of ailing O&G markets, especially in Europe, Taiwan, and also Vietnam, Korea and Japan. Also, I personally know that more FPSO projects are in the planning pipelines for 2021 and 2022. However, all these projects will takes time to materialize.

Keppel Infrastructure

- Revenue S$1.7b / EBITDA of S$119m (9M20) vs S$2.0b / EBITDA S$115m (9M19)

- YTD, S$2.1B waste-to-energy and district cooling contracts in SG, India and Thailand.

- Incl. the latest S$300m JTC contract for a new district cooling system plant for 30 yrs.

- Ops & maintenance of the Keppel Marina East Desalination Plant in SG continues to progress smoothly since commencement end of June 2020

- Tuas Nexus Integrated Waste Management Facility is undergoing its design and engineering phase.

Rolf’s Thoughts: Waste and Water management are two important initiatives from SG government. If Keppel can manage the project cost properly, there is great potential of growth. However note that while there is upside, poor management of complex projects can also cause huge losses! Just look at Hyflux!

In another news, Australia is planning to build the world largest solar farm to power 20% of Singapore’s population. Not sure how this will help Keppel’s renewables and infrastructure business?

Read:

World’s Largest Solar Farm to Be Built in Australia – But They Won’t Get The Power

Australia to power Singapore with world’s biggest solar farm

Urban Development

Keppel Land

- Sold about 2,030 homes 9M20, a decrease from 3,520 homes sold 9M19.

- SG home sales increased to 240 compared to 190 in 2019 due to Garden Residences 74% sales

- China home sales decreased to 1,580 homes compared to 2,330 a year ago, due to lesser projects launched and poor economic conditions.

- Vietnam records lower home sales due to slower approval for new launches

- Keppel Land & TVS Emerald jointly embarked on a residential project in South Chennai, India

- Announced divestment of project in Taicang in Oct 2020

- Sale of a residential plot in Tianjin Eco-Cityin Oct 2020, with about S$18m gain to Keppel

Rolf’s Thoughts: Guess property sales will continue to be tough in view of the uncertain economic conditions in coming years.

Connectivity

Keppel Data Centres

- Digitalisation and WFH trends drive demand for data centres.

- New data centre project JV with SPH at Genting Lane

- Keppel Data Centres collaborates with City Gas and City-OG Gas Energy Services to explore the use of LNG and hydrogen to power floating data centre park in SG.

M1

- Stable EBITDA of S$202 million for 9M20 vs S$211m for 9M19

- Postpaid customer base grew 6.1% yoy and has become the 2nd largest in SG

- 1st operator in SG to open up 5G access

- Extended new MVNO partnership with MyRepublic

- Inked partnership with DBS to leverage M1’s 5G network to enhance customer experience and unlock new opportunities for retail customers

Rolf’s Thoughts: Not an easy environment in competition with Singtel and Starhub. So can only share the pie, and hopefully continue to have stable profits. Growth is more far-fetched! Possible divestment?

Asset Management

Keppel Capital

- Asset management fees grew S$123m for 9M20, vs S$105m for 9M19.

- YTD, Keppel Capital-managed funds secured total commitments of US$2.0 billion from investors, including US$295 million for Alpha Asia Macro Trends Fund IV

- Strategic cooperation with the National Pension Service of Korea to explore opportunities for private infrastructure in Asia

- Launch of the Keppel Education Asset Fund to tap the fast-growing private education sector.

Keppel REIT

- is acquiring Pinnacle Office Park in Sydney

ROLF’S FINAL THOUGHTS

In my view, Keppel’s business will continue to be depressed in 2020 going into 2021 due the sectors she is in, aside from Data business that is looking good. If you decided to look further than 2021, then there is definitely light in the tunnel.

Of course, the movements of share price may not immediately mimic business figures, as share price are forward looking. Therefore, I reckon that the current share price definitely has more upside than downside going into 2021.

At the very least, I think Keppel is a much better buy than SIA, as Keppel does not need to resort in borrowing billions and lay off so many employees, with an uncertain aviation outlook.

That said, the question really lies in if there are other better stocks to buy than Keppel?

SUPER BIG PROMO DI SITUS SAHABAT KARTU

=============================================

Hai Teman – Teman Smuanya, Yang Hobi Bermain Judi Online

Anda Merasa Capek, DEPOSIT Teruss..Tapi Tidak Pernah Withdraw ?

=============================================

Nikmati Seluruh Game Berkualitas & Raih Kemenangan Anda Di SAHABAT KARTU!!

Game Yang di Hadirkan SAHABAT KARTU Yaitu :

* Poker Online

* BandarQ

* Domino99

* Bandar Sakong

* Sakong

* BANDAR66

* AduQ

* Sakong

* Perang Baccarat

==========================================

SPECIAL PROMO KHUSUS MEMBER SETIA SAHABAT KARTU

– Minimal DP & WD Cuma Rp. 20.000

– BONUS CASHBACK 0.5% ( Setiap Hari Senin )

– REFERRAL 20% ( Seumur Hidup )

– 100% NON ROBOT & 100% TANPA ADMIN BERMAIN

– 100% GAMPANG MENANG

– JACKPOT HARIAN HINGGA JUTA RUPIAH

– MENERIMA DEPOSIT VIA PULSA XL DAN TSEL TANPA POTONGAN

======================================

AKSES KAMI DI LINK RESMI :

– okekartu.org

– okekartu.info

– okekartu.net

=====================

* Livechat : SAHABAT KARTU

* LINE : Cs_sahabatkartu

* Whatsapp : +85581734028

Sahabatkartu: Situs Poker Online, DominoQQ, Domino99, BandarQ Terpercaya

sdomino99.org Merupakan Salah Satu Situs yang terpercaya Di Indonesia

dominowin99 Memiliki Permainan Yang Mudah Dimainkan & 100% Mudah Menang Lohh..

Cukup Dengan 1 USER ID Anda Bisa Bermain 9 GAME Berkualitas :

* Poker

* Domino99

* AduQ

* Capsa Susun

* Sakong

* Bandar Poker

* BANDARQ ONLINE

* BANDAR66 ONLINE

+++++++++++++++++++++++++++++++

AKSES LINK ALTERNATIF TERBARU :

– sdomino99.com

– sdomino99net

– sdomino99.org

– sdomino99.info

< Contact Us >

Info Lebih Lanjut Hubungi :

W.A : +6285974599065

Sahabatdomino : Situs QQ Online, Agen Domino99 dan BandarQ Online Terbesar Di Asia