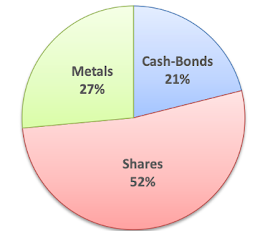

Overall portfolio

My portfolio as of 4 Sep 2020 comprise of approx. half shares and half cash – bonds – precious metals.

My bonds are as liquid as cash, as they comprise of mainly SSB and FCT3.65 corporate bonds. There are 1% cash in SRS for potentially exercising of rights issues, and 1% in CDA account for my children’s education expenses.

Precious Metal

My precious metal is used to hedge against shares and US Dollars, due to the normally inverse relationships of metals vs shares or USD. 19% is in silver and 8% in gold. Silver is currently much cheaper than gold with gold and silver ratio at 72. In the 21st century, the ratio has ranged mainly between the levels of 50:1 and 70:1.

Approx. four-fifths of share portfolio are in CDP-Custodian Brokerage account with a fifth of it in SRS as retirement fund.

I am bullish in Tech going forward, hence my stocks-mix are majority “Tech stocks” with almost equal split of China and US companies. The rest are 15% REITs and 7% health and pharmacy and 17% others (Health, Energy, Finance, Cable, Auto, F&B, Manufacturing and STI ETF)

Shares

Approx. 35% of my portfolio is SGD shares, approx. 35% USD in shares, and 30% in HKD. Hence if USD dipped against HKD or vice versa, they are somewhat hedged against one another within my portfolio. The risk is with both USD and HKD depreciate against SGD. But then again, I have 27% gold and silver to hedge against depreciating USD and HKD.

My major stock holdings of more than double digit percentage include Amazon and Alibaba, which I reckon they still have great potential of growth.

All yr metals in ETF? Looking at options for silver now..

A mixture of paper and physical. Silver I have UOB silver account and Physical silver bought from Silver Bullion.

See below.

https://www.rolfsuey.com/2016/05/gold-and-silver-things-you-need-to-know.html