What is STI Investing

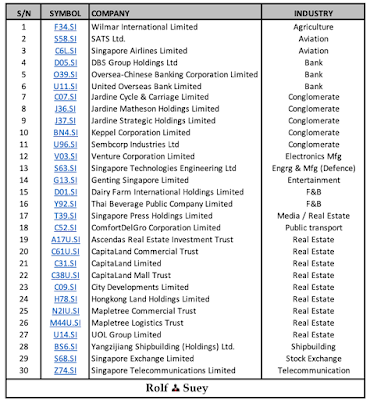

The FTSE Straits Times Index (STI) is a capitalisation-weighted stock market index that is regarded as the benchmark index for the Singapore stock market. It tracks the performance of the top 30 companies listed on the Singapore Exchange. See below.

You can invest in STI via Exchange Traded Funds (ETF) such SPDR STI ETF (SGX: ES3) or Nikko AM STI ETF (SGX: G3B). Different banks or financial institutions in Singapore also offered different plans for STI investing. You can find out how to invest in STI in this post by another blogger.

DOW JONES INDUSTRIAL AVERAGE AND NASDAQ-100

The Dow Jones Industrial Average (DJIA) is an index that tracks 30 large, publicly-owned blue chip companies trading on the New York Stock Exchange (NYSE) and the NASDAQ. Some notable names are Apple, Microsoft, IBM, Wallmart, Nike, McDonalds, Coca-cola, Exxon, American Express, JP Morgan etc. Refer to the components of DJIA here.

The Nasdaq 100 Index (Nasdaq-100) is a basket of the 100 largest, most actively traded U.S companies listed on the Nasdaq stock exchange. The index includes companies from various industries except for the financial industry, like commercial and investment banks. A large portion of the index covers the technology sector, which accounts for 54% of the index’s weight. The next largest sector is consumer services, represented by companies like restaurant chains, retailers, and travel services. Refer to the top 30 of components in Nasdaq-100 here.

STI BEATING INFLATION

Below table show the closing performance of STI comparing to US Stock Exchanges (NYSE or Nasdaq) major indices Dow Jones Industrial Average (DJIA) and Nasdaq-100 every five years in the last 35 years. I also singled out years such as 1999, 2007 and 2017 where STI is closing at peak values.

Refer to above table, If you invested in STI 35 years ago in 1985 with $100, you will have ~$400 today. Using MAS website for inflation calculation, $100 in 1985 will cost $170 today. Hence, even after taking into the account of inflation, investing in STI is definitely a much better choice compared to keeping cash.

Source: MAS website

STI IS NOT AS LUCRATIVE, BETTER INVEST IN DOW JONES OR NASDAQ

That said, if you invest in Dow 35 years ago, your $100 will become ~$1500, and Nasdaq will become close to $7000 today. The disparity is huge.

In fact if you invested $100 into STI in 1999, you will lose $2 of your capital after 20 years of investment. On the contrary, Dow investment will give you 2 folds increase and Nasdaq-100, 2.5 folds.

Even worse, if you invested $100 in STI during the peak of 2007 end, you will lose close to 30% of your capital, after more than 13 years. Instead, if you invested in Dow or Nasdaq-100, even if you invested during the peak year, you still return more than 2 folds. Of course you will still collect your dividend every year, but I am sure that are many alternatives aside STI.

Hence, investing in STI blindly over long term without any strategy is seriously not as lucrative as what you think.

In fact chances that you will lose your capital (excluding dividends collection) is quite high. If you invested at the close of every year in the last decade from 2009 until 2019, every of your investment will lose capital today. 10 years of wasted effort?

Do you still think that putting money into regularly without looking at the market price of STI is a good investment? If you are do not have investment knowledge, maybe just put in CPF OA or Singapore Savings Bonds or Fix-Deposit better still!

WHAT IS THE LONG TERM FUTURE OF STI?

STI heavy towards Real Estate, Banking & Manufacturing

If you look at the 30 top companies in STI, it is centred around Real Estate and Banking. Conglomerates like Jardine, Keppel & Sembcorp have businesses mostly also in the manufacturing, financial, trading etc. The rest of the components are also all not that exciting either in teleco, transport, aviation, F&B, newspaper, shipbuilding etc. Perhaps ST Engineering or Venture Corp are the closest to technology stocks, but still centre around engineering and manufacturing rather than internet-related service providers.

STI has no futuristic technology nor pharmaceutical stocks

When you consider the long-term future potential of SGX constituent stocks, it seriously pale in comparison to future potential of Dow Jones, let alone Nasdaq Tech-heavy stocks such as Amazon, Alphabet, Apple, Facebook, Alibaba, Microsoft, Oracle, Tesla, Netflix etc that provides internet-related services of e-commerce, cloud computing, digital streaming, artificial intelligence, block-chain technology etc.

Rarely you can find large-cap companies in SGX that is seen as potential darling of futuristic technology. Perhaps you can find none! The closest I can think of is Keppel DC REIT, which by itself is not really in the league of future e-commerce, cloud-computing, AI etc, service provider. Instead, Keppel DC REIT core is still real estate.

If not for future-internet-related, then there should at least be large cap stocks in pharmaceutical or biotechnology with breakthrough R&D looking into the future. Once again, there is none in SGX.

HANG SENG INDEX

Alternative to Dow or Nasdaq, I think Hong Kong Stock Exchange (HKSE) is also a much better exchange offering more variety of stocks than SGX. The Hang Seng Index (HSI) is a benchmark for blue-chip stocks traded on the Hong Kong stock exchange. The index is composed of four sub-sector indices in industry, finance, utilities, and real estate investment trusts. In my own opinion, HSI future is much brighter than STI. I am positive on the growth of large Chinese-cap listed in HKSE, example, China Petroleum & Chemical Corporation (Sinopec), Tencent, China Mobile, CSPC Pharmaceutical etc. Furthermore I reckon more and more Chinese US listed companies are targeting secondary listing in HKSE. Alibaba make its US$13B second listing last year in HKSE. Baidu is also said to eye secondary listing in HKSE.

ROLF’S FINAL THOUGHTS

Long term STI investing is not good unless…

STI investing is not as lucrative as you think unless you started during the 1980s or early days of 1990 when Singapore is building a nation. From 1993 onwards, there is high chance you will lose your capital today, even after decades of investing. However, if you only care about collecting dividends and don’t care if you lose capital, then it is fine! But that is not so wise.

You can generally have more promising return in STI when you time the period of your investments during the period of crises. For e.g. 1997-1998 Asian Financial Crisis, 2000-2003 Dot-com bust, 9/11 or SARs and the 2008 Great Financial Crisis, when STI falls below 2000 points.

In my humble opinion, STI at 2500 and below is also a good benchmark of buying, because if STI reaches 3000 and beyond, you can take 20% or more profit when you sell. Only if you know how to sell. I am not saying that STI will definitely reach 3000 points. But looking at historical data, the chances are higher. Afterall, I genuinely feels that investment is about weighing risks and rewards. In fact making life decisions is about that too.

Tangible and Intangible knowledge

To be honest, if you are a person who has no investment knowledge but put $10K in Dow Jones three decades ago, today you will have $90K. Better still, if you believe more in technology back then, and put your $10K in Nasdaq-100, you stock will be worth $450K today. Of course sometimes you have to stomach through the ups and downs of the stock market cycle to last that long. Of you have to resist the urge of selling to realise profits, if you already witness double or triple baggers.

This kind of knowledge of NOT letting your emotions affecting your investment decision is a kind of intangible investment knowledge.

Or simply, you just need to ignore or forget that you own that stocks entirely, until 30 years later, you realise “oh…I did own the stock!”

As a matter of fact, while tangible knowledge of stocks such as analysing reports, trends and data are important, the intangible expertise are equal if not more important. Other important intangible knowledge includes the macro-understanding of the world and global economy over time (past, present and future), understanding country-to-country relationships, understanding human nature and how people and market reacts, understanding of yourself, and your own portfolio, ability to control your emotions etc.

Invest in stocks of the future

STI thirty components are undoubtedly heavy on Real Estate, Banking or Manufacturing today. In my opinion it is just too old-fashion. If the current STI-30 composition persist, I feel that the long term future of SGX to attract investments is bleak.

For all we know, the 20th century saw the innovation of electricity, machines in factories, automobiles, ships and planes etc.

The 21st century is going to be Industrial 4.0 revolution….

Internet of Things (IOT), wireless connectivity and sensors, cloud computing, artificial intelligence, cyber-security, big data analytics and advanced algorithms, data management, data visualisation, smart cities, smart factories etc

What do you think? And what kind of stocks should you invest?

Hi Rolf,

Insightful article again that makes for a good read. Happy to have you back writing again.

As an index investor who started out with STI ETF and eventually branching out to VT and robo-advisors, I do find myself questioning the long-term viability of the Bogleheads 3 or 4 fund portfolio that is adapted for Singaporeans.

Considering our unique asset allocation (with a huge tilt towards SGD in CPF and property), it is a possibility to ignore STI ETF altogether and focus on a global portfolio. With a robo-advisor like Endowus, even CPF-OA money can now be used to build a global portfolio easily and fairly low cost!

Hi Kevin, thanks for the compliment. Reading ur blog also inspired me to write again. In fact the other day, I read one of ur posts on Google Analytics n I d/l it. It is interesting. I am IT dumbo, so love to learn all those things from u guys. Oh ya..n also Adthrive as well.

Interesting to hear Robo-advisor n Endowus. Learn sth new each day again.

Guess most of us started from STI n as we grew, we venture out. STI is more like BMT. 🙂

Hey I wrote the same thoughts on the same day as you! Great minds think alike haha

Hi FI35, wow. that is pretty incredible. The topic and timing.

You have an exceptional blog with nice design, and I added you in my blogroll.

Love what u wrote below…

"Its also not a good premise to invest in things just because they have become cheaper. If you had invested in horses because they were dropping in price when cars came out, you would be stuck with a lot of horses and poop. "

Hi Rolf,

Found yr blog a while ago. Not many retail investor take gold seriously. I do think they played an important in a portfolio especially the coming decade if not longer.

I agreed that most of us have strong home country bias, i am also considering just adding S-Reit etf as the local equity component limited to not more than 20%.

How do you think abt the bond going forward, i am of the view that bond and gold should be equal in a portfolio going forward.

Hi tcs, tk u so much for visiting n reading. Really appreciate it.

I think for a start, investing can home country bias. Frankly I did bought into STI too recently. Reit is SGX core, so it is good to earn dividend. And there r many good reits around. I m vested in Reits myself.

For bond, which type are u referring to? I m only familiar w Sg bond. Mostly those w very low risk n 2-4% return. Govt Bond, SGS, SSB? or corporate bond? I am vested in SSB few yrs back n continue to hold as it gave >2.5% n also 100% liquid. Corporate bond have to be careful eg Hyflux, not so good. Fraser 3.65% I m vested. ABF bond is also safe. If bond below 2%, I personally think it is too meager return.

For precious metal, I am a strong proponent of gold n silver.

In 2015 onwards, I started to sell my stocks to enter into Gold and Silver. Wrote many articles. See below. I also believe in bitcoin n own some although lately I cash out all my BTC n only left ETH.

Portfolio has to be overall. Not just stocks. And depending on timing n ur own personal financial situation, ur work n family situation….

Prior to the crash, I am 39% Cash, 37% metals, 6 % crypto, 9% shares, 9% bonds.

Currently, I am 51% Cash, 28% metals, 15% shares, 5% bonds, 1% crypto.

I do have a good decent size portfolio. And to be honest if Property price fall, I m considering acquire one more.

https://www.rolfsuey.com/2016/05/gold-and-silver-things-you-need-to-know.html?m=1

https://www.rolfsuey.com/2016/05/gold-and-silver-peek-into-history-to.html?m=1

https://www.rolfsuey.com/2016/06/gold-and-silver-history-always-repeat.html?m=1

Hi Rolf,

Me too sti holding ES3, for now will build up more international 1st. I think S-Reit is a favourable asset class in SG. I may even consider only to keep it as my local stock component. I am not too worry about the outlook of certain sectors like retail, commercial or hospitality because logistic and helathcare will do better.

For bonds, i am not too ken to own corporate bond individually. I have one quarter of bond in 30yrs sgs bond which has 2.75% yield. The problem is it is virtually no way to sell in the market, the liquidity is died. If sgs bonds has good liquidity, i would rather buy midterm and long term sgs bonds directly than through a35 or mbh.

Do u own mostly physical metals or paper? I am thinking of increasing to 20% but not sure should just keep 5-10% paper and the rest in physical or not. Premium is still crazy high now for both physical gold n silver.

https://www.bullionstar.com/blogs/ronan-manly/amid-london-gold-turmoil-hsbc-taps-bank-of-england-for-gld-gold-bars/

I believe in cryptocurrency and blockchain as a whole but BTC in its current form i am not so sure. I see in the foreseen future, every central banks will either work out few major currencies or each will have their own one coz no central bank will give away the power to control currency. Btw, Temasek has joined FB libra2.0 project as they willing fo pegged to fiatcurrency.

Retail & hospitality will show further weakness. Now impact not felt bcos of govt support n lock down. It’s a matter of time where pple feels the pain n lawyer letters will be everywhere into 2021.

Did a chk. Wow bond yield is v low for sgs n ssb! SSB 100% liquid. I bought several yrs ago 2.5-3%. Maybe chk bank acct which gave me 2-3% yield w bills, salary, spending tagged.

Mostly physical metals. 20% gold now n rest silver. Sold paper gold after crash to hv more cash. Have paper silver in UOB acct. Mostly silver in silver bullion storage vault. Storage fees is hefty.

Should hav buy more physical gold in the past, smaller n easier to store!

Agree Crypto in money form is unpredictable. More like speculation hence I sold. Blockchain technology is the future, but cannot find listed co except IBM.

For now, I m doing nothing much in investment except blogging. Keep cash, keep liquid bonds.

Above all, keep fit n healthy w loved ones! 🙂

What makes u go for Silver Bullion instead of Bullion Star?

Bought my gold from bank. silver from silver bullion bcos they are the largest silver bullion in town.

A broker of May bank Kim Eng also comment that HSI / S&P 500 is much better than STI. S&P 500 capitalisation is spread much evenly among high tech and high growth companies than STI.

Yup, S&P is also good! But for Singaporeans, still ok to start from STI then transit!

Hi Rolf,

Hope you are keeping well!

Thanks for another insightful post, I have been following your blog and always learning from your informative thoughts.

I truly believe in investing into the US market which i just started a few months back to diversify my portfolio. Currently holding 80/20 (SG/US) respectively. US being IWDA to reduce WHT.

If we truly want to invest into DJI/Nasdaq-100, are there ETF which allows SG investors to reduce WHT?

Thanks!

John

Hi John,

Tks for your compliments. WHT cannot be avoided unless some stocks domiciled elsewhere like Ireland or Shell in Netherlands. For US, focus on growth of the stocks as capital gains no tax.

Otherwise go to HKSE. Better to check annual report on taxation! Too many funds.

Do your own diligence.

SPDR Dow Jones Industrial Average ETF (DIA)

Nasdaq QQQ – https://etfdb.com/index/nasdaq-100-index/

SPDR S&P 500 ETF Trust (SPY)

iShares Core S&P 500 ETF (IVV), Vanguard S&P 500 ETF (VOO),

https://etfdb.com/index/sp-500-index/

Hello everyone, Are you into trading or just wish to give it a try, please becareful on the platform you choose to invest on and the manager you choose to manage your account because that’s where failure starts from be wise. After reading so much comment i had to give trading tips a try, I have to come to the conclusion that binary options pays massively but the masses has refused to show us the right way to earn That’s why I have to give trading tips the accolades because they have been so helpful to traders . For a free masterclass strategy kindly contact ([email protected]) for a free masterclass strategy. He'll give you a free tutors on how you can earn and recover your losses in trading for free..

Market neutral is an alternative investment strategy designed to profit from growth and depreciation in the value of success stocks.

What a person's income level is or their future plans, financial planning is essential to any future goals. With the assistance of a financial advisor, any individual can implement successful financial goals. what stocks to buy

Natural herbs have cured so many illness that drugs and injection can’t cure. I've seen the great importance of natural herbs and the wonderful work they have done in people's lives. i read people's testimonies online on how they were cured of HERPES, HIV, diabetics etc by Dr Edes herbal medicine, so i decided to contact the doctor because i know nature has the power to heal anything. I was diagnosed with Herpes for the past 3 years but Dr Edes cured me with his herbs and i referred my aunt and her husband to him immediately because they were both suffering from Herpes but to God be the glory, they were cured too .I know is hard to believe but am a living testimony. There is no harm trying herbs, Thanks. Write him on WhatsApp on +2348151937428. @dr_edes_remedies deals with

(1)Alzheimer virus

(2)Cancer

(3)HIV

(4)Herpes

(5)Genital warts

(6)ALS

(7)Virginal infection

(8)HPV

(9)Hepatitis

(10)Asthma

Email him on [email protected]

https://dredesherbalhome.weebly.com