Continued from Part 1 here.

To understand what led to the crash, we have to unwind one decade before the onset of the 1929 crisis. In 1919, US emerged victorious from world war one. A mood of optimism is in the air. American confidence in the economy fly so high that they feel that good times will last forever! Optimism and greed quickly led to unrealistic spending and wild stock speculations, in spite of declining foreign demand from the post-war period when Europe rebuilt their economies with local production of consumer goods. Stock crashed in Oct 1929 which marks the beginning of the biggest economic collapse in the 20th century.

WORLD WAR 1 -> US GETTING RICHER -> OPTIMISM

World war one took place from Jul 1914 – Nov 1918, where the allies led by Britain were fighting against the Central powers led by Germany. The epic centre of the war was Europe. US remains largely neutral until the last six months before the war ends. During the war, Europe took young men to become soldiers and factories were used for producing machines and weapons for the war. The entire economy was geared into war. On the contrary, US was very busy producing consumer goods and exporting all the essentials to Europe. The post war period saw Britain and other European war allies exhausted with broken economies to fix, while US was flooded with huge amount of gold from Europe.

ROARING TWENTIES -> OVER-OPTIMISM -> INSTANT GRATIFICATION -> SOCIAL PROBLEMS

When the war and the uncertainty were over, there is very little doubt that American will go through one of its largest economic expansion in the 20th century. The period between the 1920 and 1929 is dubbed as the “Roaring Twenties” in the US. This is a time when the nation’s wealth more than doubled in one decade.

Source: here

Electrification and automobiles

Roaring twenties was a time with the advent of new technologies, whether for industrial usage or for domestic appliances. Airplanes and new automobiles improved. Radio and phone lines were hooked up to the grid. The access to electricity also seen many new household goods such as televisions, washing machines, radios, irons, vacuum cleaners, instant cameras etc. These goods started as luxury, but later became necessity for everyone desire to own them. The car industry was booming as people flocked to buy the new Ford or Chrysler. In Europe, even the rich earners in the 30s of age could not afford a car, but in the America, there is mass consumption of cars. In 1919, there are 6 million automobiles in the US. Ten years later, the number hit 27 million.

Easy access to credit

There is also the introduction of instalment buying. For the first time, you can buy now with a small down payment and pay later. Advertisements were everywhere. Everyone is able to access to easy credit with no proper checks on collateral. Due to the access to easy credit, people will take on loans to buy consumer goods and luxuries which they do not really need or could not really afford. Debts mounted and the party continues.

Instant gratification “Play Culture”

There is also a kind of instant gratification mindset. “Live for the moment, play now and worry later”. Everyone believed that prosperity will last forever. The average American in the 1920s became enamoured to wealth and everyday luxuries. Cinemas started to have coloured films with sound. The first musical, the first Miss America pageant, the first Oscar ceremony. Dance clubs became enormously popular. Water skiing was invented. Fashion was part of life with women wearing dresses all day, everyday. And men in white collar jobs wearing business suits as day to day attire. Women become bold and more revealing in their dressing. Cosmetics, which until 1920s were not typically accepted in American society because of the association with prostitution, became extremely popular. Homosexuality became much more visible and somewhat more acceptable.

Gangsterism

There was also serious social problem. The “Prohibition” constitution in 1919 make it illegal to manufacture, transport or sell alcohol in the US. The 1920s prosperity period however seen heightened demand by the society for alcohol and other vices, even from police and city politicians. Organised crimes blossomed during this era, particularly the American mafia. They started importing and exporting liquors across cities. The huge profits from crimes outweigh the risks of getting caught. So much so that in some cities, illegal gambling centres with vices are actually supported by the local governments. This is also one of the root reasons why Las Vegas is a gaming city today.

ECONOMY DECLINE -> FAIL TO REALISE -> ONSET OF A CRISIS

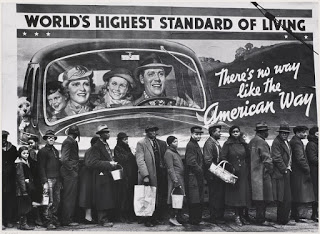

In the midst of the optimism, masked many issues to sustained US economic growth. There is a distorted fact that most Americans are doing well with high consumer spending fuel by debts in the age of prosperity. In truth, most Americans are not doing well at all. The economy is production driven, and most Americans are blue collar workers working in factories. There is a huge income disparity. The rich became richer and richer, while the middle and the lower class continue to live with low wages.

In later part of the 20s, production had already declined significantly and unemployment had risen, leaving stock prices much higher than their actual value. Additionally, consumer debt was proliferating and the agricultural sector of the economy was struggling due to drought and falling food prices and banks had an excess of large loans.

There are few who saw the bubbles and warned of catastrophe coming. Most fell to deaf ears. The majority choose not to believe that the apparent prosperity is coming to an end soon. Politicians and the wealthy made false assurance that the American economy and stock market were thriving and sustainable. The self-centred and self-love nature of most human beings believed in “these big lies”. The party continues and the population continue to live in a state of denial.

GREED –> WILD SPECULATION IN STOCK MARKETS -> CRASH

Most dangerous of all to the economy was excessive speculation that had raised stock prices far beyond their value. In 5 years from 1924 to 1929, stock market prices were almost four times. Overall from Aug 1921 to 1929, Dow rose from 67 to 382 points marking close to 600% increase. The stock market, centred at the New York Stock Exchange (NYSE) on Wall Street in New York City was the scene of reckless speculation.

Everyone is in the stock market

Everyone, from the millionaire tycoons to the poor janitors, see wall street as a place to get rich. Wall street was also deeply associated with play culture. A place to get rich, to play and to get drunk! Wall street become a part of the larger way of life. Every household put their savings in the stock market as if it is a sure-win casino! You will be foolish if you are not participating. E.g. you went to a stock market knowing nothing and put $10 into a stock. The next day, it went up by $2, and the next week another $2… it is easy money! There are ticker tapes everywhere.

Stocks of the people – RCA and GM

Two of the favourite blue chips were RCA Corp and General Motors (GM).

RCA Corp formerly known as Radio Corporation of America was a wholly-owned subsidiary of General Electric founded in 1919. RCA is the NBC of today. In the 20s, there is an upsurge of electrification in homes. The spread of electricity is like the “tech bubble” in the 2000s. Radio back then was like the internet of today. At the start of 1920s, there were only five radio stations. By the end of 1929, there were an astounding 606 stations across the country. American spent $840million on radio equipment in that year, 14x more than 1922.

RCA started trading at $1.63, and in five years, price surged past $42 per share with a PE of 33. The idea of Radio installed in automobile is driving the stock price up without any stopping. By Sep 1929, RCA share price is worth more than $490 with PE of more than 70. This is 30,000% increase in 10 years for RCA. The story does not end well and RCA shares closed at just $5.63 on Jan 1932 after the crash, a whopping 99% drop from its peak.

Source: here

GM share price rose more than 10 times in less than a decade and had more than 80,000 shareholders by 1929. Market cap was close to $4 Billion which translate to $600B in modern day. GM share price doubled from $9.62 in Aug 21 to $22.25 in 1925. Dividend yield was nearly 12% in 1925. Share price continued to surge from $68 in Apr 1928 to $97.94 at the end of 1928. This is more than 1,000% increase in 10 years for GM.

Addiction

It come to a point that American people became addicted to the stock market. In Europe the stock exchange was meant for the aristocrats. In Wall street, it was meant for ordinary folks including workers, housewives or even the shoeshine boys who poured all their savings into the stock market.

Experts’ optimistic sentiments

John Raskob, Head Financial of General Motors and Dupont said “Everybody ought to be rich” that the economy is durable, safe, sound and prosperous. And he is very bullish in the stock market. Raskob suggested every American could become wealthy by investing $15 per month in common stocks (at a time when average American’s weekly salary was between $17 to $22). Financial experts and newspaper are all publicising stock buys. There are stock brokers almost everywhere including small towns encouraging buying of stocks.

Source: here

Everyone feels that the rise of the stock market is justified by the stability and prosperity of the economy backed by the newly elected President Hoover in Mar 1929. Even the most prudent and savvy economists and elite bankers are backing that the stock market is not especially high in the 1929.

Easy credit, margins and wild speculations

Stock brokers gave credit. Banks give loans. People buy today and sell tomorrow, and profited. A new investment firm was set up everyday. There was fallacy of the bigger risk you take, the bigger you earn. When confidence is sky high about the market, people speculated by margin. They put small amount of their money, and large part by borrowings into the stock market. As long as stock price increase, margin trading is fine. But if stock price falls more than the money put in as collateral, you will have margin call which you then have to top up the losses. If stock price fall drastically, your losses will be way beyond what you put into the stock initially.

Manipulated market and illegal trades

The few rich insiders who had powerful connections would buy up the stock price and then release optimistic news into the market. The average middle class, upon hearing the positive news would pounce into the stocks. The insiders would then dump the stock at a very high price to make a huge profit out of it. Some bankers even invested customer savings without tell them. The misuse of funds would eventually create thousands of bank runs.

OVERCONFIDENCE -> UNDER-ESTIMATE THE CRISIS -> IRREVISIBLE CRASH

Hoover administration underestimate the crisis

President Hoover who based his election slogan on optimism and prosperity took office in Mar 1929. Shortly after Hoover became President, the stock market crash in Oct 1929. Instead of looking at the root cause and find solutions, Hoover downplayed the crisis, did nothing and gave a lot of false assurance. Hoover famously said that “the fundamental business of the country is on a sound and prosperous basis” and that “prosperity is around the corner”.

Hoover administration believed that the crisis is not serious and with a few bankruptcies, the economy will self-adjust and eventually recovers. He was utterly wrong! This is unlike the 1921 crisis. The 1929 crisis was way too serious caused by a decade long of over-spending and irrational euphoria of the stock market. Together with other economic issues such as low demand and farm crisis due to drought, the 1929 crisis is definitely the worst nightmare during Hoover’s presidency.

Black Thursday

Thursday Oct 24, 1929. Wall street stock market exchange collapse as reality checked. In just few hours 13 million shares were dumped. Many don’t even know at what price they sold their stock. After 3 years of intense speculation wall street crashed. Bubble burst causing financial panic.

Source: here

Due to the overwhelming volume to sell, the ticker tapes which record the sales fell behind by several hours. This means that if you initiate a sell at 10am, only 1pm or later, you will get your sell trade process. By then, you will not be able to sell because price will have fallen much. Hence, you thought you already sold the stock, but you have not. This delay helped fuel the panic and initiate largely low sell price precipitating the fall even more.

The same day, JP morgan and a pool of rich bankers march into the stock exchange and buy shares at a high price but it did not prevent the plunge. The stock market was not halted because the President of Wall street is in having holiday in Hawaii. Perhaps it is God’s will.

Billions of dollars were wiped out, with amount believed to be more than what the US has spent throughout the entire world war 1. In a matter of few days, average prices of stocks went down 40-50% and keep falling. Blue chips were not spared. Dow went from 382 on 24 Oct 1929 to 230 points on 29 Oct 1929. 40% decline in just five days.

30 Oct, 1929 – Rockefeller’s intervention did not prevent the collapse

John D Rockefeller, the rich magnate at 90 years of age with a net worth of >US$400 Billions in today’s inflation-adjusted value came out to buy stocks on Oct 30, 1929, and announced: “There is nothing in the business situation to warrant the destruction of values that has taken place on the exchanges during the past week. My son and I have for some days been purchasing sound common stocks.”

Dow up by 12.3% that day. But Rockefeller’s intervention that did not prevent the erosion of the stock market. The Dow went on to lose 84.1% more of its value before bottoming out on July-Aug, 1932. Even the rich and so-called experts can be wrong!

Dow Jones lost 90% of value from 1929 to 1932

Overall, Dow went from Sep 1929 peak of 381 to 42 points in Aug 1932, close to 90% collapse.

Source: here

(“$100 will buy this car. Must have cash. Lost all on the stock market”)

CONCLUSION

On the surface it is President Hoover’s incompetence (which I don’t deny) and the non-usage of monetary or fiscal policy that lead to the Great Depression.

But delving deeper, you will realize that the root cause of the Great Depression is the ugliness of mankind. Greed, love of pleasure, over-optimism prevented the people from seeing what is the truth.

And it is this human nature that led to the excessive spending and baseless stock bullishness, which would eventually cause the catastrophic collapse.

Most people will think if only there is a better President than Hoover? Or if only he pushed for monetary policy to inject liquidity into the financial system, there will not be the Great Depression.

I doubt so.

Perhaps monetary or fiscal policy can help to avoid the crisis by postponing it but I do not believe it can eradicate it.

For the irrational exuberance of the roaring twenties is too serious and when there is an “event” spiked so high caused by speculation, the “same event” is bound to plunge in the same magnitude or bigger.

As individual, we may be powerless to prevent a global crisis. But, if we are not blinded by greed and wickedness, we will be able to SEE THE TRUTH, and anticipate that a potential crisis is coming and be better prepared for it.

RELATED ARTICLES

DO YOU NEED A LOAN : TRUST ME WE CAN SOLVE YOUR FINANCE PROBLEM

Do you need Personal Loan?

Business Cash Loan?

Unsecured Loan

Fast and Simple Loan?

Quick Application Process?

Approvals within 24-72 Hours?

No Hidden Fees Loan?

Funding in less than 1 Week?

Get unsecured working capital?

Contact Us At : urbansuccessfundings@gmail.com

LOAN SERVICES AVAILABLE INCLUDE:

Commercial Loans.

Personal Loans.

Business Loans.

Investments Loans.

Development Loans.

Acquisition Loans .

Construction loans.

Credit Card Clearance Loan

Debt Consolidation Loan

Business Loans And many More Loan Opportunity:

LOAN APPLICATION FORM:

=================

Full Name:…………….

Loan Amount Needed:.

Purpose of loan:…….

Loan Duration:..

Gender:………….

Marital status:….

Location:……….

Home Address:..

City:…………

Country:……

Phone:……….

Mobile / Cell:….

Occupation:……

Monthly Income:….

Contact Us At urbansuccessfundings@gmail.com

Phone number : +919069983539 (Whatsapp Only)

Hello everyone, Are you into trading or just wish to give it a try, please becareful on the platform you choose to invest on and the manager you choose to manage your account because that’s where failure starts from be wise. After reading so much comment i had to give trading tips a try, I have to come to the conclusion that binary options pays massively but the masses has refused to show us the right way to earn That’s why I have to give trading tips the accolades because they have been so helpful to traders . For a free masterclass strategy kindly contact (paytondyian699@gmail.com) for a free masterclass strategy. He'll give you a free tutors on how you can earn and recover your losses in trading for free..

Do you need a Loan, or you want to refinance your home, pay-off bills, expand your business? look no further we off all kinds of Loan at 3% interest rate per year. if interested, contact us via Email: johnleemill12345@gmail.com

Thank you for choosing Guarantee Trust Finance.

Sincerely,

Mr. John lee

Natural herbs have cured so many illness that drugs and injection can’t cure. I've seen the great importance of natural herbs and the wonderful work they have done in people's lives. i read people's testimonies online on how they were cured of HERPES, HIV, diabetics etc by Dr Edes herbal medicine, so i decided to contact the doctor because i know nature has the power to heal anything. I was diagnosed with Herpes for the past 3 years but Dr Edes cured me with his herbs and i referred my aunt and her husband to him immediately because they were both suffering from Herpes but to God be the glory, they were cured too .I know is hard to believe but am a living testimony. There is no harm trying herbs, Thanks. Write him on WhatsApp on +2348151937428. @dr_edes_remedies deals with

(1)Alzheimer virus

(2)Cancer

(3)HIV

(4)Herpes

(5)Genital warts

(6)ALS

(7)Virginal infection

(8)HPV

(9)Hepatitis

(10)Asthma

Email him on dredeshome@gmail.com

https://dredesherbalhome.weebly.com