In the previous article (refer Part 1), it was mentioned that SG wealth in terms of international reserves in USD is 280 Billions. That is close to ~400 Billions in SGD.

Did some more research and digging to verify the numbers by looking at the wealth of Singapore over the last 50 over years. Managed to find an news article with the chart below.

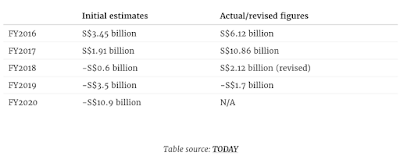

BUDGET SURPLUS / DEFICIT – 2016 TO 2020

From 2016 to 2019, Budget surplus S$17.4B

2020 Feb reported -10.9B. This is before the latest stimulus in April drawing another 5.1B, and 4B from the reserves. 2020 estimated deficit should be S$-15B

BUDGET SURPLUS / DEFICIT – 1997 TO 2015

Source: straits times. Click link here.

From 1997 to 2015 (18 years), summing up above chart in the straits times link, there is a surplus of S$49B.

From above chart and explanation since 2001, Govt locked away at least ½ of the dividends and income from past reserves. The above chart showed the reserves saved. Summing above returns of reserves from 2000 to 2015, total is S$80B. There are no figures on reserves locked away from 1997 to 1999. But to be conservative, let’s assume that there are no reserves from returns due to the Asian Financial Crisis.

Hence our total reserves from 1997 to 2015 is S$ 49 + 80B + 0 = ~ S$130B

BUDGET SURPLUS / DEFICIT – BEFORE 1997

Source: straits times. Click link here.

1965 to 1996 (31 years), there is no data except for estimates done as reflected from the Straits Times article above. Red line is spending and blue line is revenue.

1965 to 1974 – Estimates is that we breakeven and no reserves.

1975 to 1989 – Budget deficit, as these are the years we built the economy and our nation. We built houses, defence, infrastructure, MRTs, etc. Singapore borrowed heavily during these years. From below chart maybe ~ 20B deficits.

1990 to 1997 – Assume ~20B surplus. This is the golden period for Singapore as we saw huge surge of foreign capital, which are reason why Singapore did so well after the Asian Financial Crisis.

Meaning prior to 1997, actually our reserves are more or less cancelled out.

CONSOLIDATED

- 2020 = estimated deficits of S$15B

- 2016 to 2019 = 17.4

- 1997 to 2015 = 130

- 1965 to 1996 = 0

Total = S$150B.

However this does not take into Ex.rate of SGD and USD over the years, where there is at least 30% appreciation over the years. So it probably translates to an estimates of our reserves to S$200 Billions before year 2020.

OUR DEBTS

Singapore holds a very high net debt 113% of GDP as of 2018. This I also verified from data in MAS website. In fact our GROSS DEBT IS USD1.77 trillions or S$2.5 Trillions as of End 2016.

However in Ministry of Finance website, it also explains why we have high debt. Refer link here with explanation as below.

As a major financial centre, Singapore receives large inflow of capital from overseas and a substantial portion of this money is deposited with its banks. This is recorded as external liabilities or borrowings. That means that much of the so-called gross debts reflected in the Wiki article are, in fact, deposits kept in Singapore banks by overseas banks and depositors.

This money is then recycled by the banks to lend to big overseas borrowers when they take up loans from Singapore-based lenders. Once that happens, it becomes part of Singapore’s external assets.

What is important to note that in the domestic loans market, Singapore banks are able to attract sufficient deposits from local depositors to support their lending to local companies and households.

That ensures that these lenders do not have to resort to borrowing overseas in order to lend to resident borrowers. This will help to insulate Singapore from any financial fall-out if the world banking system suddenly faces a credit crunch, making it difficult for banks to borrow on the international financial markets to fund their borrowing needs.

Taken as a whole, both the public and private sectors in Singapore are net creditors with a strong net asset position equivalent to around 200 per cent of its gross domestic products in its international investments.

CONCLUSION

Singapore reserves estimated to be SGD 200 Billions from this article. In MAS our international foreign reserves is USD 280 Billions = SGD 400 Billions.

Hence a fair estimates of Singapore reserves is in SGD 200 to 400 Billions range.

Singapore reserves is definitely not in trillions. In fact, what we achieve to date is extremely commendable for a nation with a mere 55 years of history.

Singapore has one of the highest debts in the world of 1.77 trillions USD recorded end 2016. This is not because we are poor, but because as a country, we have huge capital inflows into our banks due to stability and good credit ratings. And these inflows are recorded as liability. In general, Singapore are net creditors both in public and private sectors.

During the 2020 covid-19 crisis, as of Mid Apr, we had drawn down S$21B from past reserves. Singapore will likely record a deficit of estimated of S$15B this year, the largest ever deficit since independence.

This S$59.9B stimulus budget and S$21B drawn from past reserves is definitely not small money. It is 12% of our GDP, and likely 10% of our reserves.

While we are not in a good position this year having drawn significantly into our reserves, but I believe it is still a decent call from the government thus far.

The worst case scenario will be if we require lock down for another few more months, or there are new waves of infections after we re-opened economy. Imagine it is only two months into the crisis now, and we already spent 60B. What if locked down last for few months to even one year collectively over the near future.

Question will then be if Singapore government will once again from our reserves tens of billions or even up to hundred billions.

That said, if one country that can pull through this crisis, it is Singapore. If Singapore cannot pull through the crisis, then the world will probably end up in Depression. Let us pray and hope that Great Depression 2.0 will not happen.

To let you understand better, let’s say normal year Sg suppose to surplus $10b. Return of investment $20b. so every year sg has $30b richer.

Now we spend $60B. So we are -30B. But we top up $20B from past reserves!

so we are still $10B deficit this year.

Reference you can find from Ministry of Finance website!

Still got temasek & gic.

Mas & temasek net assets are reported but they keep gic secret.

They've also reported on the long term investment returns of all 3.

Gic contains at least most of cpf & revenue surpluses. All of which have been invested & compounded over the last few decades.

Agree and already took that into consideration. Those are the returns per year already mentioned in above charts and it is S$80B (only 50%) from year 2000 to 2015. Meaning the returns taking into consideration is S$160B. For GIC and Temasek to gets returns (in dividends or sale of assets) S$160B for 15 years is also quite substantial on average.

Some of the returns were also used.

In accounting terms, net assets are not reserve, but more how much you are worth or called equity. So it is different.

So using this metric, only calculated reserve as S$200B. But if like what you said, there can be more (we do not know) from CPF also etc (which is used by GIC), hence S$400B, which is another S$200B can be upper ceiling as reflected in our MAS website. So it is logical.

I agree that most of us think we Singapore is very rich. And frankly $200-400B is already very rich for our short history.

it is the President's job to look after the national reserve. And the President needs to know how much reserve there are in the first place. Only one man tried to find out about our reserve so far. That's the late Mr Ong Teng Cheong

Agree with you. Our real reserve was never been disclose.

Here you have told about Singapore and finding the richest person there but I must tell you one thing in Singapore hiring a maid from the best maid agency singapore is really very tough. Because if you are not well settled then you can not afford them easily. Only richest person can afford them but do you know there are some places like universal who can provide you the best and highly experienced maid just at a reasonable cost.

Peak Residence by Tuan Sing & Rich Capital . Hotline 61009266. Get VVIP Discounts, Direct Developer Price, Brochure, Floor Plan, Price List & More. (Former Peak Court) Peak Residence

Peak Residence by Tuan Sing & Rich Capital . Hotline 61009266. Get VVIP Discounts, Direct Developer Price, Brochure, Floor Plan, Price List & More. (Former Peak Court) Peak Residence

Hello everyone, Are you into trading or just wish to give it a try, please becareful on the platform you choose to invest on and the manager you choose to manage your account because that’s where failure starts from be wise. After reading so much comment i had to give trading tips a try, I have to come to the conclusion that binary options pays massively but the masses has refused to show us the right way to earn That’s why I have to give trading tips the accolades because they have been so helpful to traders . For a free masterclass strategy kindly contact (paytondyian699@gmail.com) for a free masterclass strategy. He'll give you a free tutors on how you can earn and recover your losses in trading for free..

Natural herbs have cured so many illness that drugs and injection can’t cure. I've seen the great importance of natural herbs and the wonderful work they have done in people's lives. i read people's testimonies online on how they were cured of HERPES, HIV, diabetics etc by Dr Edes herbal medicine, so i decided to contact the doctor because i know nature has the power to heal anything. I was diagnosed with Herpes for the past 3 years but Dr Edes cured me with his herbs and i referred my aunt and her husband to him immediately because they were both suffering from Herpes but to God be the glory, they were cured too .I know is hard to believe but am a living testimony. There is no harm trying herbs, Thanks. Write him on WhatsApp on +2348151937428. @dr_edes_remedies deals with

(1)Alzheimer virus

(2)Cancer

(3)HIV

(4)Herpes

(5)Genital warts

(6)ALS

(7)Virginal infection

(8)HPV

(9)Hepatitis

(10)Asthma

Email him on dredeshome@gmail.com

https://dredesherbalhome.weebly.com