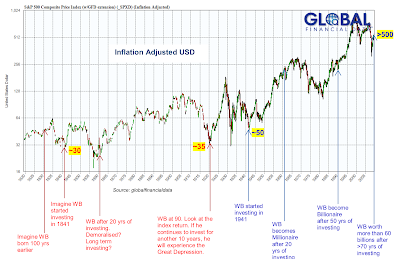

Legendary investor Warren Buffett is almost every investor’s favourite including myself.

He was born 1930, started investing at age 11 years old, becomes a millionaire after 20 years of investing, and a billionaire in 1990. Today, his net worth is US$67 billion.

Did he go through Great Depression? No.

World War 1 or 2? No.

Enjoy the best years of United States for the last 50-60 years? Yes!

Imagine Warren Buffett is born 100 years earlier? See below chart, what will happen?

Long term investing Vs born in the right era?

It should be "Does Long Term Investing Always Work" remove the "s".

🙂 thanks for the correction.

Hi Rolf

Good observation there.

The problem with long term investing is human lifeline is finite and Buffett would perhaps met or not met the event of Great Depression if he was born a century earlier.

I think it is also fair to say that things started to pick up after the world war and global technology keeps up with times to drive the world economy. What will happen a century from now, really it is anyone guess 🙂

So long term investing is not always a winner? Timing and luck still plays a part?

Need something more like lame luck and timing. Ask those have bought in 1998 AFC; some happily sold with their two to three gains. Like it or more long run (term) investing is a Game of Strategies.

Yes, lame luck just like fate in life! It still pays a part regardless of how good you are. Like the hokkien song "Ai piah cia eh Yia" 30% ti zhu dia, 70% kao pa piah!" – 30% fate or luck, 70% effort!

Hi, how did you get the S&P 500 data before 1923? I thought it was introduced only then?

Hi Investor,

Good question. As mentioned by GFD,

"Standard and Poor’s offers the most comprehensive set of indices for the US stock market. We have combined the Cowles Commission indices, old Standard and Poor’s indices and current GICS indices to provide index histories that stretch back to the 1800s. GFD provides over 200 S&P indices with their full histories, including total return series for the major indices."

Refer to Global financial Data

Rolf,

Timing, luck, and geographic location too!

Just talk to a Japanese investor who invested during the mania of the 80s.

How about 3 decades? Is that long term enough?

The Nikkei still very much under water…

It''s important when talking about "long term" investing, we are often assuming and using US examples – when USA is the no.1 economy of the world.

There are cycles for economic powers too called rise and fall of empires 😉

As a betting person, I'll rather bet on China stock index breaking their old highs than the Japanese Nikkei.

It's demographics.

Jarred,

Totally agree. Timing, luck, and geographic location too!

Can I also add “effort and knowledge about world of investing” …just a little bit ok? LOL!

Now, I reinforce my affection for the likes of Ray Dalio, Jim Rogers, Robert Shiller etc who are able to see the world and beyond. Frankly our very own LKY probably ranks on par or even above those mentioned.

Luckily I speak Chinese over Japanese!

I agree, demographics is a huge factor.

That's why I shifted more of my long-term portfolio towards "young countries" that still show a demographic pyramid that deserves its name. SEA (excl. Singapore) and Africa for example.

Hi Andy,

Wise choice.

Then again, why not China? At least I think Angel Merkel think so! Haha…

Look at how often she visited China. Look at VW in China….! Ooops…hopefully China will not put the blame to VW for contributing to their pollution problems.

I remember bidding for China government projects, Siemens was preferred over ABB. I was once told by my client and agent that Siemens understand the culture of China better than ABB. Ok…ignore the profit margins when I say this.

I was also told Siemens will own the factory and the land, whereas ABB only lease. The capital gain for the land Siemens own is significant. Ok, China can turn their head anytime if things turn sour. But maybe Chinese value relationships..haha?

When the top connects, the middle and bottom also connects over time.

Timing plays a big part.

Indeed. At least "one" part I will say.

I think affinity with market is one thing and timing is another. Back then money was back by gold. But after Nixon, they print like no tomorrow. All these paper find their way to all sector by rotation. I believe a day of reckoning is coming. I do not know I lived to see this. But definitely deleveraging is just a matter of time. This is how economy work. Dalio is right to advise his investor to buy some gold. All so call great investor will be humble. Like the great depression.

Love hurts. The deeper you are the more painful it is. Therefore it is better to have no feelings with the market, since the market has no affection for us also.

Nixon is probably the root of all bad cause for US or root of all good cause (for the top few percent)?

Now Ray Dalio Vs Buffett?

Hi Rolf

After 1 big round, I discovered I was right to "time" the market than stay highly invested all the time. Ironically.

Hi FD,

So which camps are you in now?

thanks for your post, it is indeed very interesting. For me, I am a believer in long term investing up to a certain degree, that means, economies will only go up in the long term due to demographics, technology and replacement cost. Whether will that benefit you at your age is another question.

Singaporeans who are born in the early 1970s get to enjoy the boom time if they play the cards well, however, those who didn't (eg 1997/98) will suffer quite badly. My belief is that, as investors, there will always be pockets of growth in boom and gloom time, the difficult part is the emotional and the resources available.

Hi Smalkmus,

Thanks for dropping by. Not to be mistaken, like u, I am an advocate of long term investing! It is just an illustration that macro and era do also play a big part.

A good example is what SMOL said above about Japan.

In my bold opinion, for Singapore and China, I still hold high hopes of long term investing for the next 20-30 years.