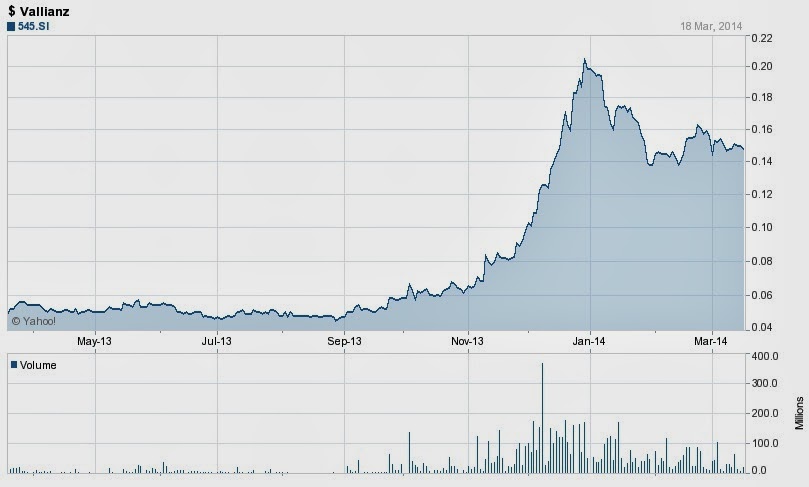

Vallianz Holdings, a subsidiary of Swiber had been growing exponentially since Sep last year from 5c to peak of 20c and now hovering around 15c. 300% increase!

This counter had been stagnant under Anders Schau as CEO since 2010 to 2012 after the RTO from Enzer. Since the appointment of Darren Yeo, who is also director and a major shareholder in Swiber, the stock had pick up pace with several announcements including JV with Saudi Arabia Rawabi and option agreement with Swiber. FY2013 results showed a 88% increase in earnings to US$10.3M with a backlog order of US$470M.

Announced appointment of Executive Director Ling Yong Wah yesterday. His background is from private equity firm which focused on expansion capital and mid-market buyouts.

With the new appointment, will there be more expansion moves to come???

Positive

- Strong fundamentals in offshore sector stem from more than 200 delivery of Jackups in coming years

- Strong order book of >S$500M

- To expand fleet of vessels from 26 to 50 by 2016.

- Strong backing from Swiber who has extensive network in S.E.A, India, Middle East & Mexico assisting Vallianz to get more contracts.

- Management has sufficient experience weathering through the 2008-09 crisis.

- Management is young at average age below 50 years old.

- Management has track record of growing a stock and sell it, as seen in Kruez Holdings.

- ROE ~ 17%, ROA ~ 5%

Negative

- High debt of US$69m. 54M is term loan for vessels.

- Current Ratio = 0.64

- If another crisis like 2009 hit again, high debt asset owning nature business will be affected seriously

- Pathetic low dividend of 0.3%

- Expansion means hiring of experienced people, which is already scarce in the market.

Related Posts: