WHO WILL WIN?

On Tuesday 3 November 2020, Americans will go to the polls to decide if their next President is Republican incumbent Donald Trump, or his Democratic challenger, Joe Biden.

The latest poll has shown that Joe Biden is leading Donald Trump for the presidential election. However it is not a guarantee that Trump will lose the election. In 2016, Hillary Clinton also had a clear lead over Trump in the polls for the entire campaign, only to lost the election.

In my opinion, the coronavirus episode is definitely disadvantageous to Trump’s position in the election. With US having the most covid contractions and most deaths, I doubt that majority of the Americans will approve Trump’s handling of the crisis.

Without the covid pandemic, I think Trump will have a landslide victory. It has almost become apparent in my opinion that most Americans love to be believed in Trump’s anti-China policies and his relentless cheerleading support for the stock markets.

To me, it is almost like Coronavirus is taking place in 2020 to oust Trump from his absolute supremacy. Without which, people will just continue to be blinded and support evil in the making. B

My take is Biden to have a slim victory!

I can be wrong, because who knows what the devil has up his sleeves? Anyway, the world is becoming more and more selfish and self-centred, and everything we do is about what is there for me to benefit with less and less compassion for others.

HOW WILL STOCKS BE AFFECTED?

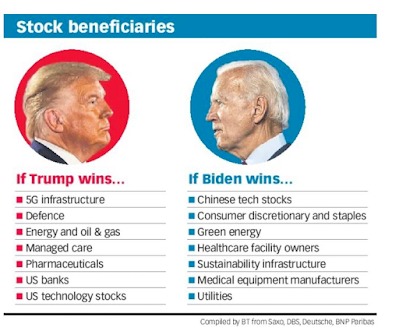

Below is an extract from Business Times, showing the stock beneficiaries of different outcome to the election.

HOW AM I HEDGING?

I am not really betting on individual stock, but I think I am more or less “hedged” regardless the outcome.

This is because I owned shares operating in US, China, and Singapore.

I believe that even Trump’s victory should not dampen the growth of Chinese stocks too much as their focus is domestic consumption and Covid is much better control in China. And Trump’s victory will also drive up the value of my ownings in US Tech and Pharm stocks.

If Biden wins, then, Chinese tech stocks will continue to rally, and perhaps Singapore’s stock will also slightly improve as Biden is expected to be comparatively milder in terms of his China’s policies as compared to Trump.

While Singapore shares should be cheering for Biden, but guess even with his victory, I reckon that STI will not be climbing too drastically, as Singapore’s economy is more dependent on the Covid situation rather the electoral result.

I own Singapore stocks, as this is still my home, and I am hoping for a recovery, and that one day in the future, Covid will just be an episode written in our history books.

In the short term, either Trump or Biden’s victory is going to give rise to volatility in the stock market, especially that Covid situation is worsening in the west. But in the long term, I think the impact of the Presidential results will have limited impact over the stock market, than the actual performance of the stock itself.

I also believe that an impending stimulus after the election is inevitable for the next US President, due to the dire states of the real US economy. Therefore precious metals (gold and silver) as a Hedge is definitely necessary.

It is interesting, nice to see this blog thanks for sharing this. Visit Ogen Infosystem for creative Web Designing and SEO Services in Delhi, India.

Website Designing Company in Delhi