Read an

interesting article on Business Times today. It headlines “Failure is Not an Option, It’s a Must.” The article

was about an interview with author and thinker Nassim Nicholas Taleb, compiled by writer Genevieve Cua. Below is

what Mr. Taleb has to say.

interesting article on Business Times today. It headlines “Failure is Not an Option, It’s a Must.” The article

was about an interview with author and thinker Nassim Nicholas Taleb, compiled by writer Genevieve Cua. Below is

what Mr. Taleb has to say.

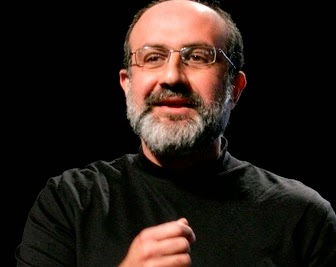

Professor Nassim Nicholas Taleb

“Universities teach you not to take

risks. Because if you make mistakes, you flunk the exam. But in life there is

no such thing as a track record of exams. You start from zero. So you have to

teach people to fail and take risks.” – Nassim Nicholas Taleb

risks. Because if you make mistakes, you flunk the exam. But in life there is

no such thing as a track record of exams. You start from zero. So you have to

teach people to fail and take risks.” – Nassim Nicholas Taleb

Education is the enemy to Entrepreneurship

It is good

to have a class of people who are educated. But if you start having a high

level of education, you start hiring people based on school success. School

success is predictive of future school success. You hire an A student if you

want them to take an exam, but you want other things like street smarts.

This gets re-pressed if you emphasize too-much education.

to have a class of people who are educated. But if you start having a high

level of education, you start hiring people based on school success. School

success is predictive of future school success. You hire an A student if you

want them to take an exam, but you want other things like street smarts.

This gets re-pressed if you emphasize too-much education.

If you have gold, you wouldn’t do as well as if

you had water all around you to travel

you had water all around you to travel

Singapore

has had advantages from the fact that it had no resources…if you look at the

history of city states and all the successful merchant cities, you realize the following

mechanism. People in Tyre, Lebanon and Sidon initially had no resources. They

needed to import copper, for instance from Cyprus. Then they figured out that

they can export it. So it’s an over-compensating mechanism for not having

resources. Exports are the biggest indicator of a lack of resources, like

turning water into gold.

has had advantages from the fact that it had no resources…if you look at the

history of city states and all the successful merchant cities, you realize the following

mechanism. People in Tyre, Lebanon and Sidon initially had no resources. They

needed to import copper, for instance from Cyprus. Then they figured out that

they can export it. So it’s an over-compensating mechanism for not having

resources. Exports are the biggest indicator of a lack of resources, like

turning water into gold.

Having difficulties makes you richer

There is

something called the curse of having resources. Singapore was a maritime

state; you didn’t need infrastructure. You had the sea, a harbour, ships.

Second, you need scale and the ability to use stressors. Third is that in the

1960s you had difficulties and you had to be motivated.

something called the curse of having resources. Singapore was a maritime

state; you didn’t need infrastructure. You had the sea, a harbour, ships.

Second, you need scale and the ability to use stressors. Third is that in the

1960s you had difficulties and you had to be motivated.

The challenge is the next generation

You have to

make sure the next generation doesn’t get too comfortable. Don’t over-educate

them. Push them harder. Don’t be too nice to the next generation. Progress

comes before education. The causality is inverse. If you increase education in

a country, you lower the progress. It inhibits risk taking.

make sure the next generation doesn’t get too comfortable. Don’t over-educate

them. Push them harder. Don’t be too nice to the next generation. Progress

comes before education. The causality is inverse. If you increase education in

a country, you lower the progress. It inhibits risk taking.

Education helps to preserve wealth, not

necessary generate wealth

necessary generate wealth

Wealth

leads to the rise of education. Education does not necessarily generate wealth.

Education however helps to preserve wealth. You can’t easily transmit wealth to

children; there is variation, inflation. But education allows you to stabilize

the fortunes. My ancestor made money in trading. He had the presence of mind to

have a fund to educate his descendants to force them not to be traders. You

stabilize and lower the variance of children with education.

leads to the rise of education. Education does not necessarily generate wealth.

Education however helps to preserve wealth. You can’t easily transmit wealth to

children; there is variation, inflation. But education allows you to stabilize

the fortunes. My ancestor made money in trading. He had the presence of mind to

have a fund to educate his descendants to force them not to be traders. You

stabilize and lower the variance of children with education.

Taiwan,

which in the 1960s had a much lower literacy rate than the Philippines and half

the income per person. Today it has 10 times more income.

which in the 1960s had a much lower literacy rate than the Philippines and half

the income per person. Today it has 10 times more income.

If you have a master’s degrees, you won’t

starve but you won’t be phenomenal.

starve but you won’t be phenomenal.

Education

is good within the family but on the level of the country, the effect

dissipates. You need someone to feed the bureaucrats and magistrates. My father

was a doctor, my grandfather a Supreme Court judge. They aren’t producing…You

need element of education but like anything, too much is bad. You have

to reserve education for those who aim to be scholars. Germany has the right

balance. They worship professors but prefer the engineers.

is good within the family but on the level of the country, the effect

dissipates. You need someone to feed the bureaucrats and magistrates. My father

was a doctor, my grandfather a Supreme Court judge. They aren’t producing…You

need element of education but like anything, too much is bad. You have

to reserve education for those who aim to be scholars. Germany has the right

balance. They worship professors but prefer the engineers.

Education removes entrepreneurs from the system

and turns them into bureaucrats

and turns them into bureaucrats

What’s

more important isn’t education; it’s apprenticeship. Germany has a huge advantage over the rest of

the world as it has a high rate of apprenticeship in its economy. Switzerland

used to be the least educated in Europe. Now’s it’s the second most educated;

that is why it’s going down.

more important isn’t education; it’s apprenticeship. Germany has a huge advantage over the rest of

the world as it has a high rate of apprenticeship in its economy. Switzerland

used to be the least educated in Europe. Now’s it’s the second most educated;

that is why it’s going down.

To

encourage “swashbucklers” and entrepreneurs, people have to be taught to take

intelligent risks – something that universities don’t teach.

encourage “swashbucklers” and entrepreneurs, people have to be taught to take

intelligent risks – something that universities don’t teach.

“You absolutely need failure for a

system to work. The healthiest economy in producing new business is the US. We

have the highest failure rate. The failure rate is the most predictive metric

for economic health.”

system to work. The healthiest economy in producing new business is the US. We

have the highest failure rate. The failure rate is the most predictive metric

for economic health.”

In

California, it is said that you need to fail seven times.

California, it is said that you need to fail seven times.

About Nassim Nicholas Taleb

Mr. Taleb

started his career as a derivative trader for 21 years, before holding senior

positions in Major financial institutions. He also ran his own derivatives firm

for 6 years. Currently, he is distinguished Professor of Risk Engineering at

New York University Polytechnic School of Engineering and co-editor in chief of

the academic journal Risk and Decision Analysis. For more information on Nassim

Taleb, refer to wiki here.

started his career as a derivative trader for 21 years, before holding senior

positions in Major financial institutions. He also ran his own derivatives firm

for 6 years. Currently, he is distinguished Professor of Risk Engineering at

New York University Polytechnic School of Engineering and co-editor in chief of

the academic journal Risk and Decision Analysis. For more information on Nassim

Taleb, refer to wiki here.

“I am not a professor of economics.

I’m a professor of engineering. This is critical. There is no nonsense in

engineering. The tolerance for nonsense in economics is monstrously high. In

engineering it’s close to zero. If a bridge collapses, economists would spin a

story. In engineering, you build another one”.

I’m a professor of engineering. This is critical. There is no nonsense in

engineering. The tolerance for nonsense in economics is monstrously high. In

engineering it’s close to zero. If a bridge collapses, economists would spin a

story. In engineering, you build another one”.

Rolf’s Conclusion

So how many times have you already failed?

I had several big falls myself in health, wealth, career and relationships throughout my life.

Is failure alone sufficient? Have you learned and improved? Have you tried again more intelligently without losing your enthusiasm?

Related Posts:

In the stock market, Losing Money is Not an Option, It’s a Must!

Our big losses will be our greatest lesson learned on what NOT to do again or we exit and never come back to the stock market

.

Those got badly burnt in the past stock market crashes, some never touch the stock market anymore. Losing to inflation slowly is still far better than losing so fast to the Bears and feel so painful.

Do we feel so painful over $3 chicken rice? No. Right?

Hi CW,

S$3 Chicken rice probably overnight to digest. Stock market loss is harder to swallow let alone digest.

Hi Rolf

Thanks for this. It is a very good read.

I was just discussing with musicwhiz and Drizzt the other day over why this generation is more likely to include risks analysis than the older generation. The older generation came with mostly nothing to lose so they got only one choice to make and that is go for the win.

Hi B,

The older generation.. Hmmm… Not me definitely, hence I don't know. We know who are they in blog space.. Maybe they can comment if they have nothing to loose?

I was exposed to "RISK" the board game at a young age. I simply love it then. Just like any other thing, too much risk bad but no risk is probably equally bad.

A story to share…

I used have an entrepreneur boss. He took risk and grow the company for >30 years. Took big projects he never done before! Always had cash flow problems due to nature of business & cycles. Company almost bankrupt several times but Never, because of his zest and ability to pick up. More important he understood the business more than any outsider. Many people only see failure when they look at the company books!

To him, he is passionate for success and to grow his business. He is a big boss but definitely not rich, has everything to loose, as the only earner in his family of 5. His house is mortgaged, with 500 employees jobs at stake if he failed. He is passionate about his business / employees as part of his life.

He is a risk taker! It's his personality and passion, not anything else. It takes just one time in his >30 years to be paid off! And the return was exceptional. He deserved it!

Is 66+ belong to the older generation you are referring to?

For me I was so Kiasi that I read and read and watch and watch about finance and stock markets for so many years before i dared to plunge into the market at the age of 40. And by then it was not true my generation (at least for me) had nothing to lose. We (my wife's) had our maisonette + cash & CPF money + car to lose. So it was not true we were not risks averse, because we had nothing to lose. And we were just ordinary average wage earners.

In fact my wife was so risk averse that we did not invest in property then.

Hi Shalom,

Thanks again for commenting.

Kiasi is better than kiasu! Anyway you are probably prudent, because every cents/dollars are hard-earned! Today's generation spend much more easily without so much thinking.

Btw, I am gg to be long winded..LOL.. Bear w me. Tks. I understand what B is implying, maybe wording is misunderstood.

I interpret as 60-70s, Sg is poorer and less educated. Only relatively rich, can have gd education and get a good job. Within those not so educated, but more driven ones, they will go all out to start their own business. Make or break! even break is not so serious since you start with nothing initially then. Probably that is "nothing to loose!"

Today it's different. We are prosperous and most are educated. Jobs now are more readily available compared to then! It is probably "less incentive" for us to take risk and start a business, and yet we still can have a good life!

A wise v successful guy (now 60s) told me before this. In the past 60-80s, you need not to be very "smart" to earn lots of money, because competition is lesser and in general people are more simple. As long as you are little "smarter" or motivated, you can be successful materially. Now it is so competitive!

But then again, in the past, it is not so easy to find people that have that slight edge over the rest. Is Messi better than Maradona? Or Maradona better than Pele?

Overall no matter which generation we are in, we do have "something to loose!" Environments are different and it's probably unsound to judge and compare!

The older generation should accept the younger generation difference! The younger generation should respect the older generation.

Just my two cents thought!

Rolf,

Ah! You were "lucky" to have worked for that entrepreneur boss.

I was extremely "lucky" to be exposed to "Learn by Failing" with my ex company too 🙂

One of the the key values and culture of that company is to encourage all co-workers to challenge the status quo and it's OK to make mistakes. No mistakes meant we have not tried something new… And that looks bad in our annual review.

That's where my "poking" and "verification" got their incubation ;).

But then, it's nothing new to our Hokkien street wisdom: 有影无?

Hi SMOL,

My entrepreneur boss is always someone I deeply respected. Not because of his entrepreneurism, but because he uses his heart more than his brain. It touches me at least!

Learning by failing is great way of managing our mind and soul. Great company you worked for. Hmmm… a theme not very familiar to our education system…We must recognize that failure to learn is more terrifying than failing!

Hokkien street is good learning. "Got shadow!" But must be very careful, because most I know ended in jail, db, drugs offenses or no bright future.. Only the minority survive, learn and shine.

Frankly I wouldn't want my kids to learn the Hokkien street way. I do not have many choices then…

Rolf : very nice article. I believed we learned more from failures than success.. Hence, if is important to fail too!

Hi Richard,

Yes… But don't loose your enthusiasm! Listen to Winston Churchill. LOL…

Hi Rolf,

Don't forget we also learn how to build on our successes. Why, "Nothing succeeds like success"

And i think it's better to learn from failures then to success to success to success…….

So have you succeeded making your 1st $100k, $500k, or even the 1st $million.

And why they say the 1st $million is the most difficult and after that it is easier?

Do you even believe in the 1st place?

Do you really know?

Shalom.

Hi Shalom,

Thanks for the comments. I think Dr Nassim recognize that success itself is very important. Just that he felt that failure should not be seen as doomsday!

I agree with most of your points, and reiterate in my opinion that failure to learn is more dreadful than failure itself.

Rolf

I learned to avoid making past mistakes and recognize how future success may look like.

Hi CW,

That is a learning! Having said that we can also learn from others experience, but just that it always carve a deeper impression when you experience it yourself.

I like the phrase "continuous improvement!"

Rolf