Added Super Group and Swissco this week to make up my

portfolio of 20 stocks.

portfolio of 20 stocks.

Super “Sweet”

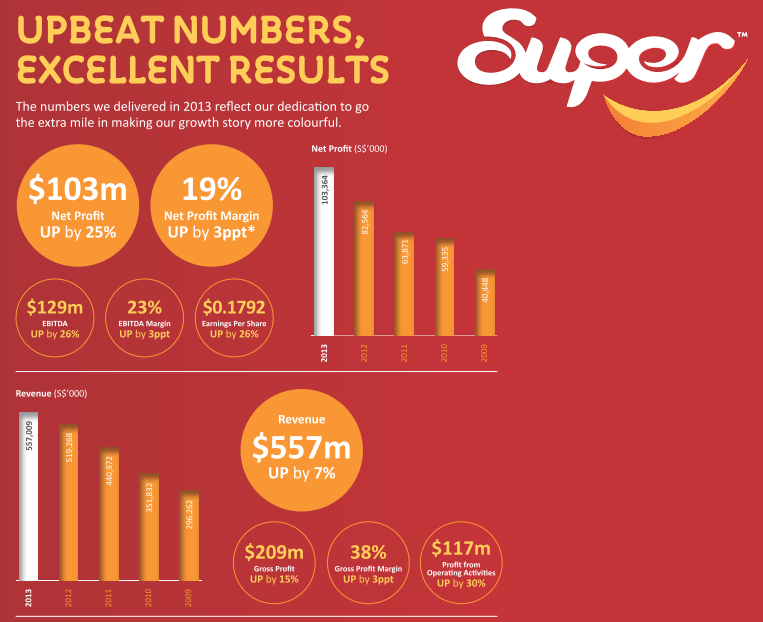

Super Group Ltd founded in 1987 manufactures and distributes food and beverage products noticeably 3-in-1 coffee, primarily in Singapore, Southeast Asia, and East Asia through its two segments, Branded Consumer “BC” and Food Ingredients “FI”.

Bet 2003 to 2013 Revenue up by 286% from S$144m to S$557m. Earnings had grown

by 581%.

by 581%.

Buy

Call

- Price at 1.46 drop >40% since high of 2.49 in Aug 13 – 52wk rangge (1.43-2.49).

- At its peak, PE is 27 vs current 17.

- Dividend payout for the last 4 years at 50%, Yield of 3% base on S$1.46 is attractive for a growing business.

- Founding members still as key management.

- Strong shareholder names; “Popiah King” Sam Goi (net worth US$2b), Yeo Hiap Seng, Far East etc.

- Solid fundamentals with no debts and ample of cash S$95m.

- Healthy gross and net margins of 37.6 and 18.6% respectively. ROE 23.1% and ROA 17.5%

- Growth potentials in Food Ingredient business.

- The construction of Botanical Herbal Extraction (“BHE”) plant in Malaysia and Liquid Glucose Syrup Solids (“LGSS”) plant in China is expected to be ready by 2H14 and 2015 respectively, further enhance economies of scale.

- Plenty of share buy-back activities this week.

Risk

- Rising commodity prices

- Rising cost of labour

- Recent civil unrest

in Thailand. Thailand is one of

Super Group’s core markets, accounting for around 30% of the company’s BC segment.

- Slower growth in BC and FI segments; suffered 6% decline in 1Q14 results recently.

- Net profits slumped 19% yoy but mainly due to higher forex gain seen earlier last year.

- Net cash from operations is S$5.7m compared to -11.9m a year ago.

Swissco “Swee”

I had blogged earlier that Swissco can be a potential double bagger. Refer link here.

You must be wondering why then I am not owning any Swissco shares before my purchase this week? If you had been following my blog, you will notice I had bought and sold Swissco shares several times and register some profitable gains in a short time. While I do not advocate trading, I do strategized at times to lock profits.

In one of my earlier post link here, I mentioned that I had sold Swissco after price rose spectacularly to 0.45 registering a 30% gain within less than a month. I also think then that price rise can be temporary and speculative in the short term, while waiting for a good re-entry opportunity. This week opportunity comes when price fall to low of 0.405.

You must be wondering why then I am not owning any Swissco shares before my purchase this week? If you had been following my blog, you will notice I had bought and sold Swissco shares several times and register some profitable gains in a short time. While I do not advocate trading, I do strategized at times to lock profits.

In one of my earlier post link here, I mentioned that I had sold Swissco after price rose spectacularly to 0.45 registering a 30% gain within less than a month. I also think then that price rise can be temporary and speculative in the short term, while waiting for a good re-entry opportunity. This week opportunity comes when price fall to low of 0.405.

PS: In case you do not know what is the meaning of “Swee”, it means “Beautiful” in Hokkien.