Met up with friend today for dinner. I try to explain difference between Reits and Business Trusts, but somehow it is not very convincing. Here is link to explain in detail.

Dividends

Most common reason to invest in Reits or Trusts is for the dividend return. Extracted herewith – “The attractiveness of Reits or Trusts

lie in their ability to pay a regular and stable dividend. This is a big plus

in a portfolio. Re-search into long-term returns shows that reinvested

dividends comprise the bulk of returns, compared to capital appreciation.”

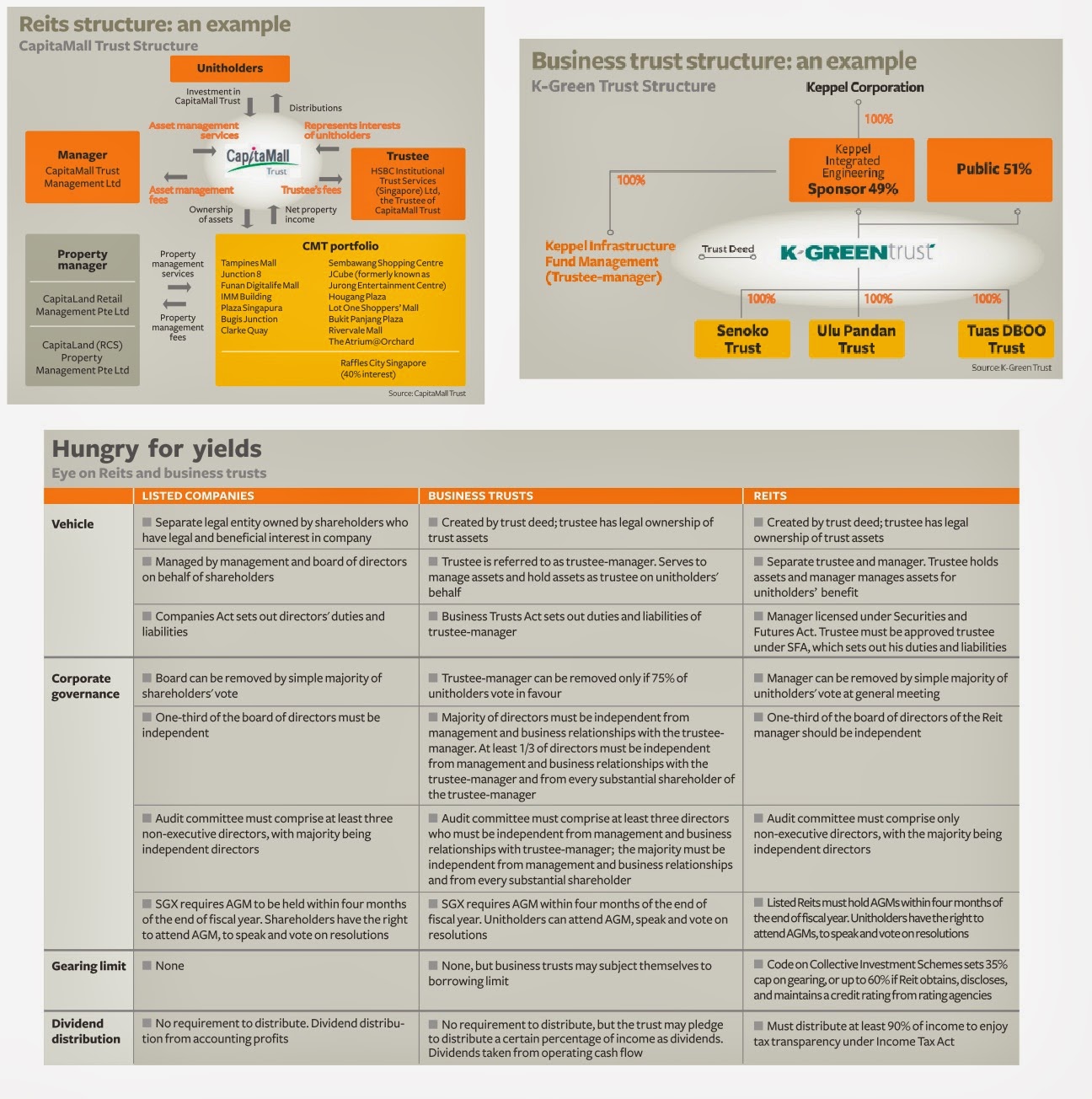

The main difference explain as follows, although there are more differences as show in earlier link or as shown in the structure/table below.

Trustee & Manager

Reit – assets are held by a trustee

on unitholders’ behalf. Separation of

roles between trustee and the manager.

on unitholders’ behalf. Separation of

roles between trustee and the manager.

Trusts – hybrid structure which

trustee has legal ownership of trust assets and mange assets for unitholders’

benefit.

trustee has legal ownership of trust assets and mange assets for unitholders’

benefit.

Leverage

Reits – gearing limit of 35 per

cent. This can be raised to 60 per cent if the Reit obtains, discloses and maintains a credit rating from

rating agencies.

cent. This can be raised to 60 per cent if the Reit obtains, discloses and maintains a credit rating from

rating agencies.

Trusts – no explicit cap on borrowings and may set their own limits. (not neccesary bad since have more flexibility in borrowing

of funds to grow its business.)

of funds to grow its business.)

Dividend distribution

Reits – Must distribute min. 90% of

income to enjoy tax transparency under Income Tax Act.

income to enjoy tax transparency under Income Tax Act.

Trusts – No requirement to

distribute, but the trust may pledge to distribute a certain percentage of

income as dividends. E.g. Croesus Retail Trust pledge 100% distribution for

first 2 years after IPO last year.

distribute, but the trust may pledge to distribute a certain percentage of

income as dividends. E.g. Croesus Retail Trust pledge 100% distribution for

first 2 years after IPO last year.

Thanks for the info. This is just what I was looking for. I am currently researching this topic so I will be back. Can you tell me how to subscribe to your blog?

PIC Claim Form

Hi Leona,

Thank you for visiting my blog.

For subscription, you can refer to upper right screen (web version and not mobile view). Then under "Subscribe and be Notified of Posts by Email" just key in your email and submit.

Looking forward to see you back. 🙂

Rolf

Thanks for sharing.I found a lot of interesting information here. A really good post, very thankful and hopeful that you will write many more posts like this one.

kodi.software

plex.software

luckypatcher.pro